Table of Contents

SAP New GL

SAP New GL offer following additional functionalities

- Cost of Sales Accounting

- Segment reporting / Profit Center Accounting. As per US GAAP and IFRS, segment reporting is required if segment external revenue exceeds 10% of total revenue. Using Document splitting balance sheet can be prepared at Segment level

- Parallel Ledgers

- SAP New GL Activation is optional for existing customer

- New GL is Activated by default for new Implementation

- Classic GL Totals Table is GLT0

- New GL Totals Table is FAGLFLEXT

- Additional fields in table FAGLFLEXT compared to GLT0 are listed below

- Cost Element

- Cost Center

- Profit Center

- Segment

- Functional Area

- Totals table FAGLFLEXT can be extended with SAP standard / custom fields

SAP New GL Implementation Steps

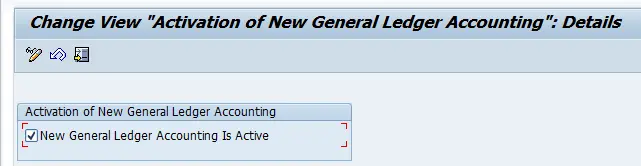

Activate New GL

Transaction code: FAGL_ACTIVATION

- Activate New GL : FAGL_Activation

- To Hide old menu path : Transaction code SE38 – RFAGL_SWAP_IMG_OLD

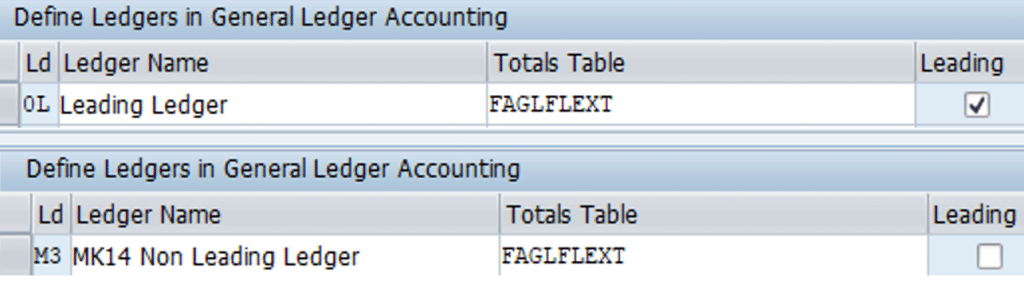

Define Leading and Non Leading Ledgers

Tcode: Financial Accounting (New) – Financial Accounting Global Settings (New) – LEDGERS – LEDGERS – Define Ledgers for General Ledger Accounting

Define the ledgers that you use in General Ledger Accounting. The ledgers are based on a totals table. SAP recommends using the delivered standard totals table FAGLFLEXT.

The following types of ledgers are available:

Leading Ledger

The leading ledger is based on the same accounting principle as that of the consolidated financial statement. It is integrated with all subsidiary ledgers and is updated in all company codes. You must designate one ledger as the leading ledger. In each company code, the leading ledger automatically receives the settings that apply to that company code: the currencies, the fiscal year variant, and the variant of the posting periods. Only leading ledger post to CO

Non-Leading Ledger

The non-leading ledgers are parallel ledgers to the leading ledger. They can be based for example on local accounting principles such as German Commercial Code. You must activate non-leading ledger by company code.

Define Non Leading ledger B2, B3, B4. Use respective company code PPV, FYV

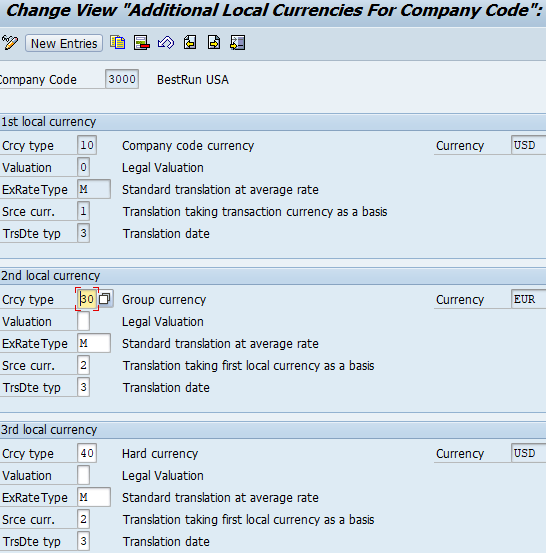

Define Currencies for Leading Ledger

Tcode: Financial Accounting (N) – Financial Accounting Global Settings – Ledgers – Ledgers – Define Currencies of Leading Ledger

