SAP Product Costing Concepts

Find Cost which are part of Product Cost (COGM)

Find optimum Lot size for manufacturing the product

Find Product cost for each manufacturing location / Plant

In Product costing we estimate the product cost. Product cost estimate is also known as standard product cost

Various techniques used to calculate product cost estimate are as below:

BPO: Base Planning Object

Cost Estimate without quantity structure

Cost estimate with Quantity Structure: BOM and Routing

BOM: It is list of Raw material along with their quantity used to manufacture the product

Routing: List of activities like operation 1, operation 2 etc. performed on raw material to convert it into finished goods

Product Costing is divided into 3 different topics as below:

Planning: Calculate standard cost

Cost Object Planning: This will cover period end process, i.e. Planned cost, Actual cost, variance, settle production order

Actual Costing / Multiple valuations: Material Ledger

SAP Product Costing Types

There are two Product Costing Types

MTS (Make to Stock): In this type goods are produced and stocked. They are sold from the stock. Under MTS there are two scenarios

Product Costing by order

Product costing by period

MTO (Make to Order): This is used for large equipment’s, aircraft manufacturing etc. In this type manufacturing of product starts after receiving the sales order.

SAP Product Costing Configuration

This involves settings for below activities

Costing variant for Plan cost

Costing variant for Actual Cost

Period end process:

WIP

Variance (Plan – Actual Cost)

Settlement: This involve settlement of production order

Create PA transfer structure for COPA

FI entries for WIP and variance are posted only at the time of production order settlement

Integration with PP (Production Planning)

For detailed, step-by-step instructions on SAP Product Costing, follow along with my video tutorial below.

SAP Product Costing Training

Costing Sheet Configuration in SAP

Costing Sheet explanation

What is Costing sheet:

The costing sheet integrates all elements of overhead costing. It consists of the following rows that are processed during the calculation:

Base Row: This contain the calculation Base. Calculation base is made up of cost elements on which OH is calculated

OH Rates Row: This contain OH Rates. OH rates contain percentage rate which applied on calculation base to arrive at OH amount

Total Rows: Used to form subtotal or total of earlier rows. No calculation performed on these rows

Set Controlling Area: OKKS

Controlling area: MK14

Define Costing Sheet Components- Calculation base

Path: SPRO – Controlling – Product Cost Controlling – Product Cost Planning – Basic settings for material costing – Overhead – Costing sheet components – Define Calculation base

The calculation base determines to which cost elements overhead is applied together.

Define Costing Sheet Components- % OH Rates

Path: SPRO – Controlling – Product Cost Controlling – Product Cost Planning – Basic settings for material costing – Overhead – Costing sheet components – Define Percentage OH rates

Define percentage overhead rates, for example, 10% in controlling area AUM1.

Select OH Rate 19MH and below entries

Select 19AH OH rate and make the below entries

Define Costing Sheet Components- Credits

Path: SPRO – Controlling – Product Cost Controlling – Product Cost Planning – Basic settings for material costing – Overhead – Costing sheet components – Define Credits

Here you define Cost center which is to be credited with OH cost. Further this credit is recorded under secondary cost element of category 41 (overhead rates)

Define Costing Sheet

Path: SPRO – Controlling – Product Cost Controlling – Product Cost Planning – Basic settings for material costing – Overhead – Costing sheet

Select Base, OH or Credit and click the respective row to see the details configured earlier

Define Costing Variant in SAP

Costing Variant contain Costing Type, Valuation Variant, Date Control, Quantity structure control, Transfer control and reference variant. We will create three costing variants - Standard cost, Planning cost and Actual cost variant

Costing variants is the link between product costing and Customizing,

The costing variant contains all the control parameters for costing.

The costing variant for a material cost estimate contains the following control parameters:

Costing type

Valuation variant

Date control

Quantity structure control

(only relevant for cost estimates with quantity structure)

Transfer control (optional)

Reference variant (optional)

Note:

Costing Type: Determine type of cost is calculated., whether standard cost, Cost for reporting, etc.

Valuation variant determine how Material, Activities, Subcontract, External Operations and OH are valued

Date Control: Determine validity period of costing run

Define Costing Variant-Costing Type

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Costing variant components – Define costing type

Here you define the purpose of a material cost estimate by specifying, field in the material master record to which the costing results can be transferred to:

Update – Material master Fields Cost Estimate (CK40N)

Standard price Standard cost estimate (01)

Tax-based price Inventory cost estimate

Commercial price Inventory cost estimate

Price other than std. price Modified standard cost estimate

In a client there can be only one costing type for standard price. We will keep SAP standard costing type 01 for standard price

Define Valuation Variant in SAP

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Costing variant components

Here you specify parameters to be used for cost estimate

Material Valuation: define the sequence in which the system searches for prices from the accounting view or costing view of the material master record to valuate materials. E.g. We can specify the sequence in which material price is picked - use moving average price, if not available use Standard Price, if not available use Purchase Info record and so on

Activity Price: Sequence in which activity price is picked. For e.g. take Plan activity price, if not available take actual activity price and so on

Overhead costs: Link the costing sheet prepared in earlier steps to pick the OH cost for cost estimates

Activity type price priority

Sub-contracting price sequence

External Operations price sequence

Under OH select the costing sheet created earlier

OH, on Material Components. Not required in our scenario. If costing sheet assigned here OH 10% and 15% defined in costing sheet will be added to the raw material

To display Number in the drop down enable visualization in the options as below

Valuation variant is defined at plant level

Define Date Control in SAP

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Costing variant components

Tcode: OKK6

Date control determines which dates are proposed or displayed when a cost estimate is created, and whether these dates can be changed by the user.

