Table of Contents

General Ledger

General Ledger master record is stored at 2 level

- Chart of Accounts Level

- Company Code level

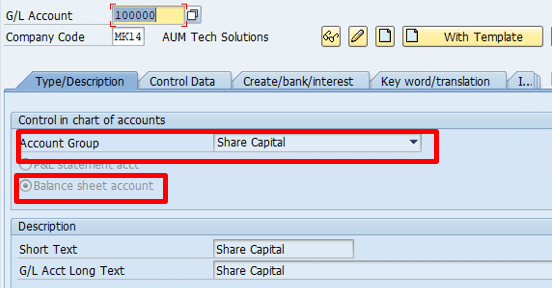

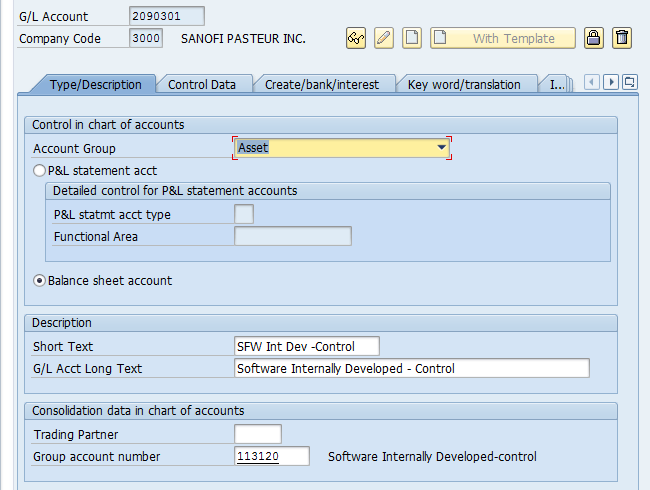

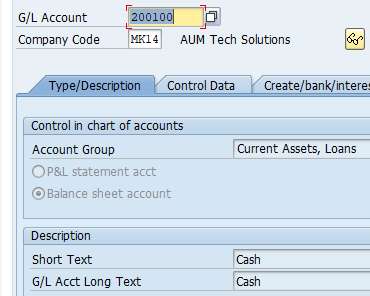

At Chart of Accounts Level following data is maintained:

- GL Account number

- GL Account type

- GL Account Group

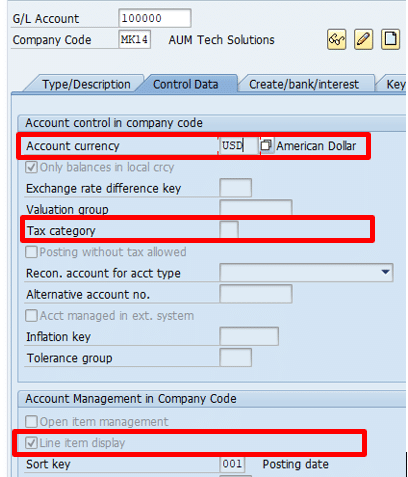

At Company Code level, following data is maintained

- Account Currency

- Valuation Group

- Tax category

- Alternative Account

- Tolerance group

- Field Status group

- Post automatically only

- GL Account Group

- Maintained at Chart of Account level

- It is a mandatory field

- The account group determines the fields for the entry screens when you create or change a master record in the company code. The account group also determines in which number interval the account number must be.

- Indicator Balance Sheet Account or P/L account

- Indicates that the G/L account is managed as a balance sheet account or P/L account

- Group Account Number

- The usage of the group account number offers the advantage that by specifying a number; a group of accounts can be assigned immediately to the balance sheet or P+L item.

- Account Currency

- If a currency other than the company code currency is specified, users can only post items in that currency to this account. If the company code currency is specified, users can post items in any currency to this account.

- Only Manage Balances in Local Currency

- Typically used for Balance sheet open item clearing accounts. Posting can be made to the account only in company code / local currency. This facilitates clearing of Invoices and GRN. Example below

- Exchange Rate difference Key

- This applies to a balance sheet GL account which holds foreign currency balances. At month end, foreign currency balances have to be revaluated and differences posted to exchange rate difference account. This is a Profit and loss account. There could be just one account to which any exchange rate difference is posted or multiple accounts depending on key specified in this field

- Tax Category

Determine whether the following apply to the GL Account

| Tax Account | Account used exclusively for tax posting |

| Tax Relevant | GL accounts which will always have a tax posting. We can also specify the tax codes that will be used |

| Tax Not Relevant | No entry made in this field. |

- Posting without Tax Allowed

- If not selected posting to the GL account not possible unless a tax code is specified at line item level during document entry

- If selected posting can be made to the GL Account with any tax codes specifications

- Reconciliation Account for account Type

- An entry in this field characterizes the G/L account as a reconciliation account. The reconciliation account ensures the integration of a sub ledger account into the general ledger.

- Alternative Account Number

- The account number from your legacy system

- The account number from a country chart of accounts

- Account Managed in External System

- Relevant in case of distributed scenario. ALE

- Tolerance Group

- Specify the GL account tolerance group for treatment of Open items during clearing

- Open Item Management

- Selected where an account is managed as open item account

- Open Item accounts are Balance sheet account

- Open Item accounts will have Open line items and Cleared line items.

