SAP Money Market Tutorial

SAP Money Market

Money market transactions are used for short- and medium-term Investments and for borrowing of funds. Key money market instruments are as listed below:

- Fixed Term Deposit

- Commercial papers

- Deposit at Notice

- Interest rate Instruments

Fixed term Deposits

A Fixed term deposit is an investment that includes the deposit of money into an account at a financial institution. Term deposit investments usually carry short-term maturities ranging from one month to a few years. Investors can withdraw funds only at the end of term

Commercial Papers

A Commercial paper is an unsecured, short-term debt instrument issued by a company for the financing of accounts payable and inventories and meet short-term liabilities. Commercial paper is usually issued at a discount from face value and reflects prevailing market interest rates

Deposits at Notice

These investments are similar to fixed term deposit. However, money can be withdrawn only after advance notice period has expired. For e.g. If you have a 50-day notice deposit account, you ca withdraw money only after 50 day withdrawal notice period has expired

Interest rate Instruments

An interest-rate instrument is a derivative where the underlying asset is the right to pay or receive a notional amount of money at a given interest rate. Its value increase / decrease based on movement of the interest rate

In this tutorial we will discuss SAP business process, configuration, master data setup and end user transactions codes / testing of Money market instrument (Fixed term deposit)

Configuration steps – Money Market Instruments

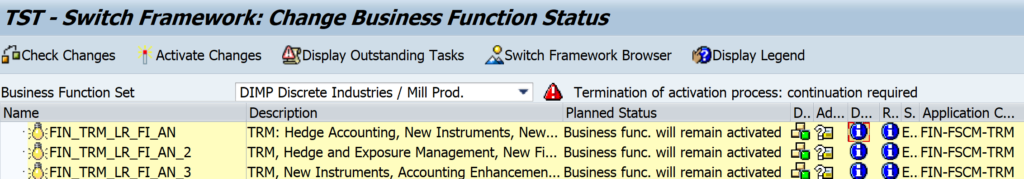

Activate Treasury Functions in SAP

Path: SPRO- Activate business functions – Continue – Enterprise Business functions -Activate below functions

- FIN_TRM_LR_FI_AN

- FIN_TRM_LR_FI_AN2

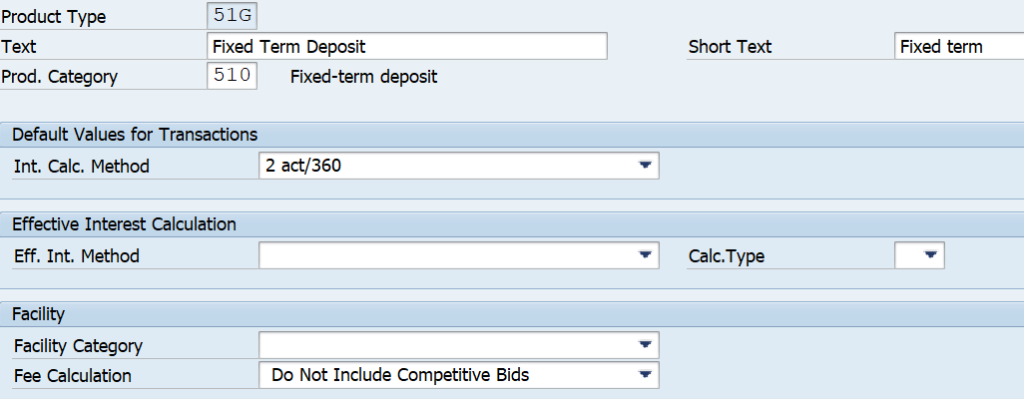

Define Product Type Path

Explanation

Product types help to differentiate between different Money Market financial instruments. In Money Market area, the following product categories are available in standard SAP

- 510 Fixed-term deposits

- 520 Deposits at notice

- 530 Commercial Paper

- 540 Cash flow transaction

- 550 Interest rate instruments

Product type 510 is used for fixed term deposits. We will configure a new product type 51G, which will be a fixed term deposit to understand various configuration steps in SAP

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Product Type – Define Product Type