Transaction Code : OB22

Only for leading ledger we can define 2 more currencies in addition to company code currency

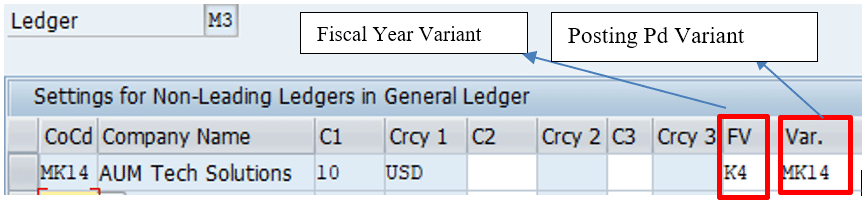

Assign and Activate Non Leading Ledgers

IMG Path: SPRO – Financial Accounting (N) – Financial Accounting Global Settings – Ledgers – Ledgers – Define and Activate Non – Leading Ledgers

Make the following settings for the non-leading ledgers for each company code:

- Activate the non-leading ledgers in the company code.

- Ensure Company code to be assigned to Non Leading ledger is not set to Production in Tcode OBY6

- Define additional currencies beyond that of the leading ledger. The first currency of a non-leading ledger is always the currency of the leading ledger (and hence that of the company code). For the second and third currencies of a non-leading ledger, you can only use currency types that you have specified for the leading ledger.

- Define a fiscal year variant that differs from that of the leading ledger. If you do not enter a fiscal year variant, the fiscal year variant of the company code is used automatically.

- Specify a posting period variant. If you do not enter a variant, the variant of the company code is used automatically.

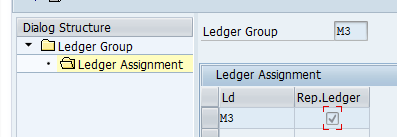

Define ledger Group

IMG Path : SPRO – Financial Accounting (N) – Financial Accounting Global Settings – Ledger – Ledger – Define Ledger Group

When you define a Leading or a Non leading ledger, system automatically creates a Ledger Group with the same name.

Ledger Group M3 automatically created by system Non Leading ledger M3 was created

Define Document Type for Entry view

IMG Path : SPRO – Financial Accounting (N) – Financial Accounting Global Settings – Document – Document Type – Define document type for entry view

No changes are required here.

- In this activity, you define your document types. Document types are used to differentiate the business transactions and to manage how document are stored

- If you only work with one ledger (the leading ledger), proceed as follows: In this activity, define for all postings the document types for the documents in the entry view. Also assign a number range to the document types.

- If you work with a leading ledger and with non-leading ledgers, proceed as follows: Since the majority of postings has the same effect in all ledgers, define in this IMG activity the document types for the entry view for postings that affect all ledgers. Also assign a number range to the document types.

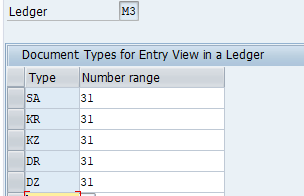

Define Document Type for Entry view in a Ledger

Path : SPRO – Financial Accounting(N) – Financial Accounting Global Settings – Document – Document Type – Define document type for entry view in a Ledger

Here, you make the settings specifying the document type for postings to non-leading ledgers.

To define document types for postings to non-leading ledgers, proceed as follows: Set up a separate document type for these postings. Assign a unique number range to this document type for each ledger.

Example:

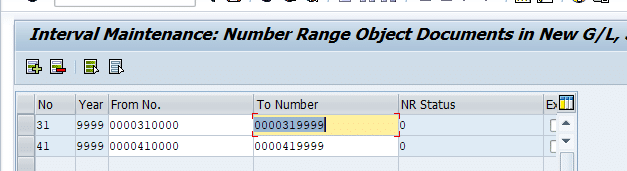

Document Type SA, KR, Ledger M3, Number Range 31

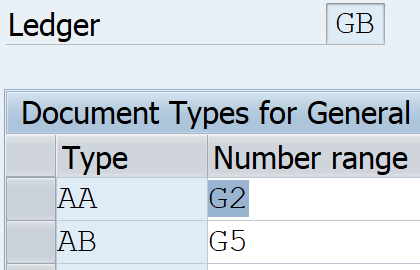

Define Document Type for General Ledger View

Tcode: SPRO – Financial Accounting(N) – Financial Accounting Global Settings – Document – Document Type – Define document Type for General Ledger View