- For e.g. let’s take a vendor account. When vendor invoice is posted to it, it is unpaid and thus it shows as open line item. When Payment is made to vendor for this invoice, SAP Payment program identifies this invoice and clears it against the payment document. So in vendor account we see Open Invoice. These are unpaid invoices. Cleared Invoices. These are paid invoices

- Open Item Management typically is used for below types of accounts

- Clearing accounts

- Bank clearing account

- Payroll clearing account

- Cash discount clearing account

- GR/IR clearing account

- Line Item display

- Enable line item display for GL account. Enable in case of Open Item Managed accounts

- Sort Key

- Specify what information should be entered in the Allocation field in the GL Account line item display. For e.g. PO number, Assignment number

- Field Status Group

- Specify Field status of the GL Account

Create GL Account Centrally

Transaction code : FS00

Create GL Accounts

Transaction code : FSPO

This is another transaction code used to create GL accounts. This create GL data at chart of accounts level only. To create data both at chart of accounts and company code level use transaction FS00

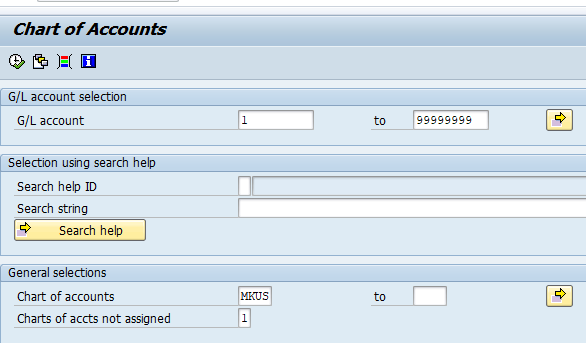

Display the list of GL accounts created in Chart of Accounts

Transaction Code : F.10

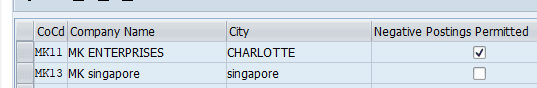

Permit Negative Posting

A negative posting correct an incorrect posting without influencing the trail balance, for e.g. when a document is reversed , it’s negative amount is posted on the same side of the transaction.

Transaction code: S_ALR_87004651

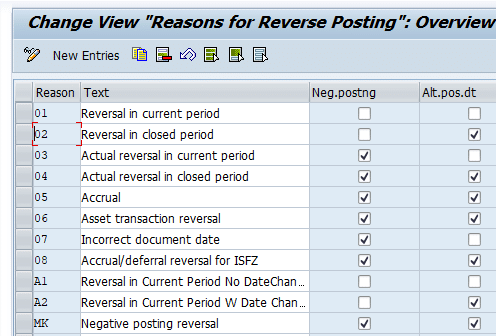

Define reason for Reversal

While reversing a FI document a reason for reversal has to be selected. Define reason for reversal of FI document here.

Transaction Code: S_ALR_87004660

Neg Posting: If selected documents with this reason code will be reversed with negative posting

Alt Posting Date: If selected reversal document can be posted on a date other than the system date

Open Item Clearing

Open items are unfinished transactions such as vendor / customer invoices which have not been paid. These are cleared partially / fully against the payment document.

The Open items can cleared in document currency or in foreign currency. If cleared in foreign currency system follows below steps for conversion

- Translate document currency to company code currency

- Translate company code currency to Clearing / foreign currency

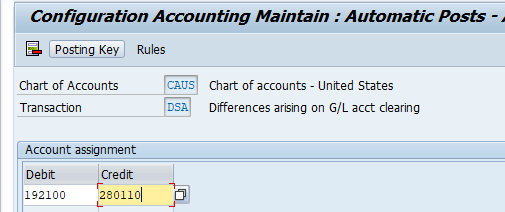

Exchange rate difference in the translation are automatically posted to GL accounts defined in Transaction code OBXZ

For Open item clearing to take place below are the prerequisite requirements:

- GL account is Open Item managed in FS00

- Item that can be cleared cannot be special GL transaction like down payments, Guarantee etc.

Methods of clearing Open Items:

- Regular posting:

- Payment Program: F110

- Reversing a FI document: FBRA

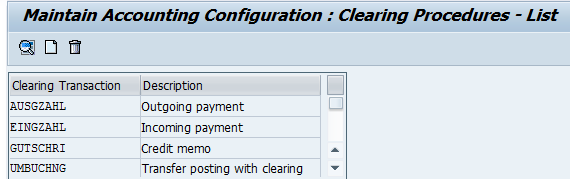

Configuration for Open Item Clearing

Standard posting keys for Open Item Clearing. We will not change any settings here

Transaction code: OBXH

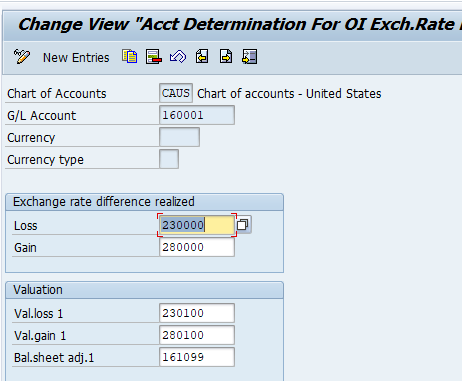

Define GL Accounts for gain / loss realized during open item clearing

IMG Path : SPRO – Financial Accounting (New) – General Ledger Accounting (New) – Business Transactions – Open Item Clearing – Define Accounts For Exchange Rate Differences

Transaction code: OB09

G/L Account 160001 : This is trade payable account / vendor reconciliation account for which open items are considered for clearing

Exchange rate difference realized, Loss 230000, Gain 280000 : These are the GL accounts to which exchange rate realized is posted. For e.g. payment is made to a foreign currency invoice of a vendor. Exchange rate on payment date is different from one date when Invoice posted in SAP system. This difference which could be loss or gain is posted to these GL accounts. These arise at the time of payments during automatic payment run in transaction F110

Valuation block GL accounts loss/ gain and Balance sheet adjustment accounts : These are posted with exchange rate difference during month end foreign currency translation valuation in transaction code #FAGL_FC_VAL . For e.g. if there is an exchange loss, Val Loss 1, GL account#230100 is debited with loss amount and Bal sheet adj 1, GL#161099 is credited with this amount. In the beginning of next month these entries are reversed. These are reversed as the loss is not realized yet. It was calculated only for month end P/L and Balance sheet reporting purpose