You can create it by copying SAP standard product type 51A for Fixed term Deposit

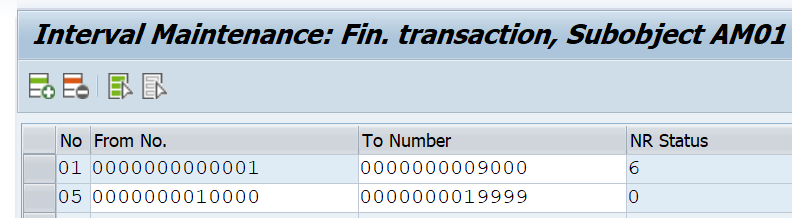

Define Number Ranges

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Transaction Type – Define Number Ranges

Define Transaction Types

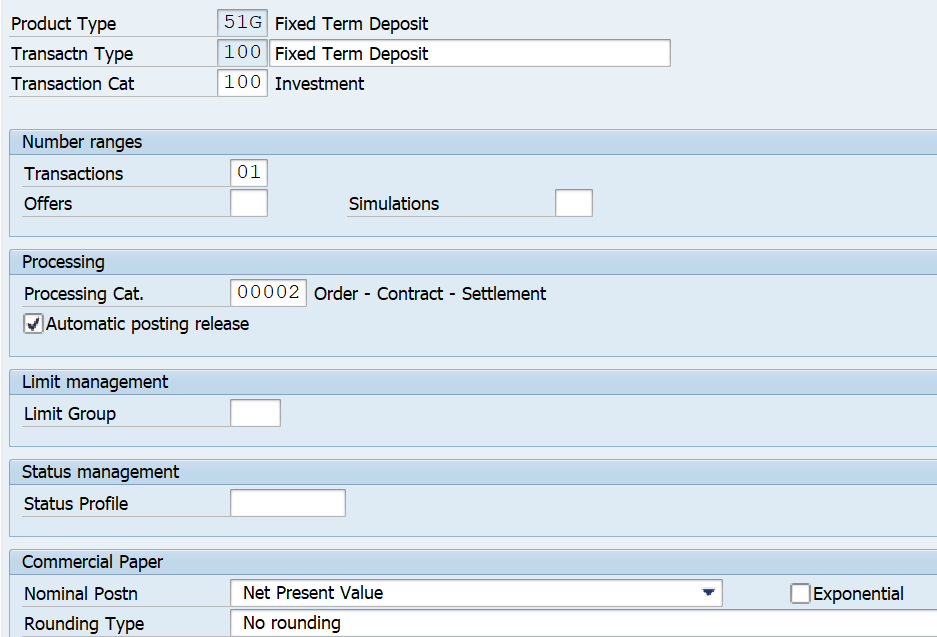

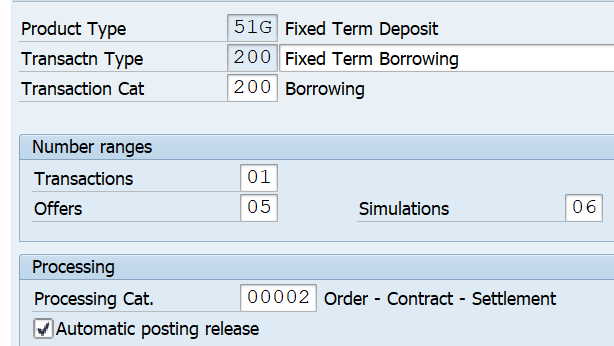

Explanation: Transaction Type is assigned to a Product Type. Transaction Type define the direction of the Trade. For Product Type 51G, we can use Transaction Type used by 51A as below

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Transaction Type- Define Transaction Type

Transaction Type for Fixed Term Investment - 100

Transaction Type for Fixed term Borrowing -200

Define Flow Types

Explanation

Flow types represent different types of flows related to Fixed Term instruments. We will use the SAP standard Flow types used for product type 51A for our product type 51G. These are listed below