The validity period of the cost estimate

The date on which the quantity structure is determined ( quantity structure date)

The date on which the quantity structure is valuated ( valuation date)

Define Quantity Structure Control in SAP

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Costing variant components

Tcode: OKK5

Check BOM Selection in SAP

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Settings for qty structure - BOM Selection – Check BOM selection

Tcode: OPJI

BOM: BOM (Bill of Material) : This is list of Raw material along with the quantities required to produce Finished Goods

Specify different sequences of priorities of BOM usages according to your requirements

Check BOM Application

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Settings for qty structure - BOM Selection – Check BOM application

Tcode: OPJM

Here you define BOM application area. Now you assign BOM selection ID created earlier to this BOM application area. Selection ID decides the sequence in which BOM are selected during cost estimate for this BOM application area

Check Routing Selection

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Settings for qty structure - Routing Selection – Check automatic routing selection

Tcode: OPJF

Routing: It is sequence of activities. It specifies on which Work Center (A work center typically refers to a machine) what activities are to be performed for how many hours. Raw Material is converted into finished goods at work center

Define a Routing selection ID

Assign it to alternative selection priorities

Specify selection priority for each of these scenarios

ID: A6: Can be any identifier

SP: Selection Priority

Task List: N: Routing, R: Rate Routing

Plan Usage: 1: Production

Status: 4: Released general

Assign BOM application ID and routing selection ID in Quantity structure control

Tcode: OKK5

Define Transfer Control in SAP

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – costing variant component – define transfer control

Tcode: OKKM

Transfer Control: The transfer control specifies how the existing cost estimate is to be used in the cost estimate of the other product. For e.g. Costing done at beginning of the year. All components of the product cost have to be costed to arrive at final Standard Cost. Costing of new component during the year. We can use standard cost of components costed at the beginning of the year if they are being used in manufacture of this new Product. Here we will use the transfer control

In this step you define parameters for partial costing. The purpose of partial costing is to prevent the system from creating a new cost estimate for a material when costing data already exists. Instead, the existing costing data is simply transferred into the new cost estimate. This improves performance.

Define Costing Variant in SAP

Path: Controlling – Product Cost controlling – Product Cost planning – Material Cost estimate with quantity structure – Define costing variant

Tcode: OKKN

Select costing component created in earlier steps and assign to Costing variant MK14. Costing type assigned is 01 Standard Cost and not one created earlier as we want to do standard costing

Qty Structure selection

Additive cost. These are transportation, packing cost added to COGM.

Update selection

Itemization: Detailed break up of cost based on its components

Error management selection

Assignment are optional so ignored for now

Define Cost Component Structure in SAP

Path: Controlling – Product Cost controlling – Product Cost planning – Basic settings for material costing – Define Cost component structure

This content is for SAP FINANCE-Silver members only.