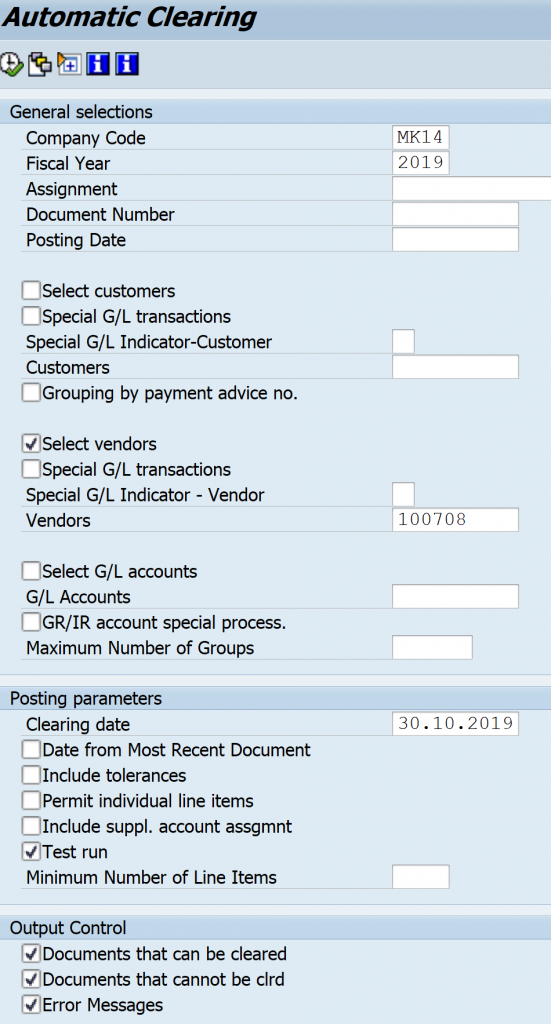

Automatic clearing of Open Line items

Program clears the open items by grouping them together if their total balance equal zero in local and foreign currency.

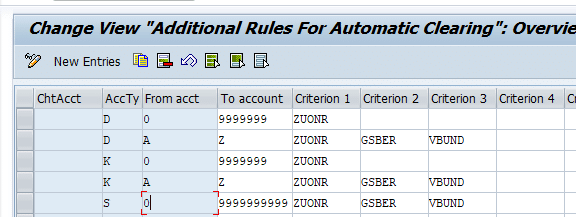

Configuration settings for automatic clearing is done in transaction code# OB74

To enable automatic grouping SAP comes pre delivered with standard criteria of Account type (KOART) and Account number (KONT and KONT2). It also provides the additional criteria like Assignment (ZUONR), business area (GSBER), and Trading Partner (VBUND)

Run Vendor/Customer Invoice automatic clearing in Transaction code : F.13

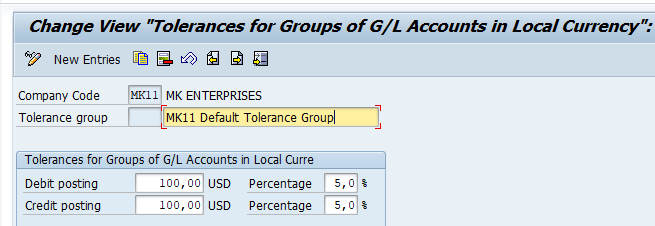

Define Tolerance group for GL Accounts

For clearing GL Accounts in transaction code F-44 tolerance amount has to be specified. Documents can be cleared only if clearing difference is within the tolerance specified here.

Transaction Code: OBA0

IMG Path : Financial Accounting (New) – General Ledger Accounting (New) –

Business Transactions – Open Item Clearing – Clearing differences – Define

Tolerance Groups For G/L Accounts

- Each company code must have at least one tolerance group

- Blank tolerance group applies to all users, not assigned to specific tolerance group

- Specific tolerance group has to be assigned to employee in transaction code # OB57

- System consider lower of the debit amount and percentage during clearing of GL line items

- As we have defined tolerance group at employee level and also at GL account level, SAP consider lower of these at the time of clearing

Create Account for clearing differences

Difference arising during clearing of GL accounts line item will be automatically posted to account set up in transaction#OBXZ

IMG Path : Financial Accounting (New) – General Ledger Accounting (New) – Business Transactions -Open Item Clearing – Clearing differences – Create Accounts for Clearing

