Table of Contents

Account Receivable

Accounts Receivable is a submodule of SAP FI and is used to manage and record Accounting data for all the customers. It handles customer invoices, customer receipts, correspondence and related activities. SAP Accounts Receivable will be covered in below post

- SAP AR Master Data

- SAP Customer Correspondence

- SAP Customer Dunning

- Automatic calculation and posting of Interest on customer past due invoices

- Lockbox

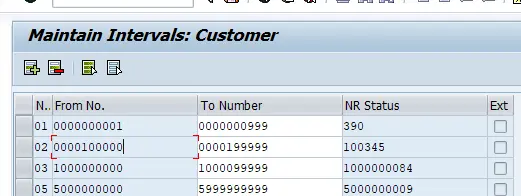

Create Number ranges for Customer Accounts

- Number range can be internal / external

- Number range decide customer master number at the time of creation. If external number range, you have to provide customer number at the time of customer creation. If internal number range, system generate the customer number at the time of customer creation

- Number range are assigned to Customer Account Group

Transaction code: XDN1

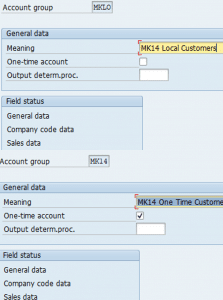

Define Account Groups

Customer are classified into various account groups. The account group determines the following:

- Number range interval of the customer

- Mandatory and Optional fields during customer master creation in transactions code XK01

- Whether a customer is one time vendor

Transaction code: OBD2

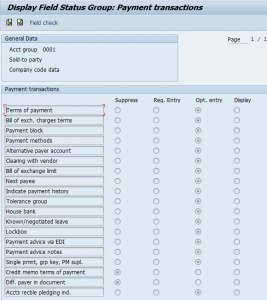

Field Status

This control the fields available in Customer master data accessed through transaction code XD01, XD02

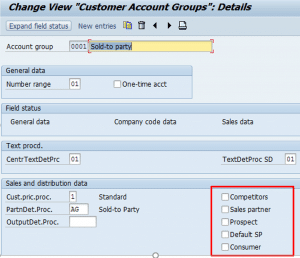

Assign number range and Customer Account group and define customer account group characters

Transaction Code: OVT0

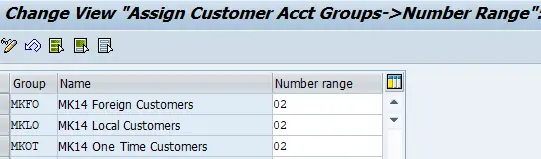

Assign Number Range to Account Groups

Transaction code: OBAR

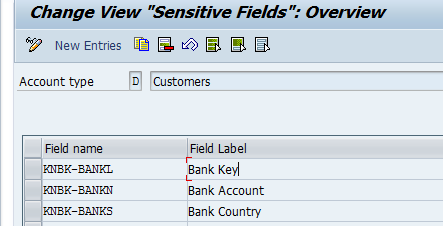

Define sensitive field for Dual Control

Transaction code: S_ALR_87003378 IMG Path : SPRO – Financial Accounting – Accounts Receivable and Accounts Payable – Customer Accounts – Master Data – Preparation for creating customer master data – Define sensitive field for dual control (Customers) We can define certain fields in customer master as sensitive fields. Any changes to these have to be confirmed by two users for the change to be effective. Further once a sensitive customer is changed, customer is blocked for sales till changes confirmed This block is removed when the change to sensitive field is confirmed by second user in transaction code FD08. If the change is rejected by second user in transaction code FD08, customer remains blocked for sales. Generally fields like Customer Bank account number, routing number are defined as sensitive fields

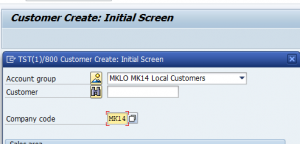

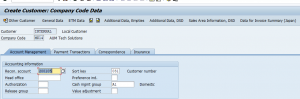

Create Customer master Record

Centrally: XD01 Accounting Alone: FD01 Sales area only: VD01 Create customer in account group MKLO created earlier