Register

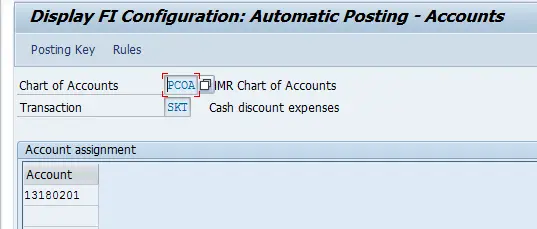

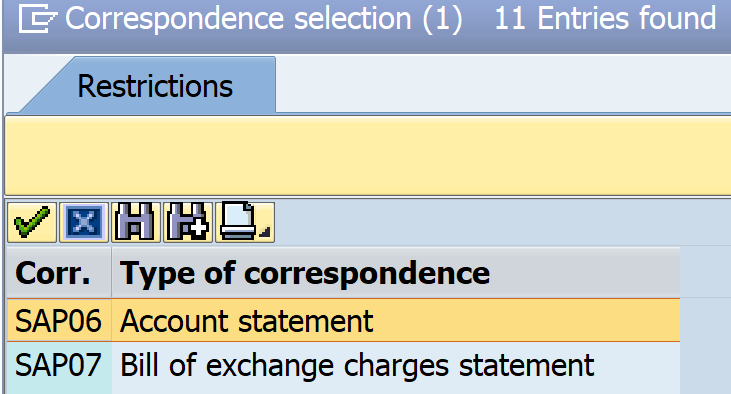

OBXK

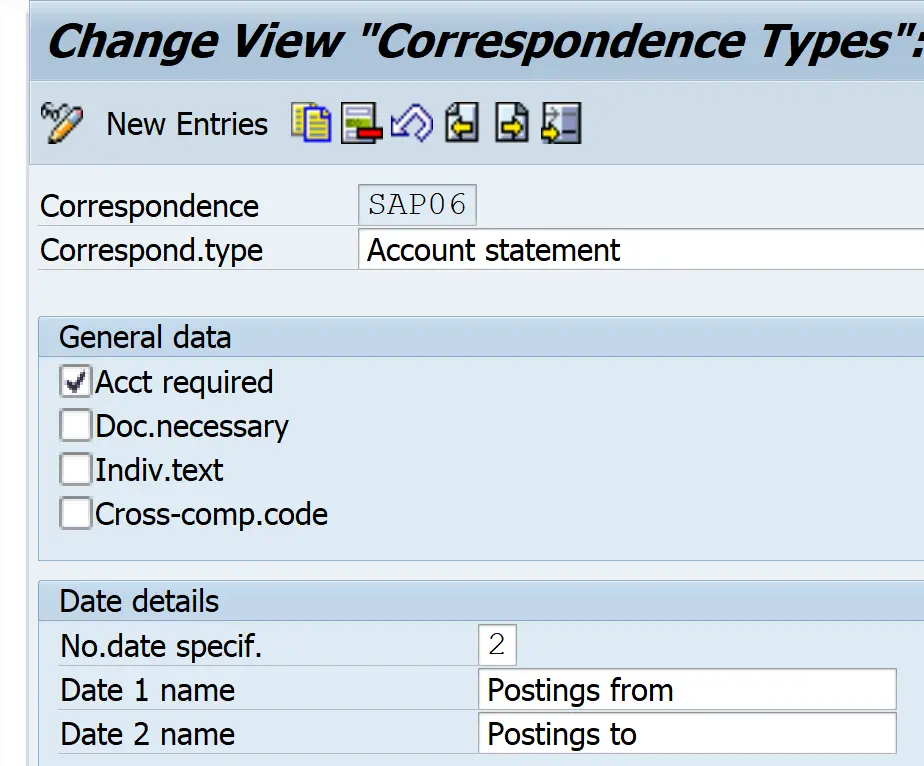

OBXK

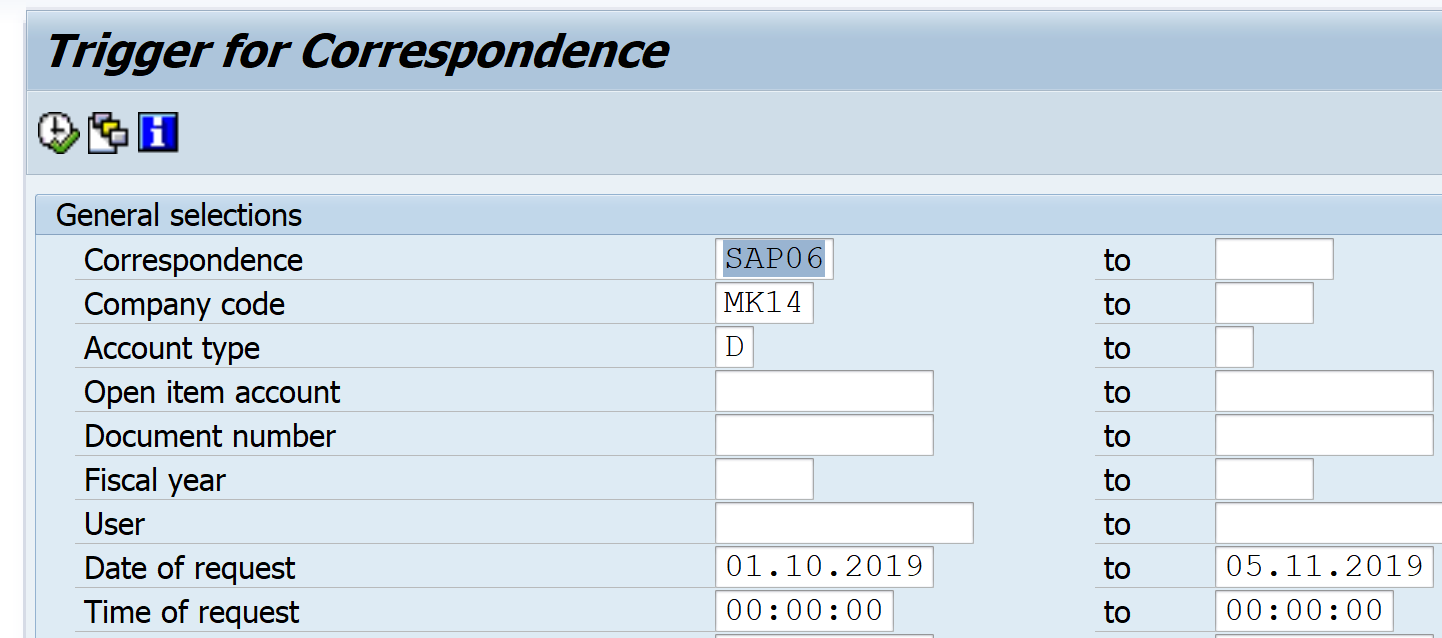

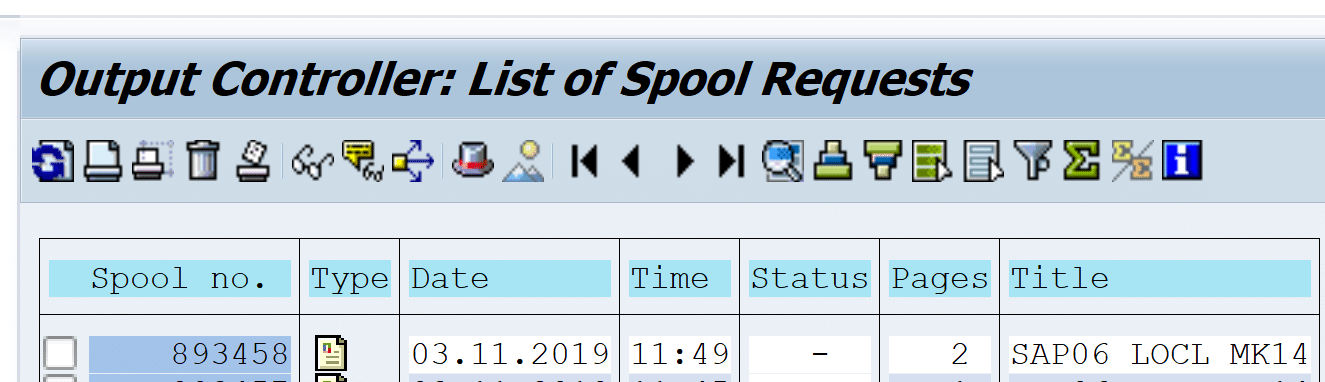

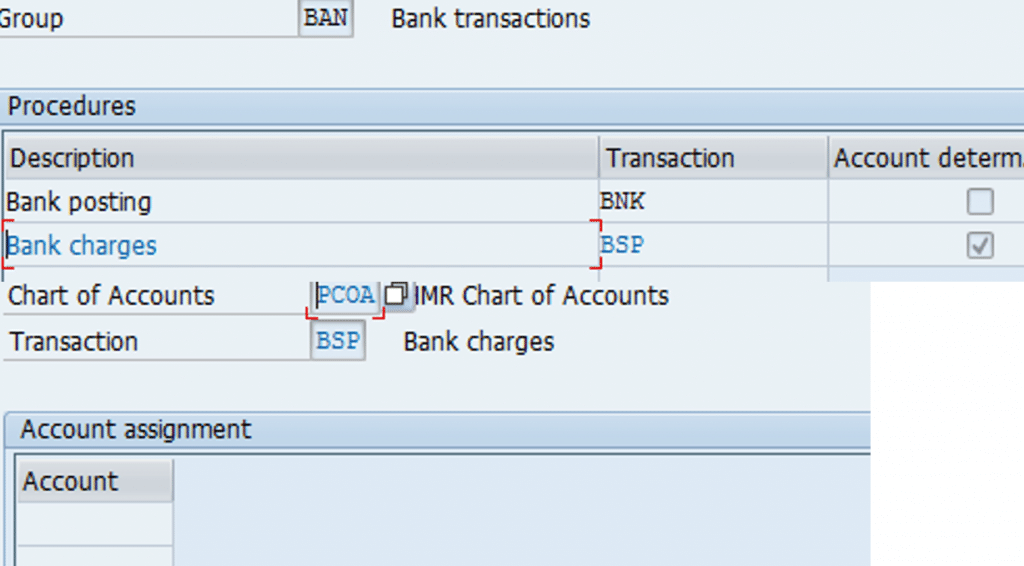

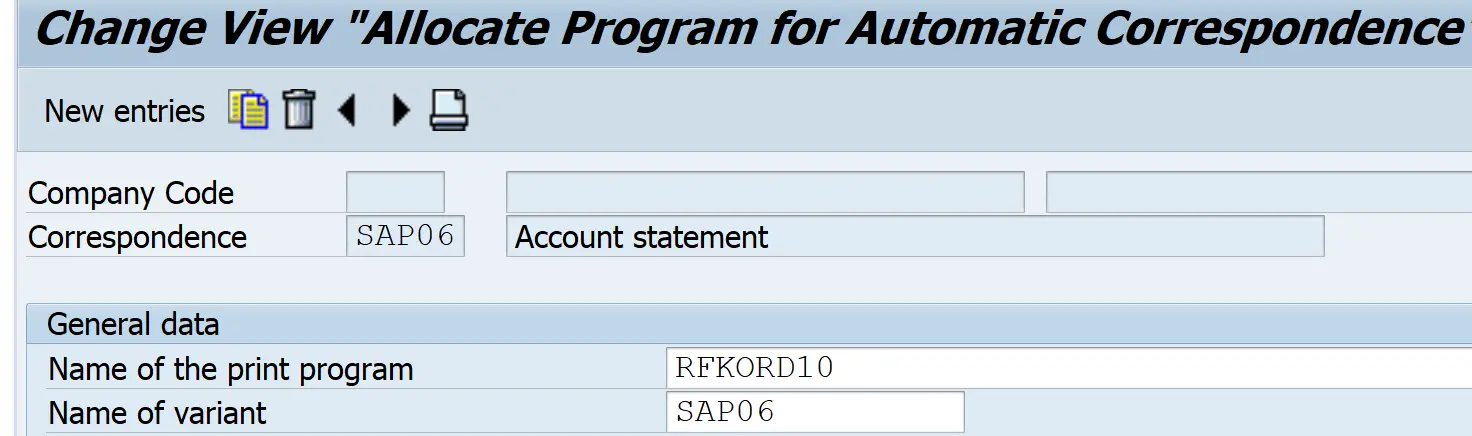

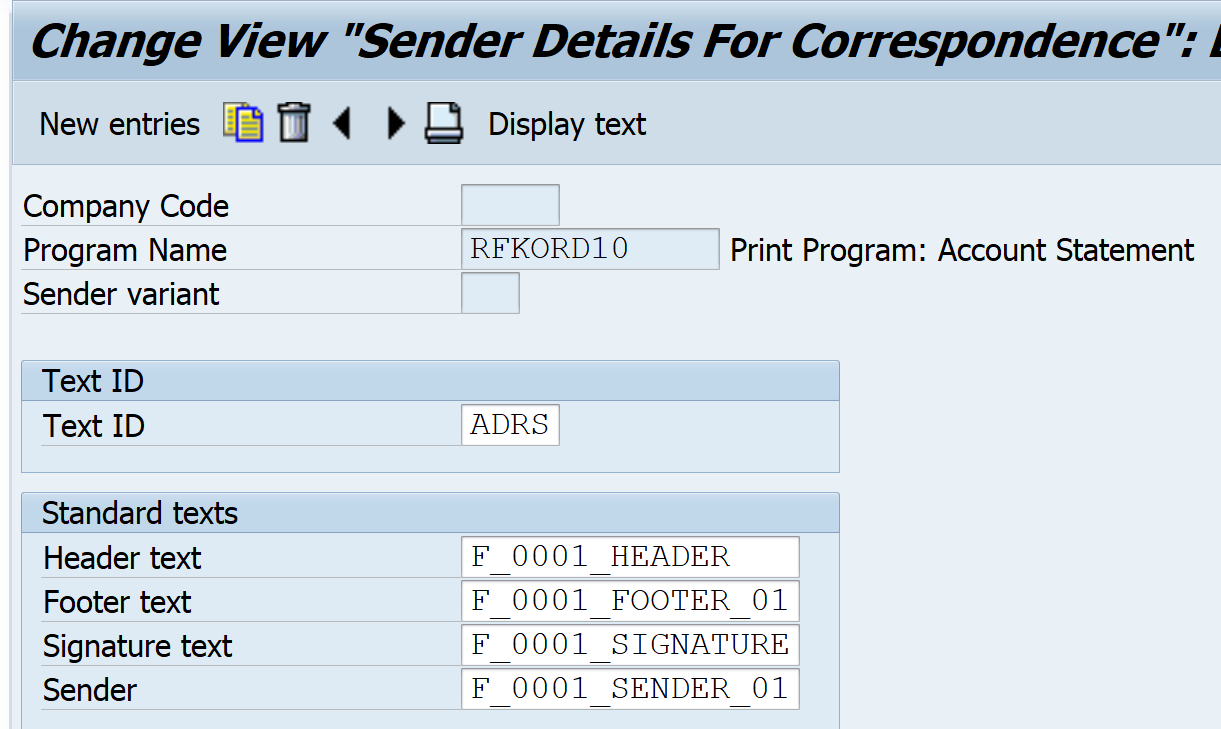

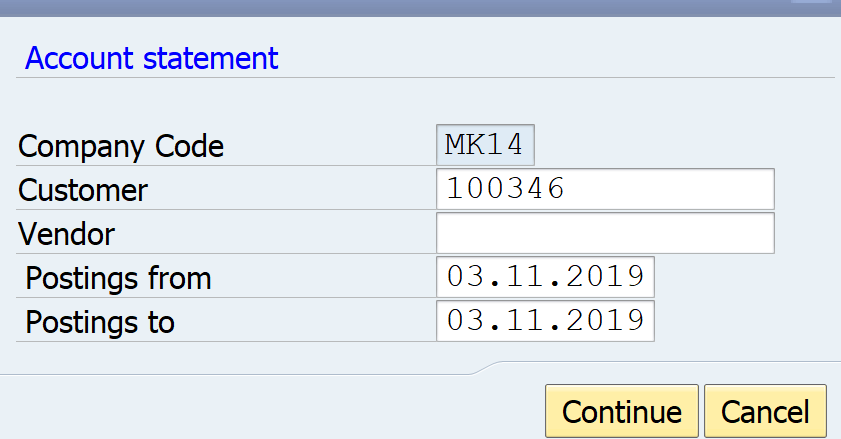

Here you need to link the correspondence generator program to the correspondence type. You can also specify different programs for different company codes. (Also, you can specify the default variant here for the program to execute. You can create such variant from transaction SE38/ SA38 for the program.) You can also create your own custom program as a copy of the standard program and can make suitable changes to meet any of your client specific need