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Flow Types- Define Flow Types

| Product Type | Description | TType | Transaction | SAP Std. Flow Type | Flow Type name |

| 51A | Fix Term Dep | 100 | Investment | 1100 | Principal Increase |

| 51A | Fix Term Dep | 100 | Investment | 1110 | Principal Decrease |

| 51A | Fix Term Dep | 100 | Investment | 1120 | Final Repayment |

| 51A | Fix Term Dep | 100 | Investment | 1150 | Interest Capitalization |

| 51A | Fix Term Dep | 100 | Investment | 1901 | Charges |

| 51A | Fix Term Dep | 100 | Investment | 1905 | Withholding tax 1 |

| 51A | Fix Term Dep | 200 | Borrowing | 1105 | Borrowing / Increase |

| 51A | Fix Term Dep | 200 | Borrowing | 1110 | Borrowing Decrease |

| 51A | Fix Term Dep | 200 | Borrowing | 1120 | Final Repayment |

| 51A | Fix Term Dep | 200 | Borrowing | 1150 | Interest Capitalization |

| 51A | Fix Term Dep | 200 | Borrowing | 1901 | Charges |

Uses of SAP Treasury Payment Program

Assign Flow Types to Transaction Types

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Flow Types- Assign Flow Types to Transaction Types

| Product Type | Desc. | TType | Transaction | SAP Std. Flow Type | Flow Type name |

| iDoc Purpose | iDoc Type |

| Send Customer master data | DEBMAS |

| Send Vendor Master data | CREMAS |

| Send Material master data | MATMAS |

Below steps are involved in setting up outbound iDoc in SAP

- Create Logical System

- Create RFC Destination

- Allocate Logical System to Client

- Maintain Ports

- Create Partner Profile

- Create Distribution Model and Filter

- iDoc Segment Filtering

- Enable Change Pointer

- Enable Change pointer for specific message type

- Create iDoc from change pointer

- Send full customer master data through iDoc

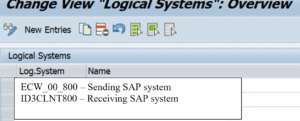

Create Logical System in Sending System

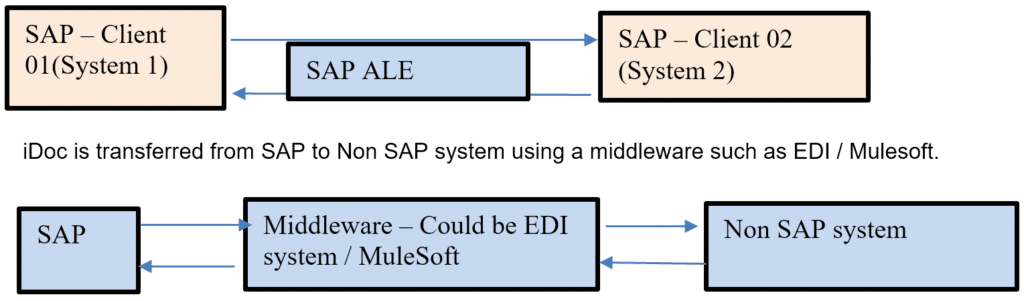

A 'logical system' is used to identify an individual client in a system, for ALE communication between SAP systems.

Login to Client 105 (SENDER SYSTEM)

Transaction code : BD54

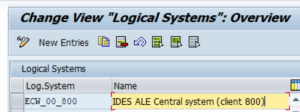

Create Logical Systems with naming convention 'system name'+'CLNT'+client no . E.g: ECW_00_800

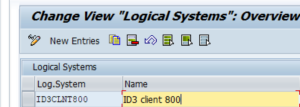

Create Logical Systems with naming convention 'system name'+'CLNT'+client no ex: example for receiving system e.g.: ID3CLNT800

Save and come back

Receiving Logical system

Sending Logical System

Log on to SAP system, client 105

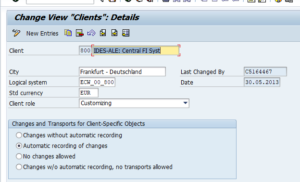

Transaction : SALE – Logical System – Assign Logical System to client

Assign client 800 to Logical system ECW_00_800

Create Logical System in Receiving System

Login to Client 800 (RECEIVING SYSTEM)