Differences

Transaction Code: OBXZ

GL Master Data Migration Transactions

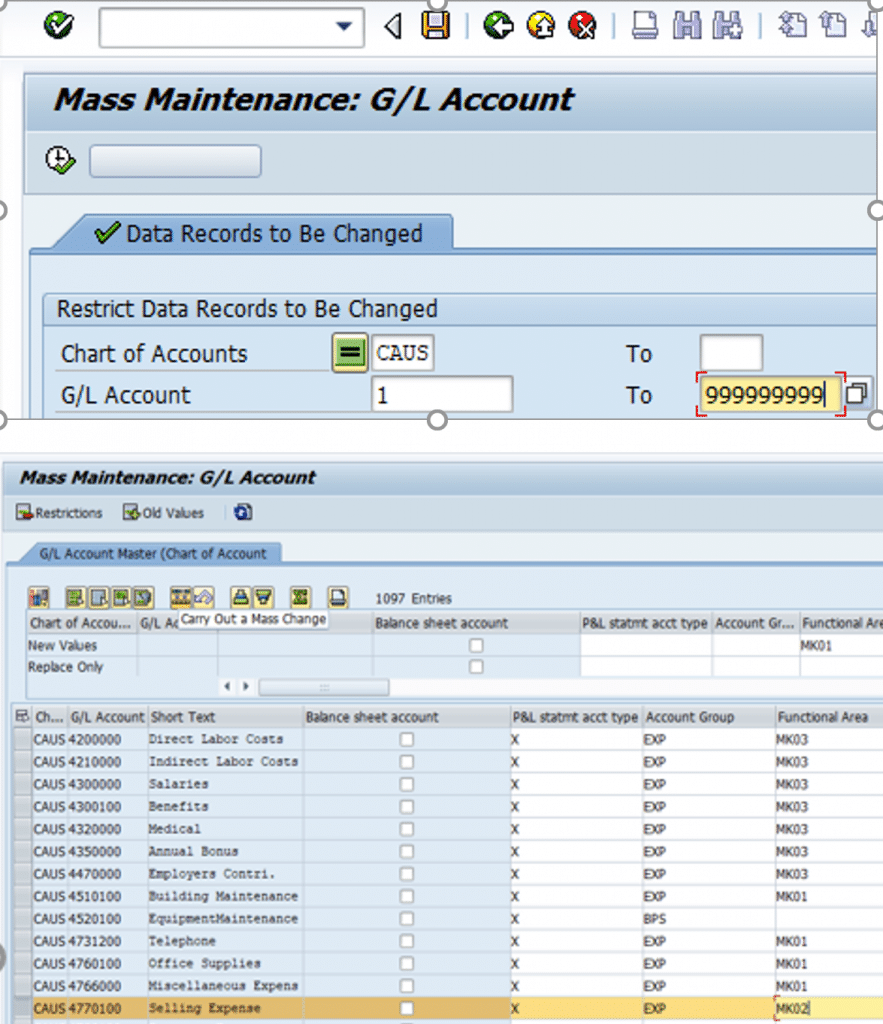

Change Chart of Accounts data of GL Accounts

Transaction code : OB_GLACC11

Here we will update functional area and account group for GL accounts

Enter the account group and functional area in the rows where it has to be changed or added. Further can select multiple rows and enter the functional area to be entered for these rows in new values as shown in image above. Use carry out mass change button to update these values. When you save, Account Group and functional area updated for these GL accounts

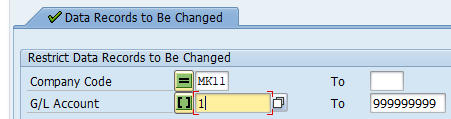

Change Company code data of GL Accounts

Transaction code : OB_GLACC12

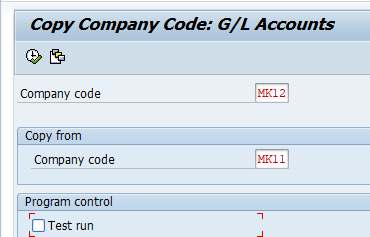

Copy Chart of accounts from Company code

Transaction code : OBY2

This transaction code can be used to copy Chart of accounts from a company code. We will use this to copy chart of accounts data from company code MK11 to MK12

For detailed, step-by-step instructions on SAP Finance Business process, configuration and development follow along with my video tutorial below.

Special GL Transactions

Special G/L transactions are special transactions in accounts receivable and accounts payable that are recorded in the General Ledger in alternative reconciliation accounts instead of the normal Vendor/Customer reconciliation accounts. We usually make use of Special G/L Transactions to take care of business process requirements of down payments, Provision for bad and doubtful debts, guarantees etc. In this post we will discuss the concept of Special G/L Transactions, the system settings for Special G/L Transactions and some end user activities related to Special G/L Transactions.

Examples of Special GL transactions

- Down Payment request

- Down Payment to Vendor / Customer. A down payment to vendor is advance payment to vendor

- Provision for Bad and Doubtful debt

- Guarantees

Down Payment Request

- This is a noted item

- Single line entry with no impact on GL accounts

- Based on Down Payment request automatic payment program ( F110) will make an Advance payment / Down Payment to the vendor

Down Payment

- These are advances to vendors or advance received from customer. They are credited to alternative reconciliation account linked to vendor / customer reconciliation account.

- Configuration of special GL accounts : FBKP

Guarantees

- A Bank guarantee is a legally binding document issued by Bank to a vendor / 3rd party on behalf of its client. It is an assurance by the bank that in case it’s client fails to pay the dues to the vendor, bank will pay the amount. Bank many times request some collateral as security for issuing the guarantee.

- Guarantee appears as notes in the Balance sheet. Guarantees are posted to alternative reconciliation account.

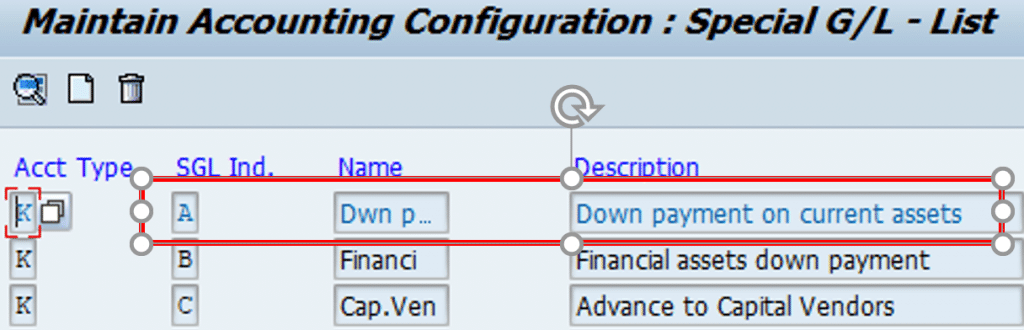

Steps to setup Special GL Transactions in SAP

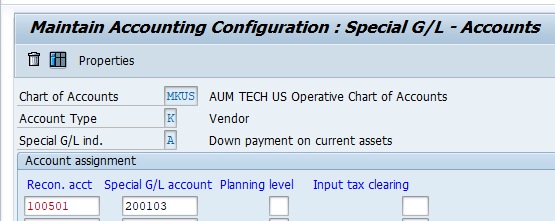

Define Alternative reconciliation account for Down Payment Made(Vendors)

Transaction code : FBKP

Alternatively you can also use transaction OBYR

IMG Path : SPRO – Financial Accounting (New) — Accounts Receivable and Accounts Payable — Business Transactions — Down Payment Made — Define Alternative Reconciliation Account for Down Payments