Here you need to link the correspondence generator program to the correspondence type. You can also specify different programs for different company codes. (Also, you can specify the default variant here for the program to execute. You can create such variant from transaction SE38/ SA38 for the program.) You can also create your own custom program as a copy of the standard program and can make suitable changes to meet any of your client specific need Here you need to specify that at what point of time you can generate the particular correspondence type. The various options available are:-

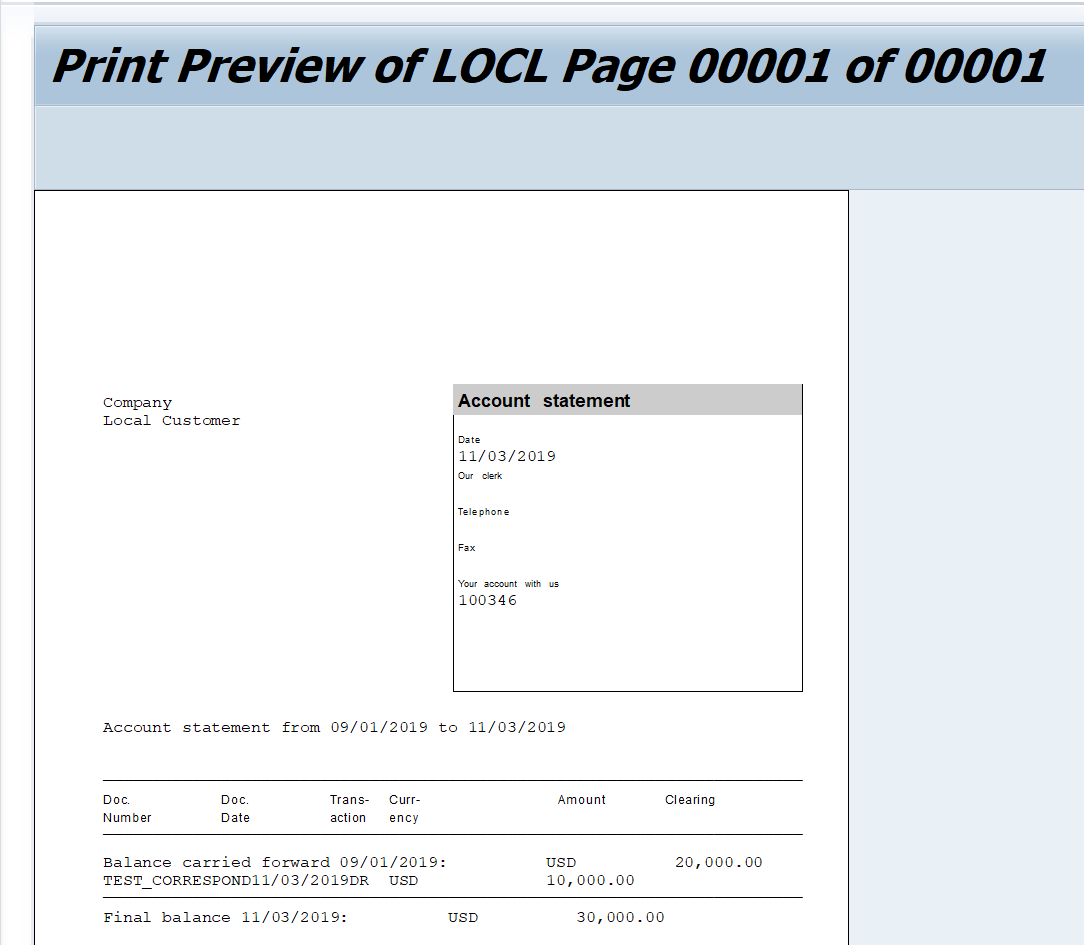

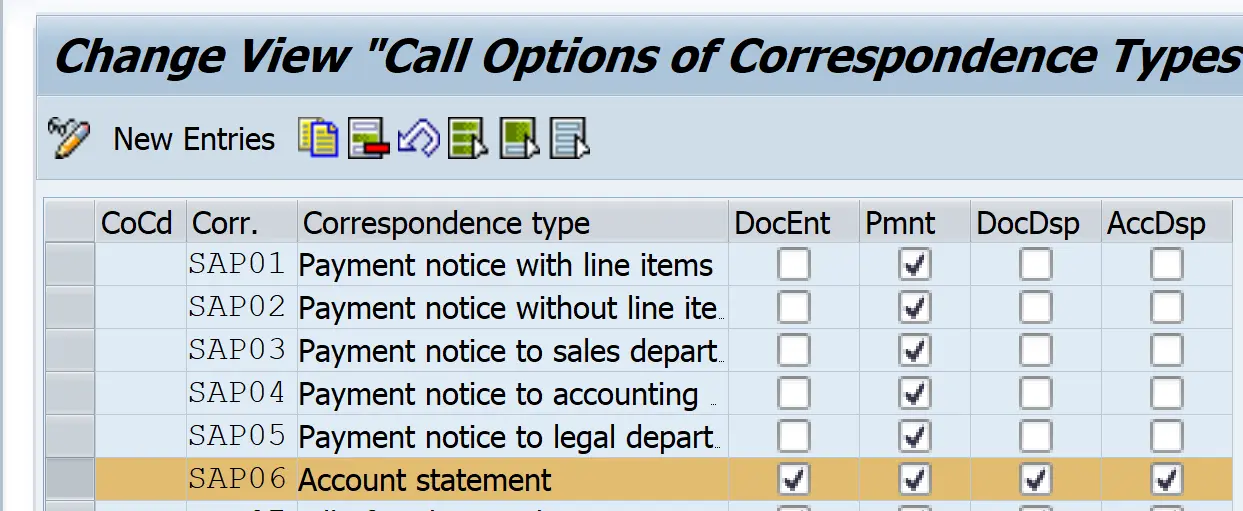

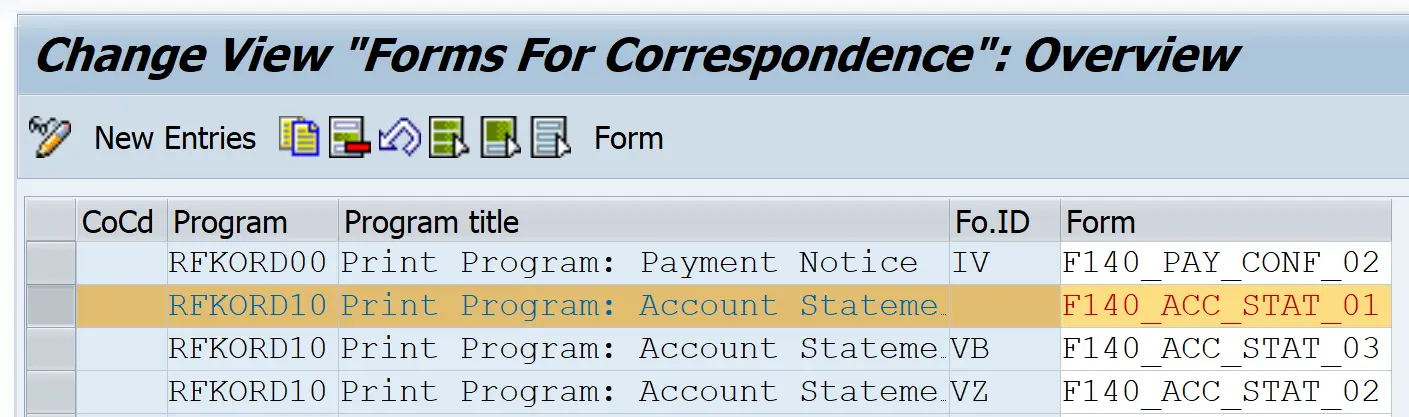

Here you need to specify that at what point of time you can generate the particular correspondence type. The various options available are:- Here you need to specify that which forms definition will be used by the correspondence print program. You can also specify a different setting for different company codes. (The SAP Script form is defined using the transaction SE71, where the various data is arranged in the output format to get processed.) You can also use two digit form IDs, by which you can call different forms for different form IDs in the same company code. This form ID can be given in the selection screen of the print program generating correspondence.

Here you need to specify that which forms definition will be used by the correspondence print program. You can also specify a different setting for different company codes. (The SAP Script form is defined using the transaction SE71, where the various data is arranged in the output format to get processed.) You can also use two digit form IDs, by which you can call different forms for different form IDs in the same company code. This form ID can be given in the selection screen of the print program generating correspondence.