Transaction code : BD54

Create Logical Systems with naming convention 'system name'+'CLNT'+client no ex: example for receiving system e.g.: ID3CLNT800

Save and come back

Assign Logical System to client in Receiving System

Log on to SAP system, client 800

Transaction : SALE – Logical System – Assign Logical System to client

Assign client 800 to Logical system ID3CLNT800

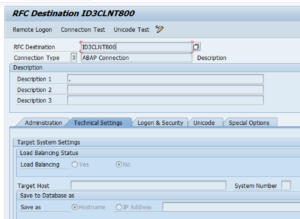

Create RFC Destination in sap

Transaction : SM59

The information about the target system of an RFC call is stored in the RFC destination. The attributes of destinations are defined statically and managed in AS ABAP using the transaction SM59. Every destination managed in transaction SM59 has a unique name that can be specified after the addition DESTINATION in RFC

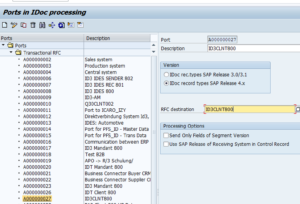

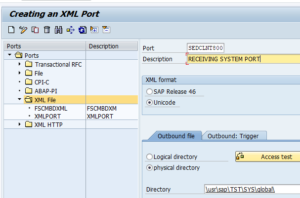

Maintain Ports

Go to transaction WE21

Select folder Transactional RFC

Click create and select generate port name

In the RFC destination field give the Receiving system (ID3CLNT800) created earlier in transaction BD54

Please note an iDoc can be created in 3 formats

- Transactional RFC

- XML file

- Flat file

Transactional RFC : This for real time transfer of data from one SAP system to another SAP system

XML File : Here the iDoc is created in an XML file format. If XML file format iDoc is required select folder XML in transaction WE21 and then specify the receiving system port. In this we have to also specify a location in share point where the XML file will be delivered by the sending system. Receiving system will pick the file from the location specified here.

Flat file iDoc : Similar to XML file. Only difference it is txt file format

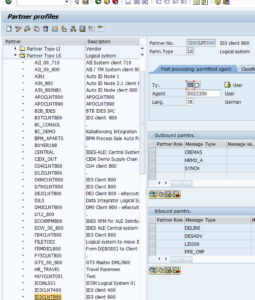

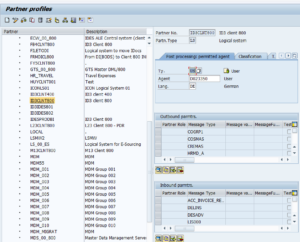

Create Partner Profile in sap

Transaction code - WE20

This has to be configured separately for different iDoc types. Here we will set it up for outbound iDoc type Vendor Master (CREMAS)

Select folder LS (Logical System) – Now click the create button

In the Partner Number field enter the receiving system created earlier

In the outbound Parameters click the plus sign

In the next screen enter iDoc message type CREMAS and other details as shown below

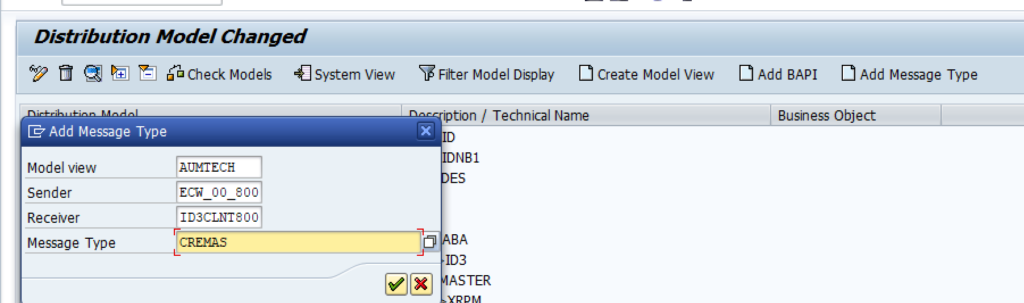

Create Distribution Model and Filters

Transaction Code : BD64

Click create model view. Give a name to your model, say AUMTECH, Save

Now select the model (AUMTECH) and click create message on header.