In this IMG activity, you define for non-leading ledgers the document types for the documents in the General Ledger view. At the same time, you assign for each document type a number range

You do not need to make these settings for your leading ledger because, in the case of this ledger, the document number in the entry view always corresponds to the document number in the general ledger view. You only have to make these settings for any non-leading ledgers that have a fiscal year variant that differs in at least one company code from the fiscal year variant of the leading ledger in this company code. In this case, the document number in the entry view does not correspond to the document number in the general ledger view and you have to define a separate document type with document number assignment for the general ledger view

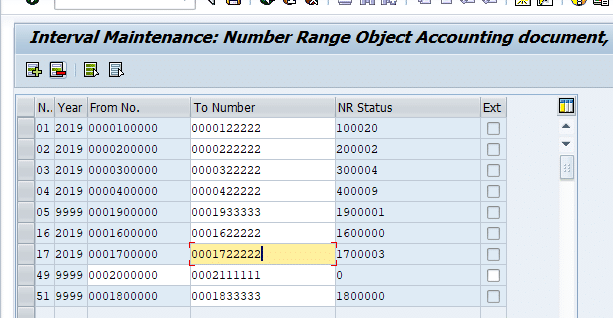

Define Document Number range in for entry view

Path : SPRO – Financial Accounting(N) – Financial Accounting Global Settings – Document – Document No. Ranges – Documents in entry view – Define document number ranges for entry view

Define Document Number range in for General Ledger view

Path : SPRO – Financial Accounting(N) – Financial Accounting Global Settings – Document – Document No. Ranges – Documents in General Ledger view – Define document number ranges for general ledger view

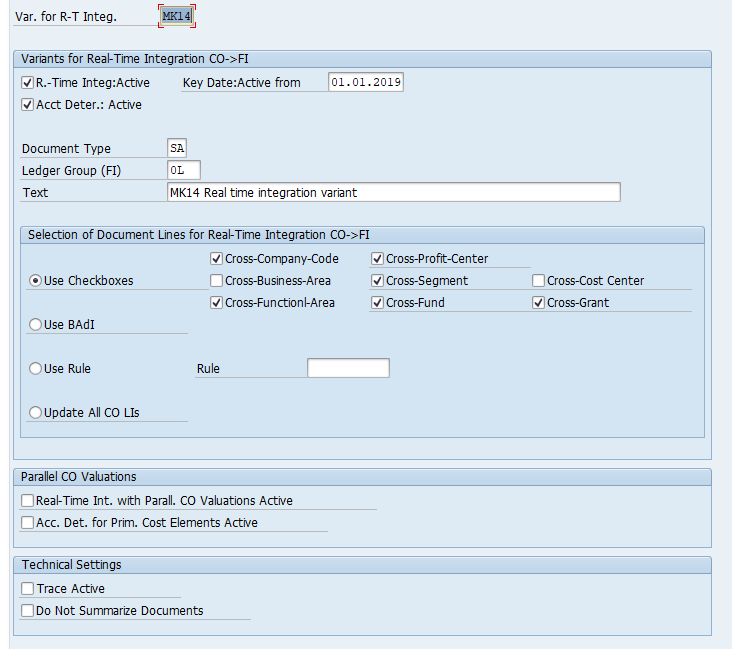

CO-FI Real Time Integration

Define Variant for CO-FI real time integration

Path : SPRO – Financial Accounting(N) – Financial Accounting Global Settings – Ledgers – Real time integration of Controlling with Financial Accounting- – Define variants for real time integration

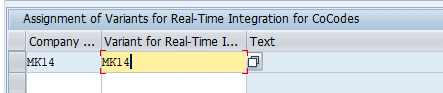

Assign Variant for CO-FI real time integration to Company Code

Path : SPRO – Financial Accounting(N) – Financial Accounting Global Settings – Ledgers – Real time integration of Controlling with Financial Accounting- – Assign variant