Double click Down Payment on current assets and enter the below details

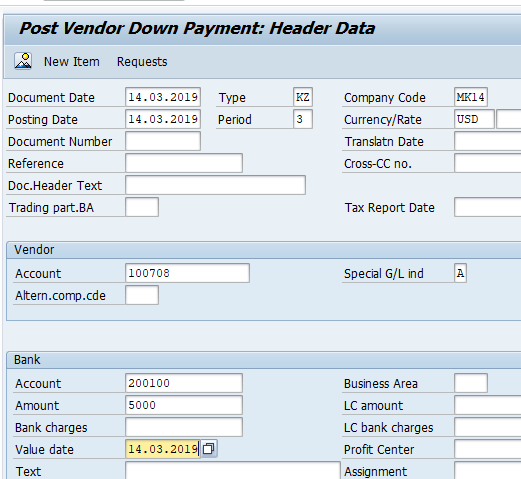

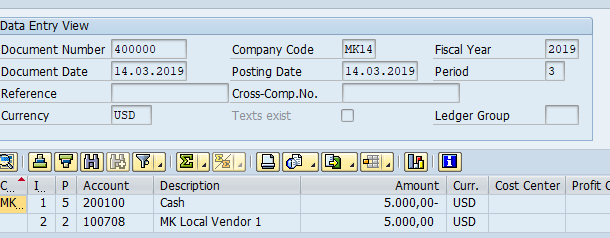

Advance Payment Posting to Vendor

Transaction code : F-48

Post Vendor Invoice

Transaction code : FB60

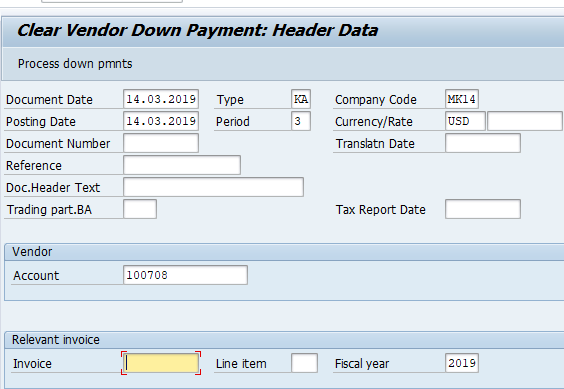

Transfer Advance Payment from Special GL/ Alternative reconciliation account to Normal GL

Transaction code : F-54

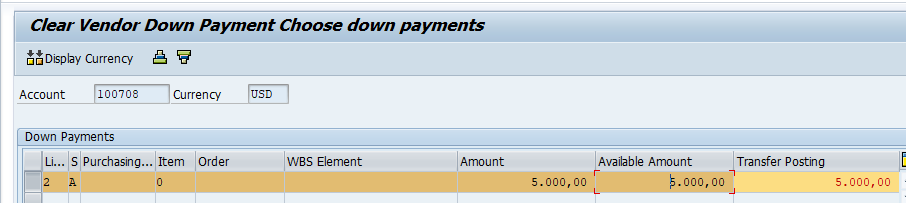

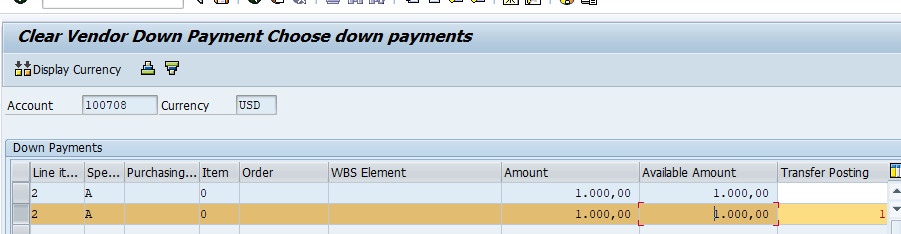

Click Process button. Double click to move amount to Transfer posting field and then press Save

Now manually clear the vendor invoice against the advance in transaction code F-44

Noted Items

Special G/L transactions are also used to manage noted items. These are postings that are not displayed in your accounts but are only to remind you of outstanding payments due or to be made. You can process them with the payment program or dunning program. As a result, it is possible to dun outstanding down payments or to make down payments with the payment program. To do this, you enter and store a down payment request. Always mark the Line item display option for these accounts

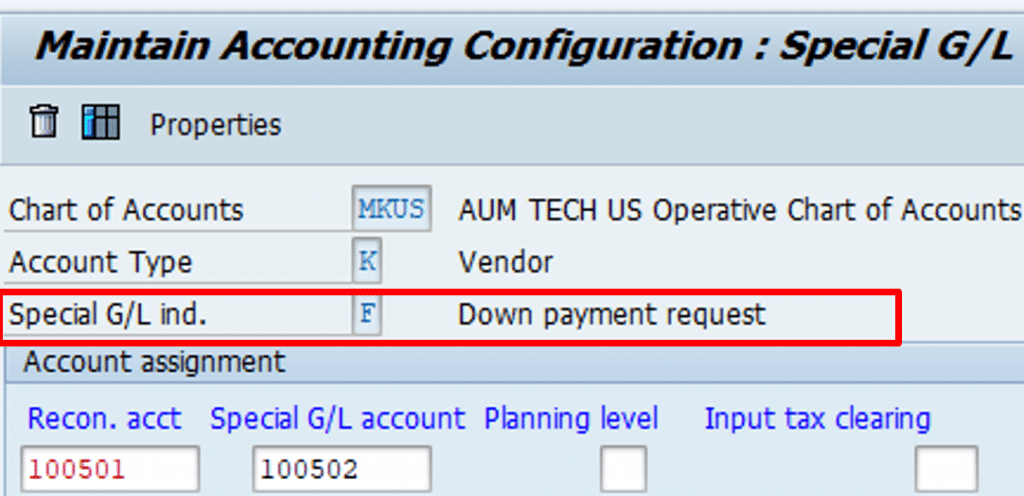

Define Alternative Reconciliation Account for Down Payments Request

Transaction code : OBYR

IMG Path : SPRO – Financial Accounting (New) — Accounts Receivable and Accounts Payable — Business Transactions — Down Payment Made — Define Alternative Reconciliation Account for Down Payments