Enter the details as show below and save.

Adding Distribution Filters

Transaction code : BD64

Select the model created above. Now click on No filter Set as shown below.

Than click on create filter set. After that you can select specific fields as filter. For e.g. field company code can be used as a filter. It there are company code 100, 200, 300, 400 etc. and you select company code 100 in the filter. In that case vendor master data for company codes other than 100 only will be sent

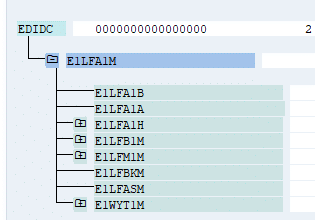

iDoc Segment Filtering

Transaction code : BD56

An iDoc is made up of many segments. These segments are buckets which contain fields. Fields have the value. Below we list Vendor master iDoc (CREMAS) segments. Go to transaction WE19 and enter the iDoc message type. In this case CREMAS. Here you will be able to see all iDoc segments as shown below

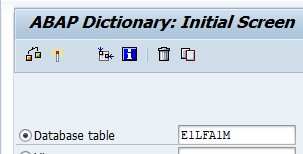

To see the fields in a segment enter the segment in SE11

iDoc-15

Another segment - E1LFBKM

This iDoc segment has vendor bank details. You may not want to send vendor details to other system. For this in transaction BD56 remove the idoc segments which should not sent

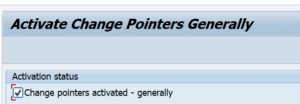

Enable change pointers

Transaction code : BD61

Change Pointers

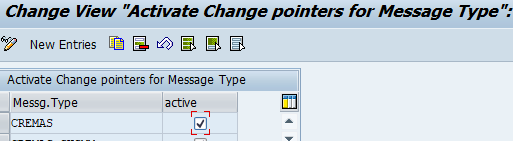

Enable Change Pointers for specific message type

Transaction code : BD50

As we are sending out Vendor master data through iDoc, message type is CREMAS. So enable change pointer for CREMAS

iDoc20

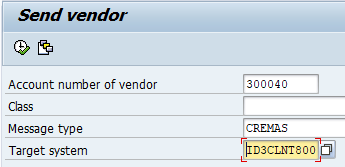

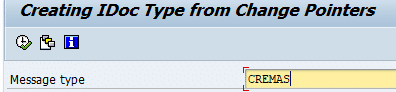

Transaction code : BD14

iDoc-21

Transaction code : BD21

iDoc-22

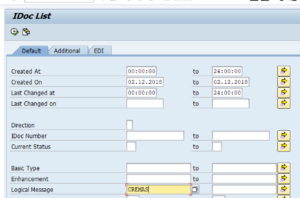

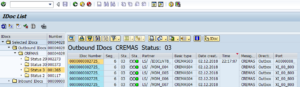

Display and Edit SAP iDoc

Transaction code : WE02

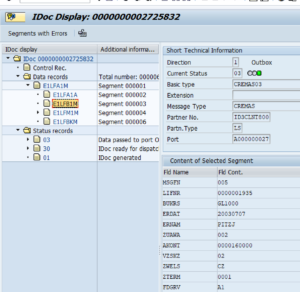

Let’s understand Vendor master iDoc. It has below segments. Segments are containers. Within each segments ae fields. For e.g. E1LFB1M has fields LIFNR (Vendor Number), BUKRS (Company code) etc.

iDoc type : CREMAS

| Segment | Fields | Fields Description | Sample Value |

| E1LFB1M – Segment for company code data for vendors | LIFNR | Vendor account number | 1935 |

| BUKRS | Company code | 1000 | |

| ERDAT | Date | 20030707 | |

| ERNAM | Person who created Vendor number | PITZJ | |

| ZUAWA | Sort Key | 002 | |

| AKONT | Reconciliation account | 0000160000 | |

| ZTERM | Payment Term | 0001 |

You can go to transaction SE11, enter iDoc segment and see all fields in the iDoc segment