Transaction codes for Customer Master

| S.No. | Description | Transaction |

| 1 | Change Customer Master | XD02 |

| 2 | Display changes to Customer Master record | XD04 |

| 3 | Block / Unblock Customer Master | XD05 |

| 4 | Flag Customer master for deletion | XD06 |

Delete Customer master records

Transaction code: OBR2 Master record can be deleted only if below conditions satisfied:

- No transactions posted to the customer

- Company code is not productive

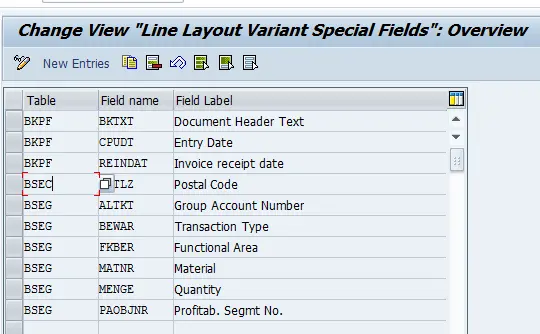

Define Additional Fields for display in customer line item report

IMG Path : SPRO – Financial Accounting – Accounts Receivable – Customer Accounts – Line Items – Display line Items – Define Additional fields for Line Item Display Here we can define additional fields from table BKBF, BSEG, BSEC etc. which can be displayed in FBL5N

Incoming Payment

| Task | Description | Transaction Code |

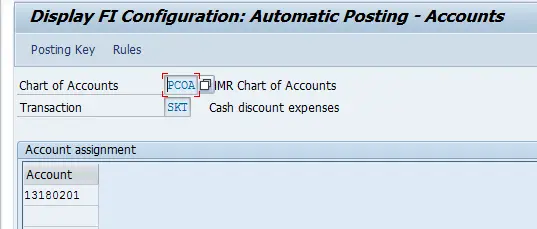

| Accounts for Cash Discount | System post to this account when clearing a customer invoice against payment received from customer with tolerances defined | OBXI |

| Define accts for Under/ Over payments | Discussed earlier | OBXL |

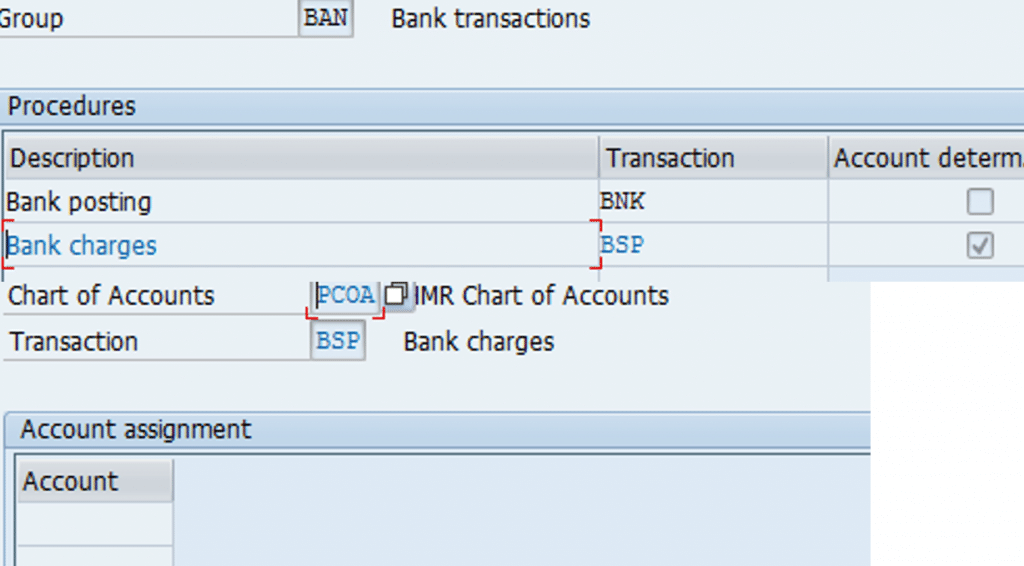

| Bank Charges | BNK : Bank Posting BSP : Bank Charges | OBXK |

OBXI  OBXK

OBXK

Interest calculation on customer past due invoices in SAP

This functionality calculates interest at the specified rate ( in SAP configuration) interest on customer invoices past due and Invoices paid after due date. This interest is debited to customer account and credited to interest received account. Program can also create a correspondence with details of past due customer invoices, interest amount on these invoices. This it can send automatically to customer through various means like email etc.