Double click on special GL indicator ‘F’ and enter the below details:

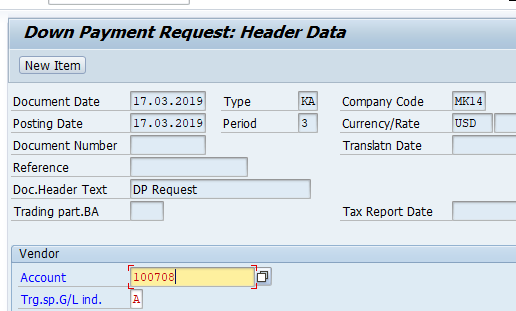

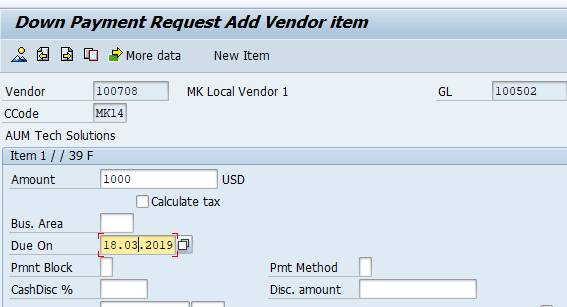

Posting Down Payment request

Transaction Code : F-47

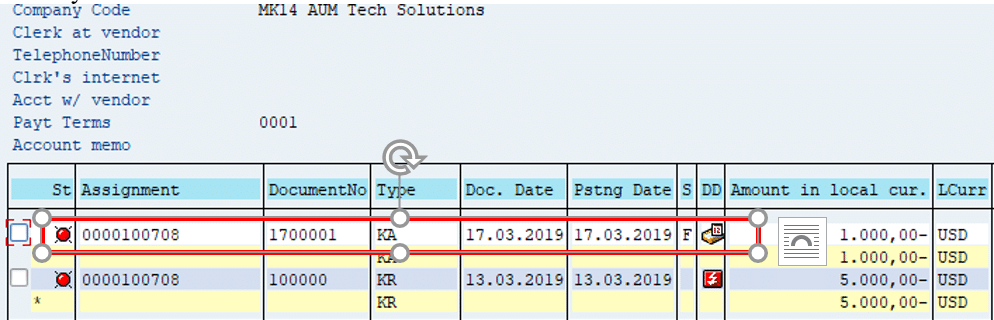

Display Vendor Down Payment Request

Transaction : FBL1N

Ensure you select noted item check box on FBL1N selection screen

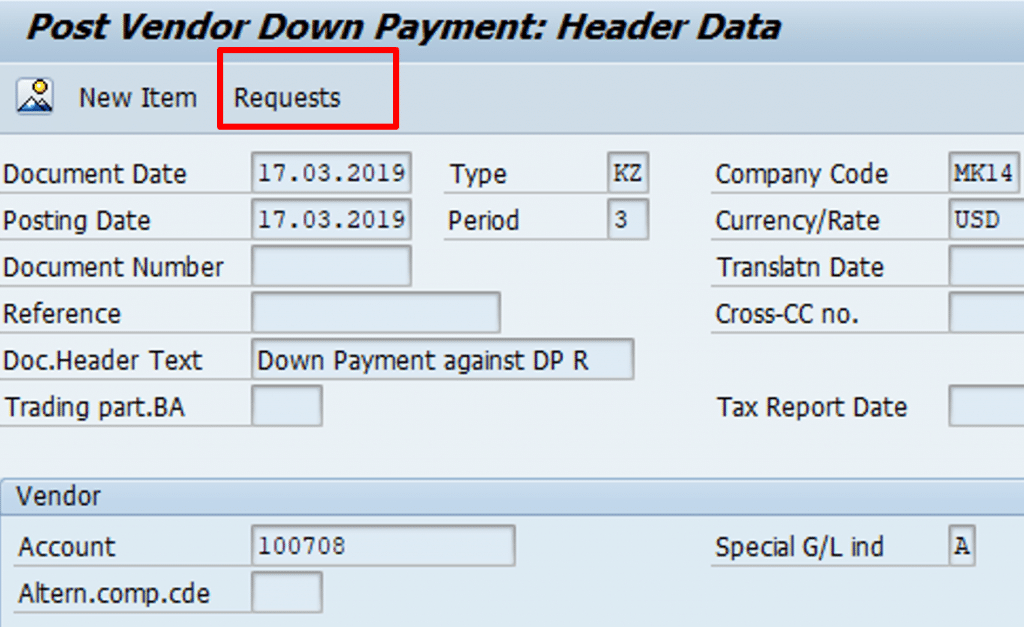

Post Down Payment against the Down Payment Request

Transaction : F-48

Click on button ‘ Request’

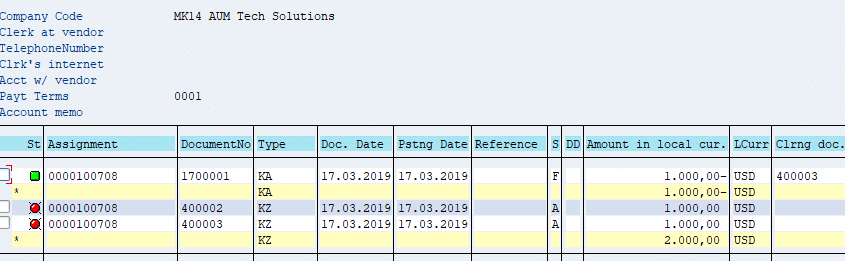

Down Payment request (Doc 1700001) has been cleared and a new Down payment ( Doc 400003) has been created