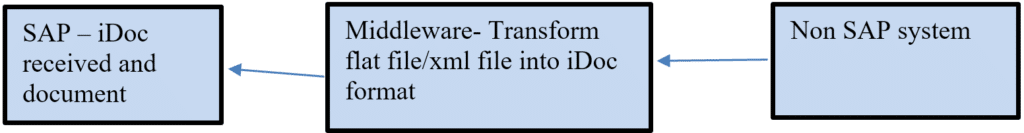

SAP iDoc : Inbound

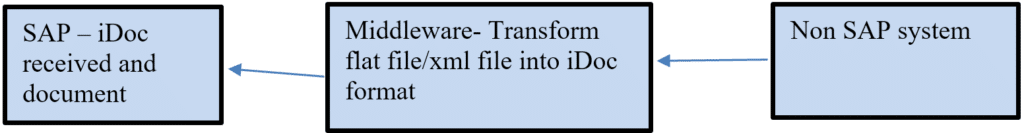

SAP inbound iDoc is generated outside of receiving SAP system. Middleware system like EDI / Mulesoft receive the inbound data which could be in the flat file, xml format. This is than transformed into iDoc format by the middleware system. This iDoc is than sent to receiving SAP system. SAP system process the iDoc and post documents in SAP

Configuring inbound iDoc in SAP

SAP has different iDoc types for different purposes. Here we will configure Customer master outbound iDoc type (DEBMAS). Below are some of the iDoc types:

| iDoc Purpose | iDoc Type | Message Type |

| Post Vendor Invoice | ACC_INVOICE_RECEIPT03 | ACC_INVOICE_RECEIPT |

| Post Customer Invoice | ACC_BILLING02 | ACC_BILLING |

| Acknowledgement iDoc | ALEAUD01 | ALEAUD |

Please refer to SAP Note #210137 for more details on above iDocs

Below steps are involved in setting up outbound iDoc in SAP

- Create Logical System in sap

- Create RFC Destination in sap

- Allocate Logical System to Client

- Maintain Ports

Above steps are common for both inbound and outbound sap iDocs. These have been covered in detail in SAP iDoc Tutorial 1