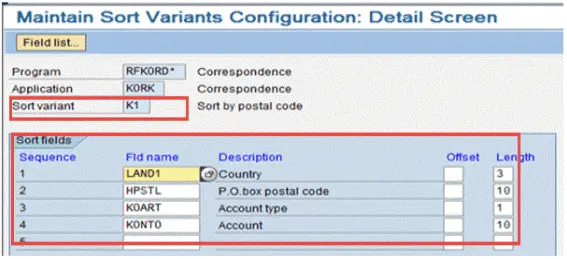

You can specify in which order the correspondence letters will get generated. E.g. if you are generating account statement for multiple vendors, then vendors will get sorted in this order and then the letter will get generated. This Sort Variant can be given in the selection screen of the print program generating correspondence.

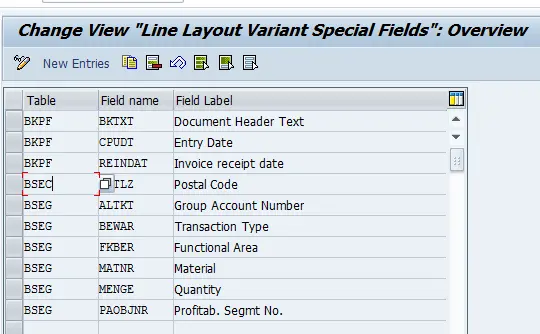

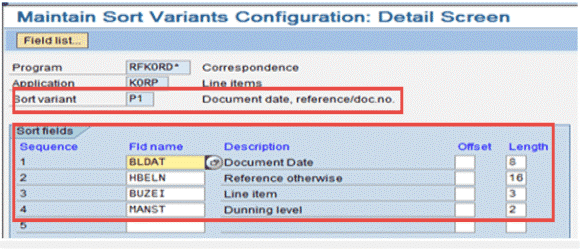

You can specify in which order the correspondence letters will get generated. E.g. if you are generating account statement for multiple vendors, then vendors will get sorted in this order and then the letter will get generated. This Sort Variant can be given in the selection screen of the print program generating correspondence.  You can specify that in which order the various line items will appear in a correspondence letters. E.g. if a vendor account statement has multiple invoices, then invoices will get sorted in this order and then the letter will get generated. This Sort Variant can be given in the selection screen of the print program generating correspondence.

You can specify that in which order the various line items will appear in a correspondence letters. E.g. if a vendor account statement has multiple invoices, then invoices will get sorted in this order and then the letter will get generated. This Sort Variant can be given in the selection screen of the print program generating correspondence.