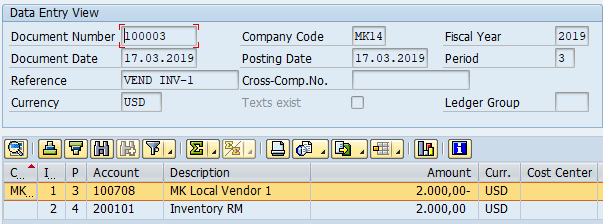

Post Vendor Invoice

Transaction : FB60

Transfer Down Payment from special GL account to Normal GL account

Transaction : F-54

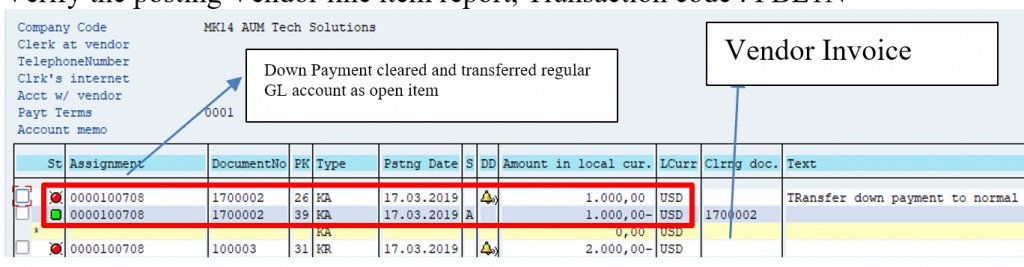

Verify the posting Vendor line item report, Transaction code : FBL1N

Now you can clear the vendor invoice against the vendor advance document (Doc#1700002) in transaction code F-44

This completes our discussion on configuration and testing of special GL transactions in SAP.

Intercompany transactions in SAP

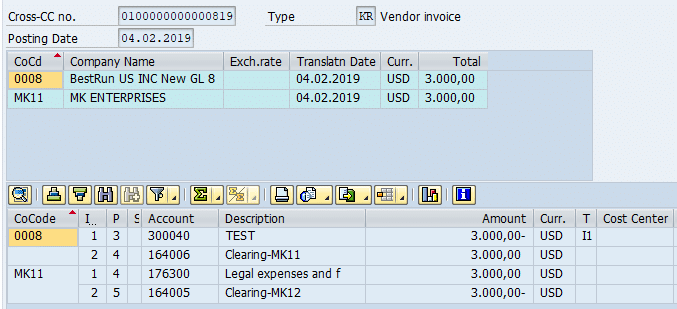

Several company codes are involved in a cross-company code transaction. In a cross-company code transaction, the system posts a separate document with its own document number in each of the company codes. Individual documents are linked by a common cross-company code number. The system generates line items automatically (receivables and payable arising between company codes) in order to balance the debits and credits in each document.

At times one company code makes purchases on behalf of another company code or makes payment on behalf of another company code. This needs entries to be passed in both company codes. If cross company code settings are done, entry in one company code would generate the entry in the other company code also.

Steps to setup inter-company configuration in SAP

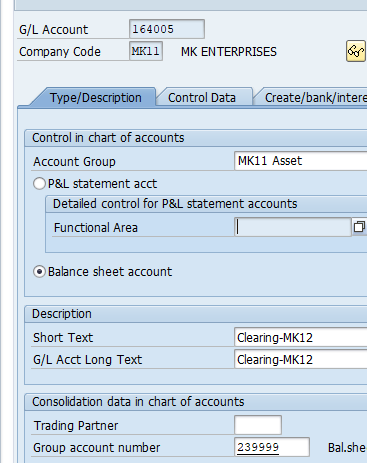

Create Clearing G/L account in both company codes

Transaction code : FS00

| GL Acct | Company code | BS | Acct Gr | CURR | Open Item Mngt | Line Item Dis | Field Status Group |

| 164005 | MK11 | X | MK11 Asset | USD | X | X | G001 |

| 164006 | 0008 | X | MK11 Asset | USD | X | X | G001 |

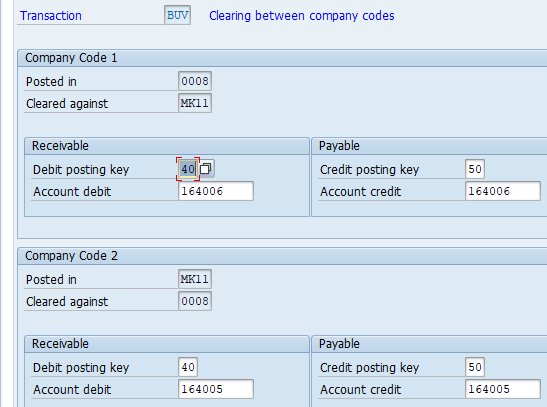

Define inter company code configuration for company code MK11 and 0008

Transaction code : OBYA

IMG Path : Financial Accounting –> General Ledger Accounting–> Business transactions–> Prepare cross-company code transactions