- Create Partner Profile in sap

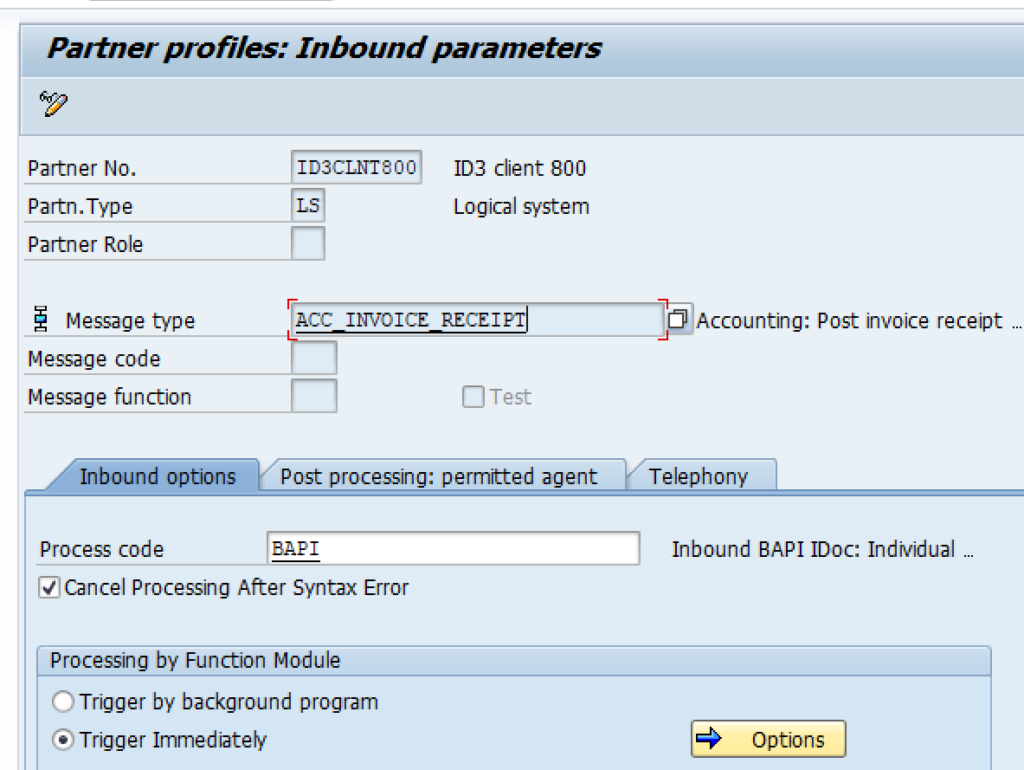

Create Partner Profile in sap Transaction code : WE20

This has to be configured separately for different iDoc types. Here we will set it up for inbound iDoc type ACC_INVOICE_RECEIPT03 (Post Vendor Invoice)

Select folder LS (Logical System) – Now click the create button

In the Partner Number field enter the receiving system created earlier

In the inbound Parameters click the plus sign

In the next screen enter iDoc message type ACC_INVOICE_RECEIPT and other details as shown below

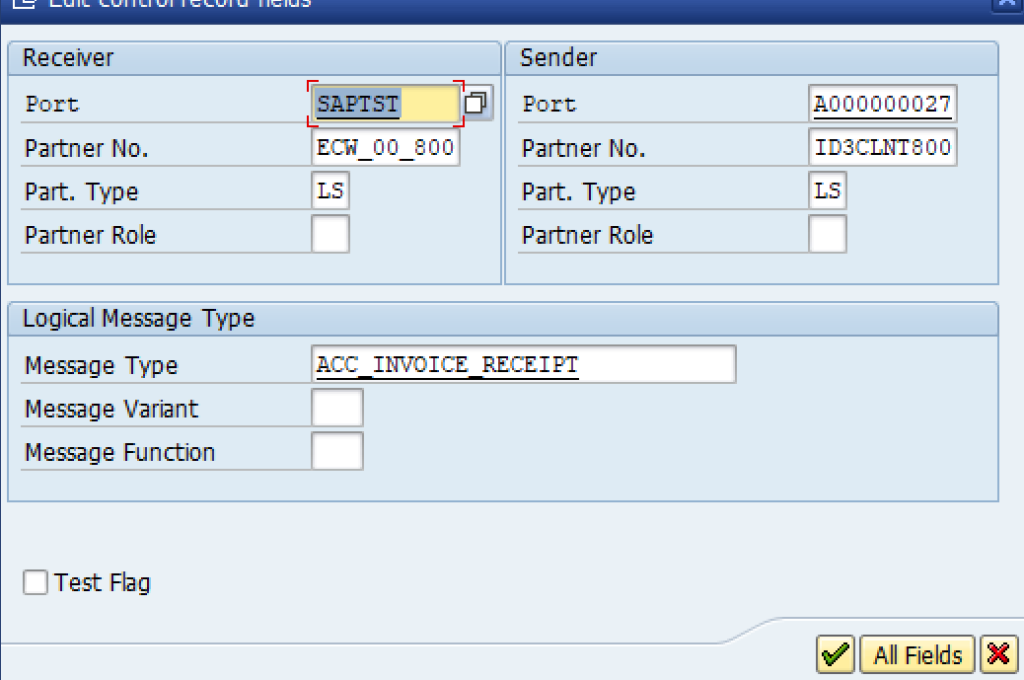

Test Inbound iDoc

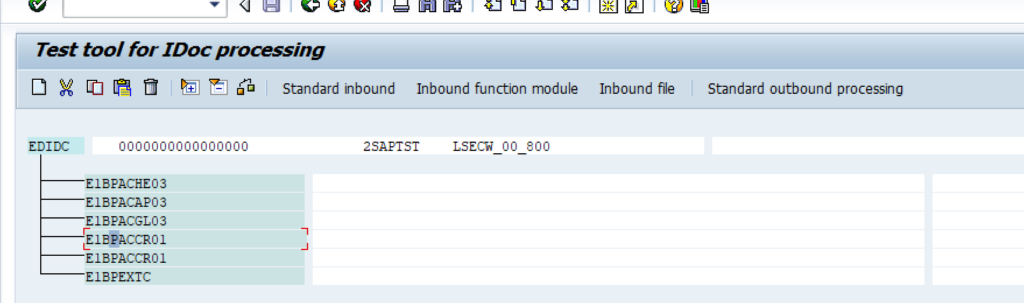

We can use transaction code WE19 to test iDocs. Enter the details as shown below:

