SAP Finance Changes Required for BREXIT

- Implement SAP Note #2885225. This note is central note about BREXIT.

- For Norther Ireland business/ vendor / customers there could be two VAT registration numbers

- GB VAT Registration number for trade with GB mainland

- XIGB VAT registration for trade between NI and EU (27 MS)

- Implement SAP Note#3000100. This will add additional field to customer, vendor master (STCD6) to store XIGB VAT registration number for customers / vendors located in Norther Ireland.

- Add below entries to Table#T00I1.

- Parameter Type: XIVATN

- Description: XI VAT Number

- Length: 14

- ISO Code: Blank

- Updated Region field for GB vendors for NI codes as per SAP Note #2885225. Currently we have 552 vendors whose country in vendor master is GB. Some of these vendors have address of Northern Ireland. For these vendors region code must be updated in vendor / customer master

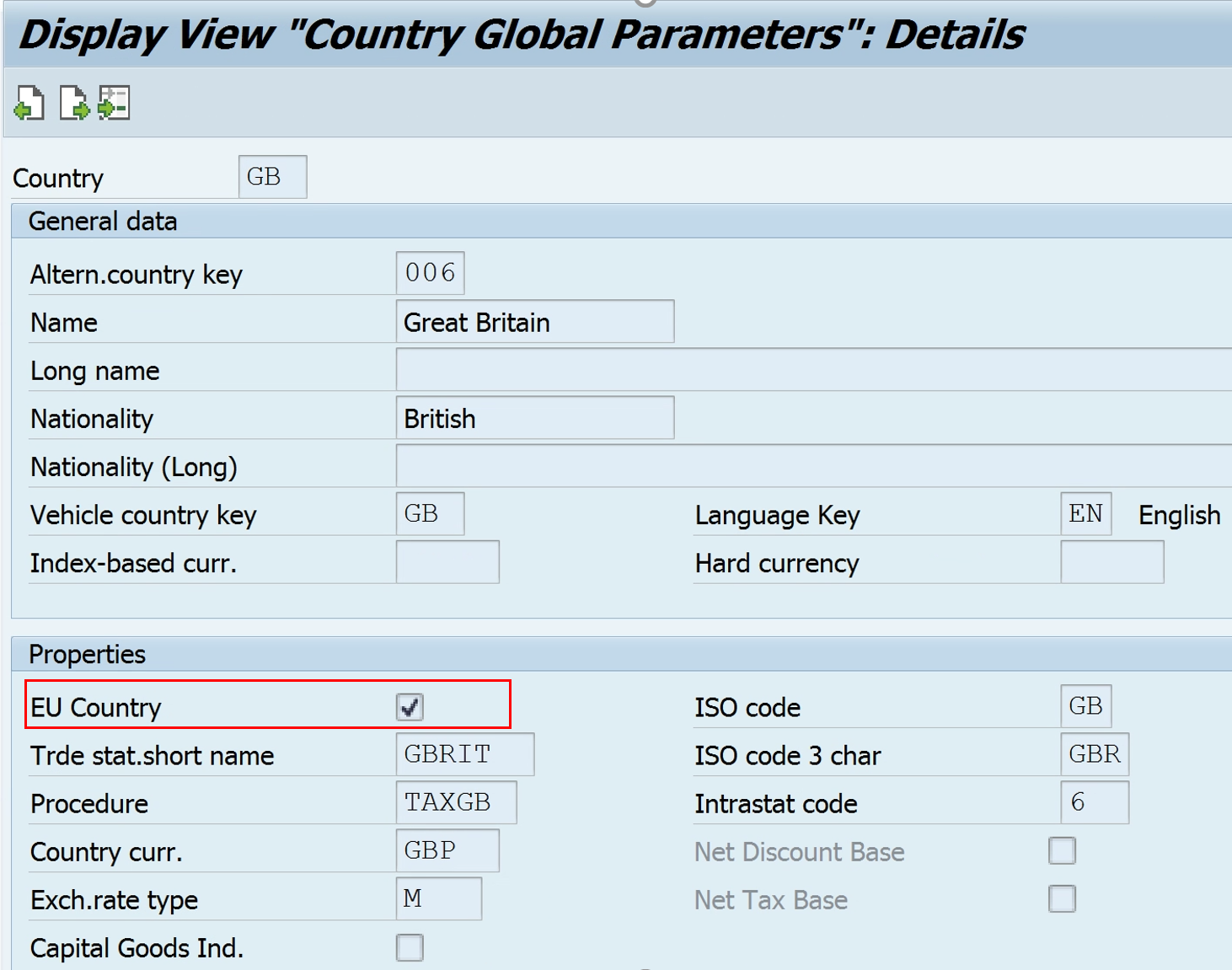

- Deselect EU Country Indicator from County GB in configuration: OY01.

Implement following notes in the sequence as per Central Note#2885225

2998790, 2998897, 2999507, 2999508, 3001331, 2998910, 2999119, 3006827, 3000100, 3002377, 3020722

Pingback: SAP Tutorials | AUMTECH Solutions-SAP Training

Pingback: Top 21 sap oss note brexit hot nhất, đừng bỏ qua - 2022 The Crescent