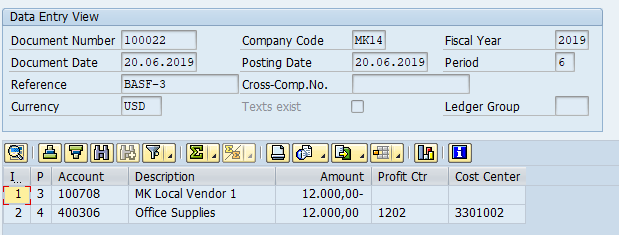

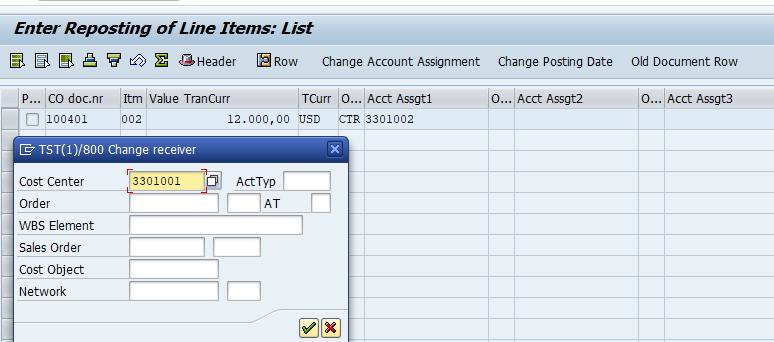

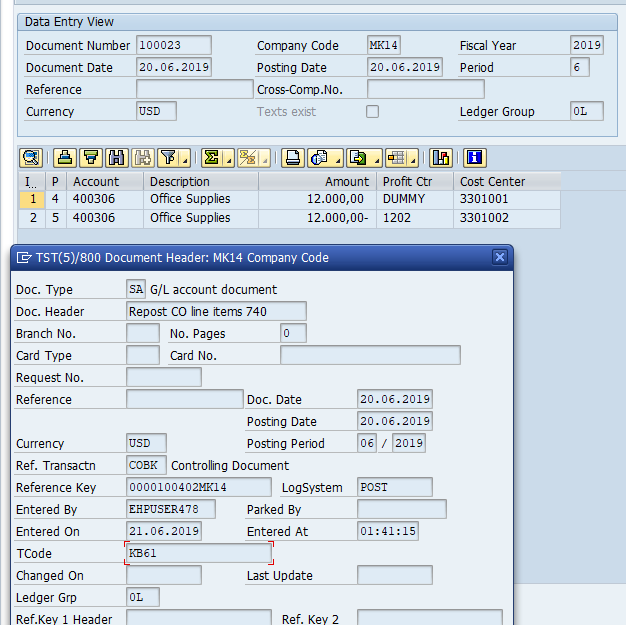

Post a Vendor invoice in cost center# 3301002 (Administration)

Tcode : FB60

Now in Transaction KB61, repost line item to Cost center # 3301001 (Canteen). Cost center changed from 3301002 to Cost Center#3301001

Display Vendor Invoice again : FB03

Automatic Transfer entry posted by CO-FI reconciliation variant

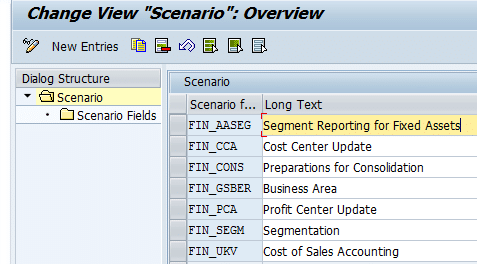

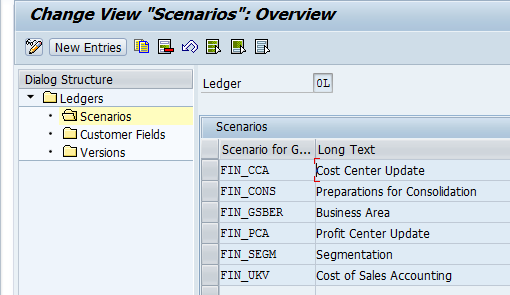

Scenarios

- A scenario defines what fields are updated in leading ledger (FAGLFEXT Table) during document entry/ posting

- SAP has provided below scenarios. We have to use below scenarios, cannot define our own scenarios

- Cost center Update ( FIN_CCA) : Sender / Receiver Cost center

- Profit Center Update ( FIN_PCA) : Profit Center update

- Segmentation (FIN_SEGM) : Segment Field Update

- Cost of Sales Accounting ( FIN_UKV) : Update Sender / Receiver Functional area

- Display Scenarios: Financial Accounting (New) – FAGS- Ledgers) – Fields – Display scenarios for GL