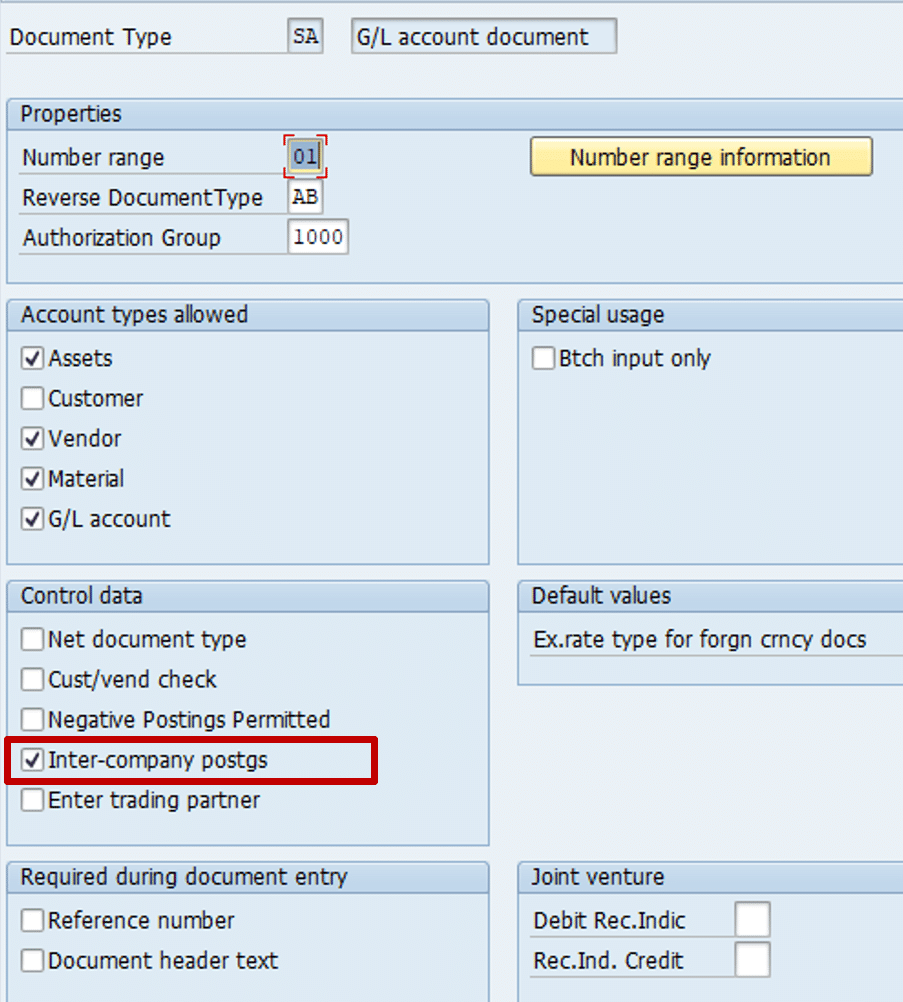

Verify Doc type SA allows cross company postings

Transaction code: OBA7

IMG Path : SPRO – Financial Accounting( new) -> Financial Accounting Global Settings (New) -> Document –> Document Types -> Define Document types for Entry View

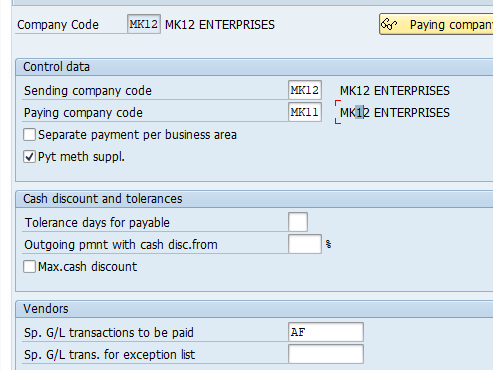

Prepare Cross company code for manual payments

Transaction code: OB60

IMG Path : Financial Accounting –>Accounts Receivables and Payables –> Business transactions–> Outgoing payments –> Manual Outgoing payments–>Prepare Cross Company code for manual payments

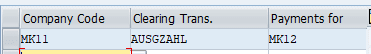

Prepare Cross company code for Automatic Payments

IMG Path : Financial Accounting–> Accounts Receivables and Payables–> Business transactions –> Outgoing payments–> Automatic Outgoing payments –>Payment method/Bank Selection for Payment Program–> setup all company codes for payment transactions

Transaction code: FBZP

Select tab all company code

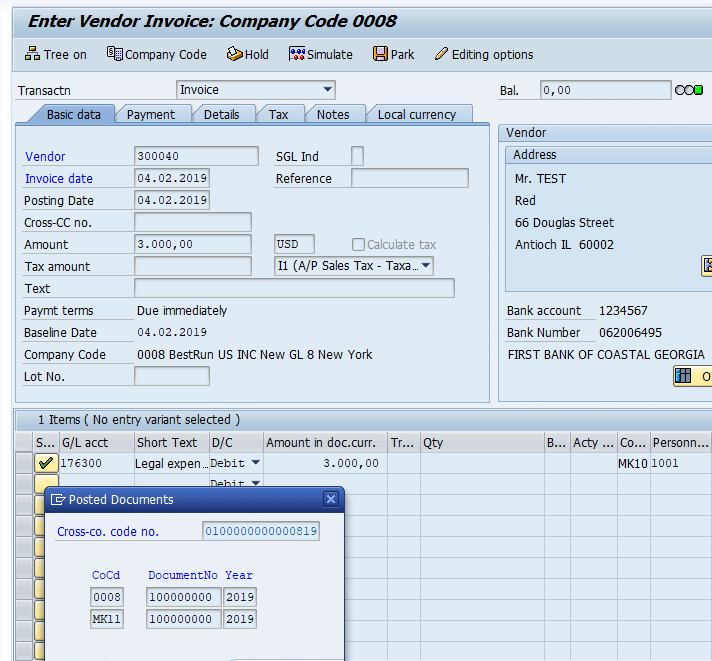

Post a Cross company transaction

Transaction code: FB60

Via Menu : Accounting -> Financial Accounting-> Accounts Payables -> Document Entry -> Invoice

Display Cross company code document

Transaction code: FBU3

Other Cross Company transactions i.e. Change/Display Reverse Cross Company document

- FBU2 – Change Cross Company code document

- FBU8 – Reverse Cross company code transaction

Pingback: SAP Fiance Global Settings, Fiscal year variant etc

Pingback: SAP Finance Tutorials | AUMTECH Solutions-SAP Training

Pingback: SAP FICO Interview Questions & Answers | AUMTECH Solutions-SAP Training

its really great help for me to develop my skills in SAP FICO Module.