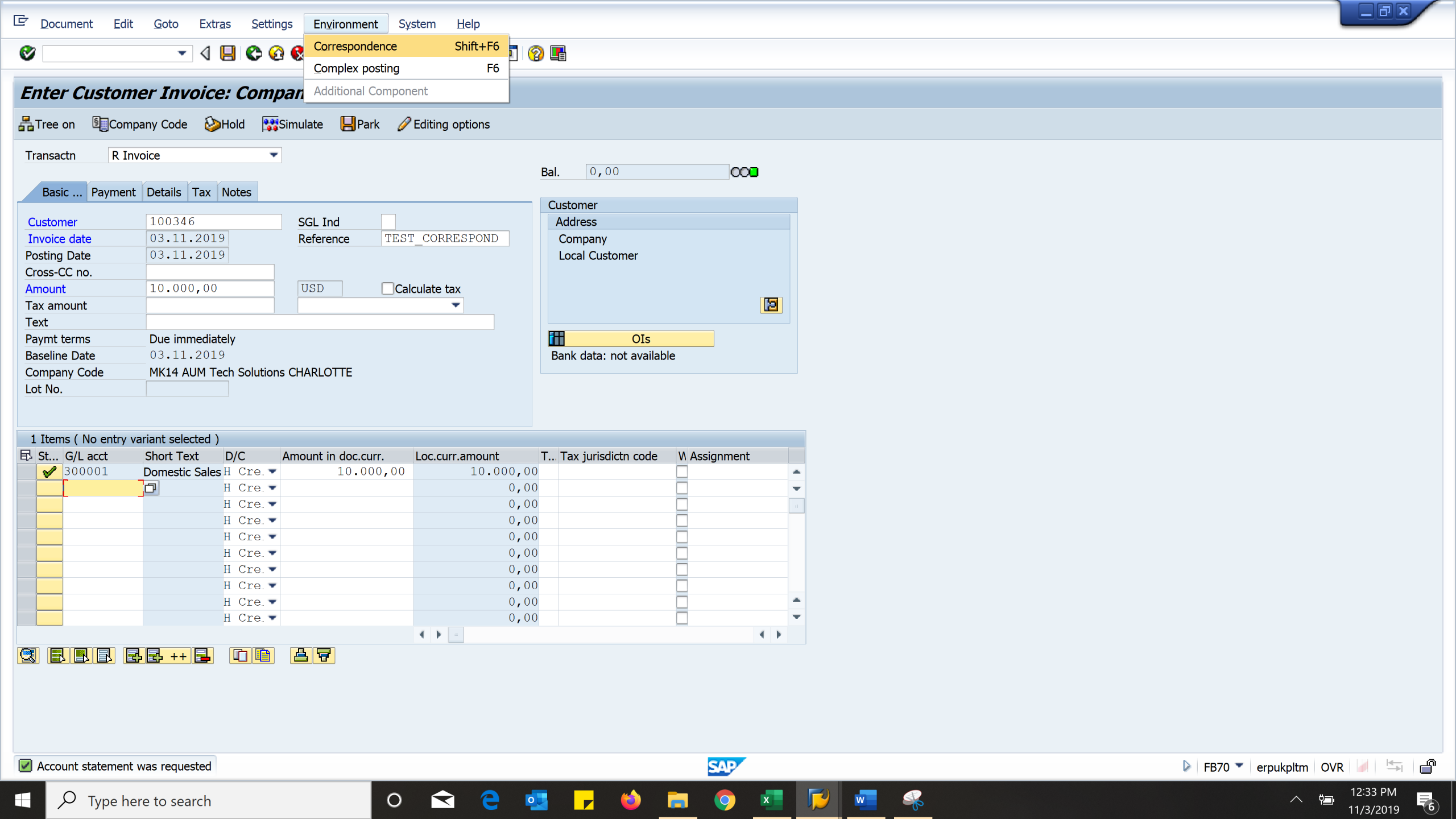

Similarly correspondence can be generated from document display/ change from the transaction, like in FB02/ FB03/ FLB5N, etc.

Similarly correspondence can be generated from document display/ change from the transaction, like in FB02/ FB03/ FLB5N, etc.