Transaction code : WE19

Used for testing iDoc

Enter the iDoc type or message type as shown below:

Now double click on segment EDIDC and enter sender and receiver data

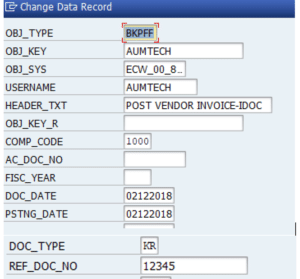

Enter data in Vendor Invoice header record segment #E1BPACHE03

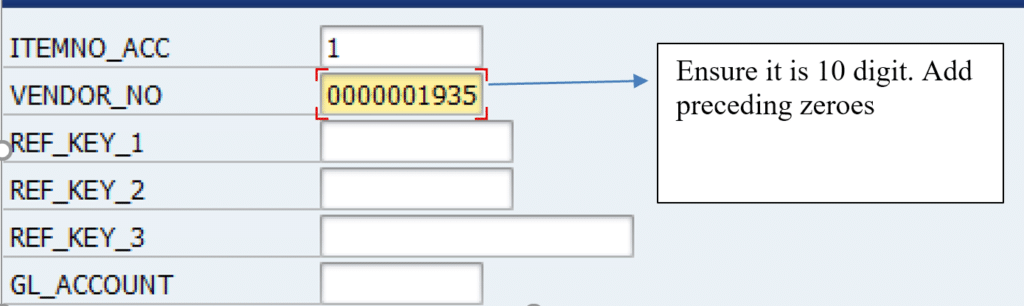

Enter data in Vendor Invoice Vendor Line item record segment #E1BPACAP03

iDoc-9

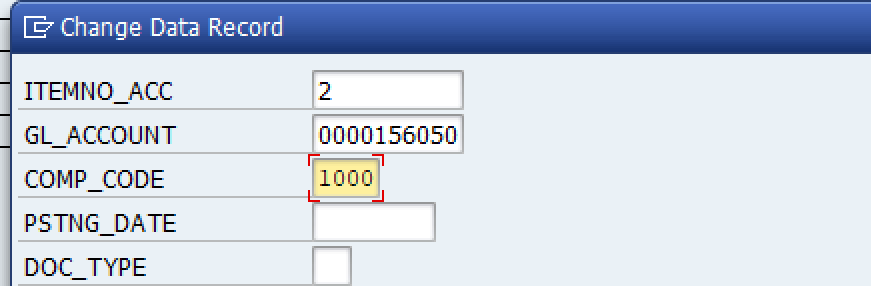

Enter data in Vendor Invoice GL Line item record segment # E1BPACGL03

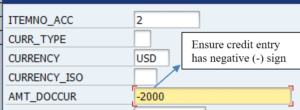

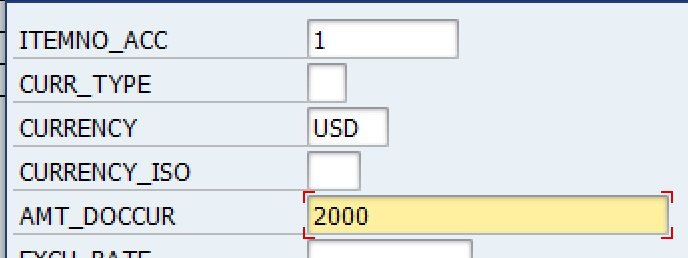

Enter amount for vendor line item, segment # E1BPACCR01

Enter amount for GL line item, segment # E1BPACCR01