- Define Interest calculation types

- Prepare Item interest calculation

- Define Reference interest rates

- Enter interest values

- Define time-based terms

- Calculation of interest on arrears

- Assign interest indicator in customer master

- Calculate and Post interest on customer past due invoices

Define Interest Calculation Types in SAP

Path: SPRO – FA – AR/AP – Business Transactions – Interest Calculation – Interest Calculation Global Settings – Define Interest Calculation Types

Here we define the interest indicator. This has to maintain in customer master on whom interest has to be calculated.

Interest Calculation Types:

- P: Calculate interest on invoice line item

- S: Calculate interest on customer account balance

Prepare Item interest Calculation in SAP

Path: SPRO – FA – AR/AP – Business Transactions – Interest Calculation Global settings –Prepare Item interest calculation

Here make general settings for item interest calculation:

- Select interest calculated: Open Invoices due for payment, Cleared invoices after due date

- Reference date: Date with reference to which interest on overdue invoices is calculated.

- No Interest payment: Interest is calculated on items paid before due date (Credit interest) and items paid after due date (Debit interest). If you do not want credit interest to be credited to customer account, select this check box

- Post Interest: Select to post interest to customer account

- Posting with Invoice Reference: If you have set this indicator, the interest receivables created are posted with reference to the invoice for which interest was calculated.

Define Reference interest rates

Path: SPRO – FA – AR/AP – Business Transactions – Interest Calculation – Interest calculation – Define reference interest rates

Here you maintain interest rate for which interest rate percentage is maintained later in the configuration. This percentage is used to calculate interest amount

Enter Interest value

Path: SPRO – Financial Accounting – AR/AP – Business Transactions – Interest Calculation – Interest calculation- Enter interest value

Define Time Based Terms

Path: SPRO – FA – AR/AP – BT – Interest Calculation – Interest calculation- Define Time based terms

In this activity, you specify how the system determines an interest rate for each interest indicator.

- Specify a reference interest rate for which the interest rate is defined.

- Specify the required interest rate directly in the Premium field without specifying a reference interest rate.

- Specify a reference interest rate and an interest rate in the Premium field. The interest premium is added to the reference interest rate during interest calculation.

Calculation of Interest on arrears

Path: SPRO – Financial Accounting – AR/AP – Business Transactions – Interest Calculation – Interest Posting – A/R: Calculation of interest on arrears

In this step, you define the specifications for posting the interest calculated as interest on arrears.

The account determination is carried out via the posting interface of application 0002.

Account determination keys and posting details

For the business transaction account determination key, 1000 (interest earned) and 2000(interest paid) should be entered.

For every combination of the account determination keys, you specify a debit-posting key, a credit posting key and account symbols (posting details). You use the account symbol 1000 for the customer posting.

GL Accounts

G/L accounts: For each G/L account symbol, you specify the account allocation for interest earned and interest paid in full.

Create Account symbols

Assign Interest indicator in customer master

Tcode: XD02

Assign forms to print interest calculation

Path: SPRO – Financial Accounting – AR/AP – Business Transactions – Interest Calculation – Print

Calculate and Post interest for customer overdue items

Transaction code: FINT

Interest document posted: FB03

For detailed, step-by-step instructions on SAP Lockbox follow along with my video tutorial below

SAP Dunning

When the customer misses the payment for the outstanding invoice within specified payment due date. The dunning letter is generated via sap program and sent to customer address / email as reminder of outstanding payment.