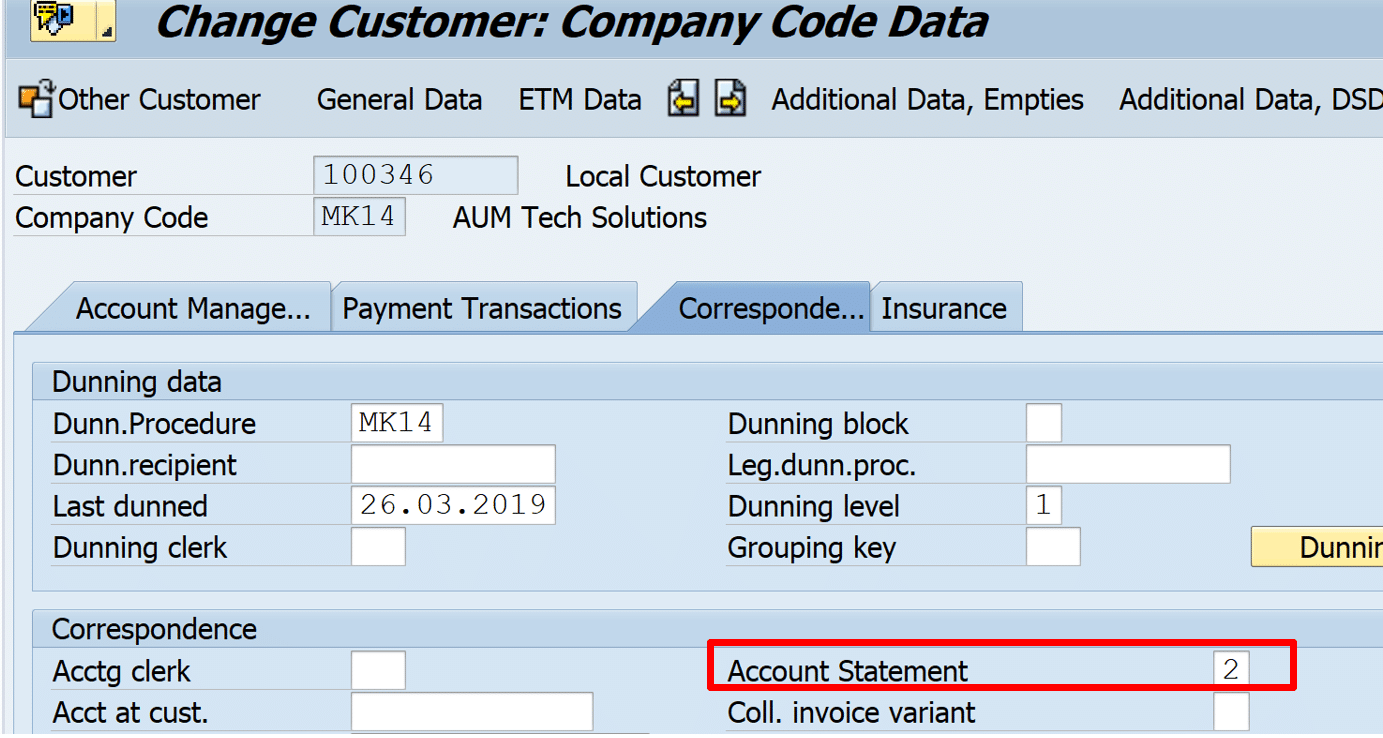

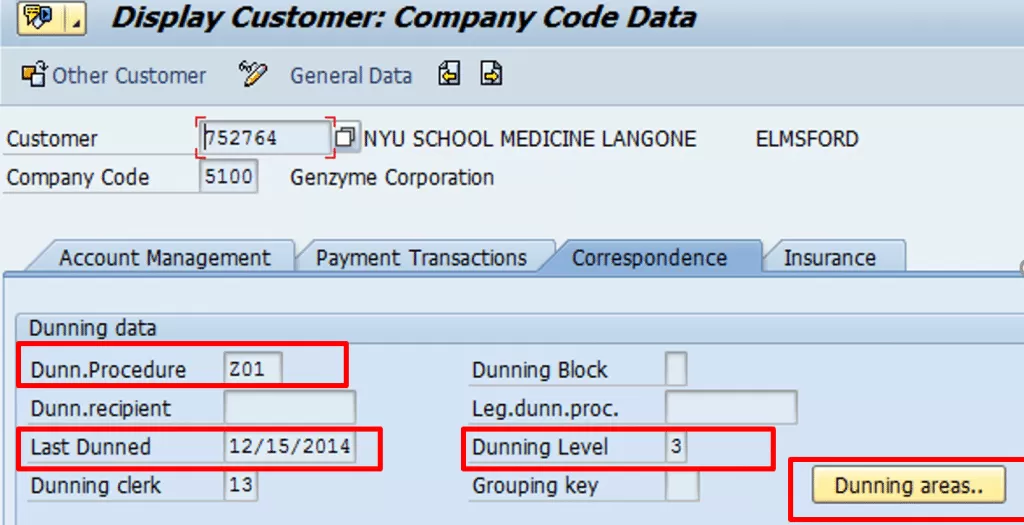

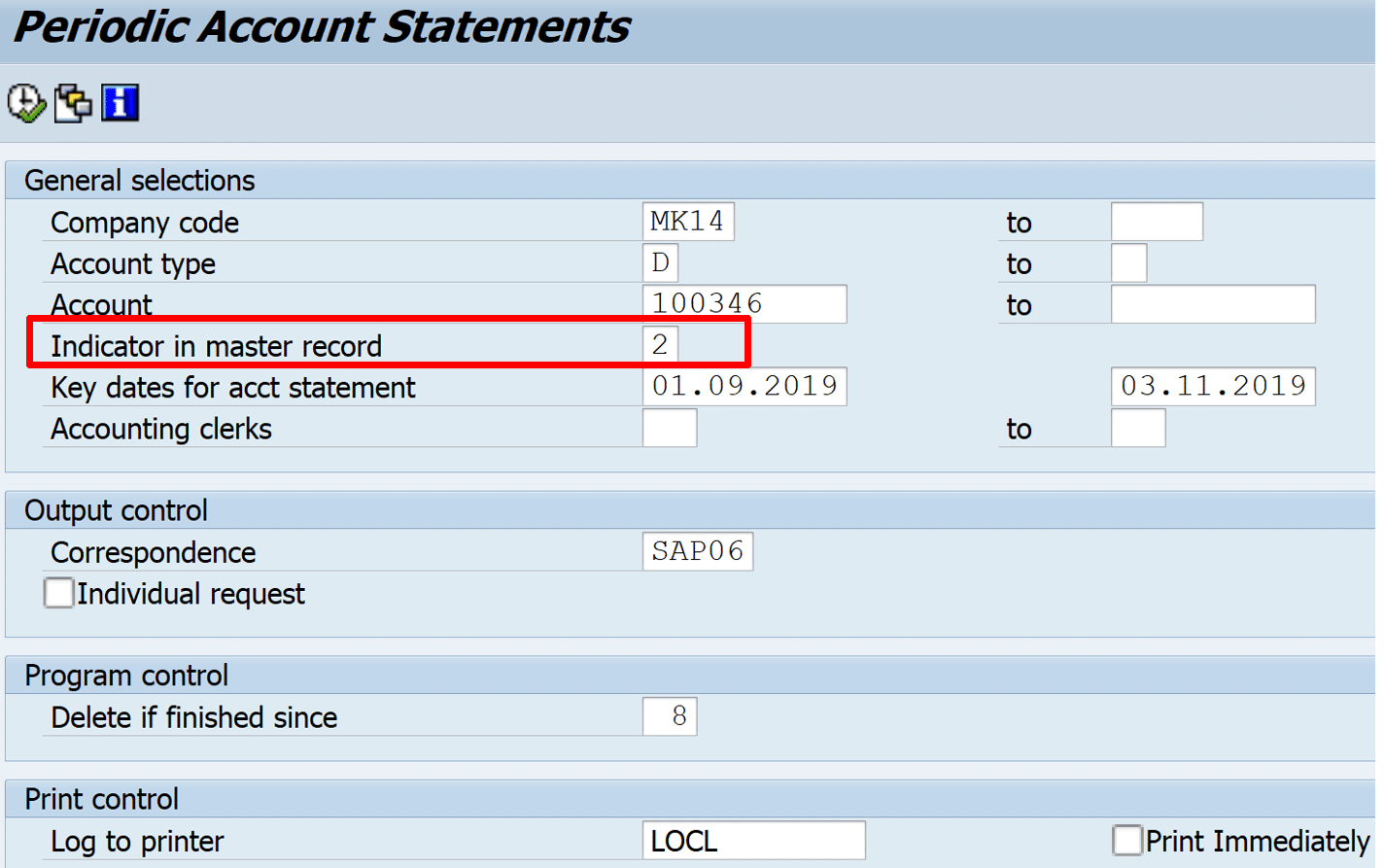

Here “Indicator in Master Record”, the value given should match with the value given in customer/ vendor master data > Company Code > Correspondence.

Here “Indicator in Master Record”, the value given should match with the value given in customer/ vendor master data > Company Code > Correspondence.