The dunning system covers the following documents

- Open A/R invoices, including invoices that are partially credited or partially paid

- Invoices that include installments

- A/R credit memos

SAP Dunning CONFIGURATION

Define Dunning areas in sap

IMG Path: SPRO > Financial Accounting (New) > Account Receivable and Account Payable > Business Transactions > Dunning > Basic Setting for Dunning >

Dunning can be done at Dunning area or company code level. For Company code MK14 (AUM Tech Solutions) dunning is done at company code level (MK14) so dunning areas not defined

Define sap Dunning Keys

Dunning keys limits the dunning level of an item.

Path: IMG > Financial Accounting (New) > Account Receivable and Account Payable > Business Transactions > Dunning > Basic Setting for Dunning

Transaction code: OB17

Define Block reason for Dunning Notices

The key can be entered at a line item (FBL5N) or in the account of a Customer master. Blocked line items or Customer Accounts are not considered for the dunning run. Reason could be item already paid etc.

IMG Path: SPRO> Financial Accounting (New) > Account Receivable and Account Payable > Business Transactions > Dunning > Basic Setting for Dunning > Define Dunning Block Reasons

Tcode: OB18

Define Dunning Procedures in sap

IMG Path: SPRO > Financial Accounting (New) > Account Receivable and Account Payable > Business Transactions > Dunning > Dunning Procedure > Define Dunning Procedure

Tcode: FBMP

- Dunning Intervals in days: Day’s interval between dunning run. A new dunning notice is generated for a customer only after no. of days mentioned here have lapsed from the last dunning notice

- No. of Dunning Levels: Maximum no. of dunning levels in this Dunning procedure

Click New Procedure and enter the below details:

Special GL Indicator

Click special GL indicator and select special GL indicator ‘A’ for customers. Here you Select Special GL Transactions to be considered for the Dunning Run

Dunning Text

Click Dunning text button and enter the below details:

Save and come back. Now again click Dunning text button and enter the Dunning Form details. A Dunning form is a Key to identify the form used to create dunning notice. The layout of the form is defined in the SAP script word processing tool using the key specified here. Dunning Forms used in SAP are designed using SAP script and Smart Forms. Smart Forms preferable

Dunning Levels in sap

- Dunning levels are assigned to customer Open Items

- Level 1: Item overdue between 15 to 44 days

- Always DUN: If selected customer account is always dunned even if there is no change in it as compared to last dunning notice

- Print All Items: If selected print all Open Items in Dunning Notice

Dunning Charges in sap

This is like an administration charge to dun the customer. Currency USD is assigned during the dunning charge.

Minimum Amount

Click Minimum amount button and specify the minimum dunning amount. If this amount is not reached in a dunning level, then the items in this dunning level are assigned to the next lowest, and the system checks whether a dunning notice can then be created in this dunning level. If you have specified a minimum percentage rate for this dunning level, then this must also be reached.

Assign Company code to sap Dunning Procedure

Transaction code: FBMP

Select Dunning Procedure Z01 – Environment – Company code data

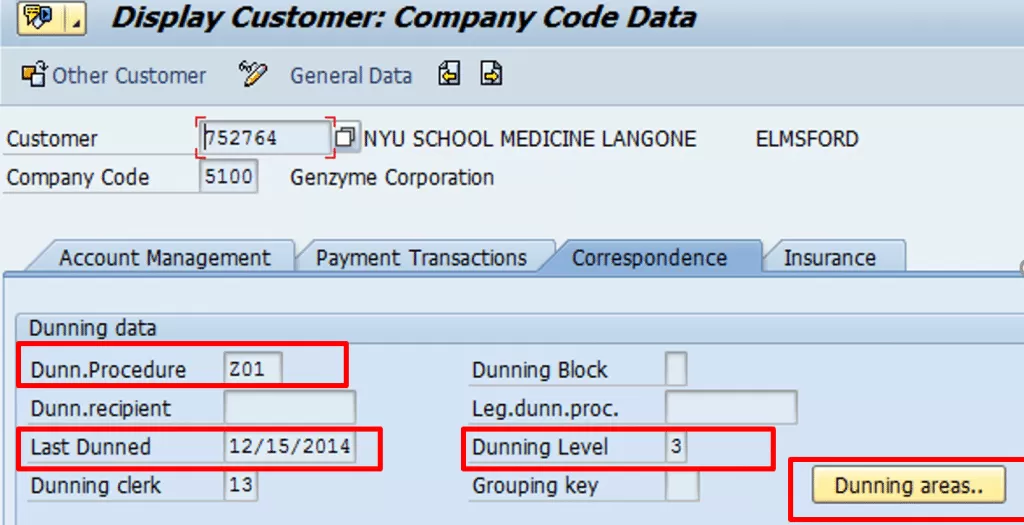

Assign Dunning Procedure to Customer master

Transaction Code : XD02

- In this step, we insert Dunning procedures in the customer master (Correspondence tab). If dunning at company code level, Dunning Procedure should not be entered at Sales Area Level

- We have to maintain the Language field in the customer master data (Address tab) to print the Dunning Notice as per there language, Dunning Text should also be maintained in reference to dunning level. So that the content of dunning notice will be different to dunning level.

- Go to correspondence tab and enter the Dunning procedure

Dunning Run – End user business Process

Post Customer Invoice to test Dunning Run

Transaction : FB60

In the Customer Invoice, change the baseline date to an earlier date to post invoice eligible for dunning notice

Dunning Run

Transaction code: F150

Click Parameters tab and enter below details:

Save parameters and click schedule tab. Select Start immediately

Wait till Dunn selection appears complete as below

Click Dunning Printout button, enter printer as LP01 /LOCL. Go to own spool (Transaction SP01)

To see the dunning notice

Dunning Email functionality

- Customized program ZFI_PROCESS_00001040 is developed to send Dunning notice through email.

- Further SAP Connect is configured to send emails to Customers. Emails to be pushed from SAP Connect

- View emails sent to customer for dunning: SE38-RSSOSOSTSTAT

In order to send Dunning Mail with introductory Text and Subject, use BTE process 00001040.

Create Product

Initial Screen

T-Code: FIBF

Image-18

Create Customer Product

- Give a Product Name(e.g. ZFTR_DUN) and corresponding text

- Tick the checkbox

- Click on Save

Add Process

- T-Code: FIBF

- Create a process module “of a customer” under “Process Module”

BTE Implementation 00001040 is added here

Assign Customer Product

- Enter the process Name

- Application area being used (e.g. TR-LO)

- Function module (e.g. ZFTR_PROCESS_00001040)

- Product defined in earlier steps

Fill Parameters in Customer Function Module

- T-Code: SE37

- Copy function module SAMPLE_PROCESS_00001040 onto your function module (e.g.

ZFTR_PROCESS_00001040) - Use perform “get_email_id” to get email IDs for business partners

- Fill in details has shown

Create Mail Introductory Text

- T-code: SO10

- Enter Text Name

- Choose Text ID as “FIKO”

- Choose Language (e.g. EN in case of English)

For detailed, step-by-step instructions on SAP Finance Business process, Configuration and Development follow along with my video tutorial below

SAP Finance, Accounts Receivable Training

For details on SAP Accounts Receivable Business User Guide, Please follow the below tutorial : SAP Accounts Receivable Business User Guide

Pingback: SAP Finance Enterprise Structure | SAP FINANCE and Treasury

Pingback: SAP AR - Dunning | SAP FINANCE and Treasury

Pingback: Vendor Payments-ACH/Wire, DMEE-Part 2 – SAP FINANCE and Treasury

Pingback: SAP Finance Tutorials | AUMTECH Solutions-SAP Training

just before|ahead of|in advance of|right before} or

right after the muse course tob uild Your very own SAP Fiori Application during the Cloud.

Anubhav’s Teaching will train you about rules, instruments, and ideal tactics for

building, creating, and deploying your pretty very own SAP Fiori application.

Thank you for curating the content on scn.This publish has become incredibly valuable.

Pingback: SAP S4/HANA Finance Accounts Receivable | AUMTECH Solutions-SAP Training