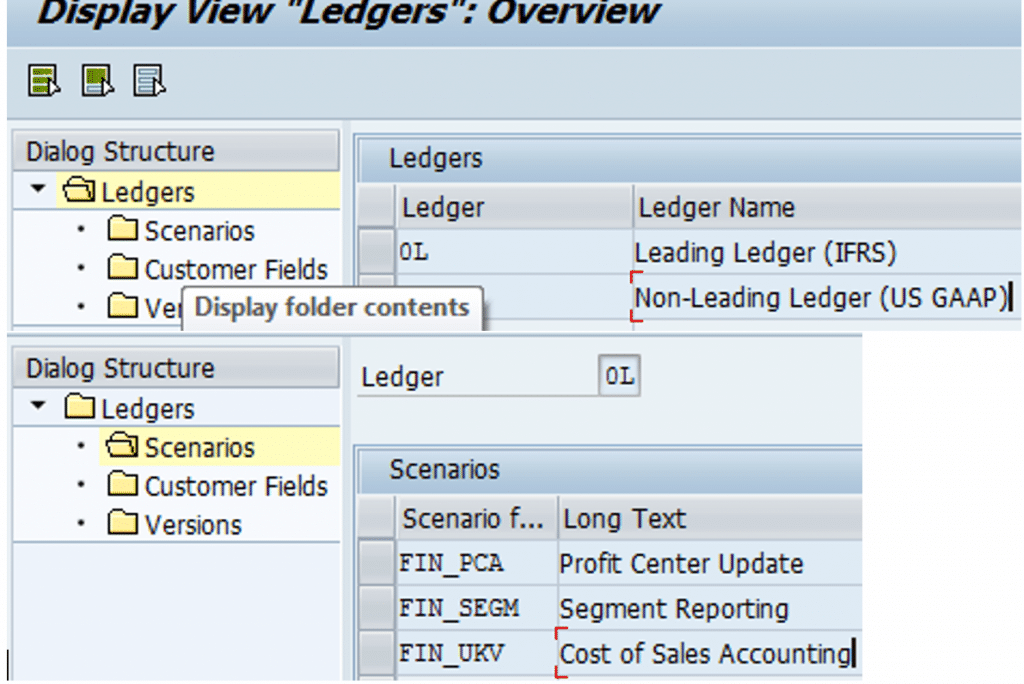

- Assign scenarios to Ledgers: ( )* – Ledgers – Assign scenarios to Ledgers

- Can assign 1 / all scenarios to leading ledger

- Can assign 1 / all scenarios to Non leading ledger

- Now General ledger FI document has two views. Entry view and General Ledger view. In the entry view data is enter into Cost center field, Segment field etc. Now if relevant scenario is not assigned to leading ledger / Non leading ledger, these values are not available in GL view. If Cost Center Accounting scenario not assigned to 0L (Leading ledger), cost center value entered in entry view is not displayed in GL view. Thus Segment reporting is not possible

We have to use SAP supplied scenarios. Cannot create own scenarios

Assign Scenarios to Ledger

Tcode: Financial Accounting (New) – Financial Accounting Global Settings – Ledgers – Ledgers – Assign scenarios & custom fields

Assign the following to your ledgers:

Scenarios : A scenario determines what fields in a ledger are updated when it receives posting from other application components.

Document Splitting

Document splitting allows producing full balance sheet at level below company code for dimensions like Profit Center, Segment. Document splitting splits the cash/ bank/ vendor and customer accounts, like revenue / expense account. This enables production of balance sheet. Ratio of split is inherited from that of expense line items.

Accounting Entry

| Account Description | Amount | Profit Center |

| Vendor Account | -11000 | |

| Purchases -1 | 8000 | PC-1 |

| Purchases – 2 | 2000 | PC-2 |

| Input Tax | 1000 |

Required (Expected) for Segmental Reporting

| Account Description | Amount | Profit Center |

| Vendor A/C | -8800 | PC-1 |

| Purchase 1 | 8000 | PC-1 |

| Input Tax | 800 | PC-1 |

| Vendor Account | -2200 | PC-2 |

| Purchase -2 | 2000 | PC-2 |

| Input Tax | 200 | PC-2 |

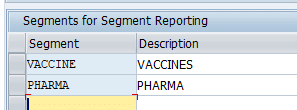

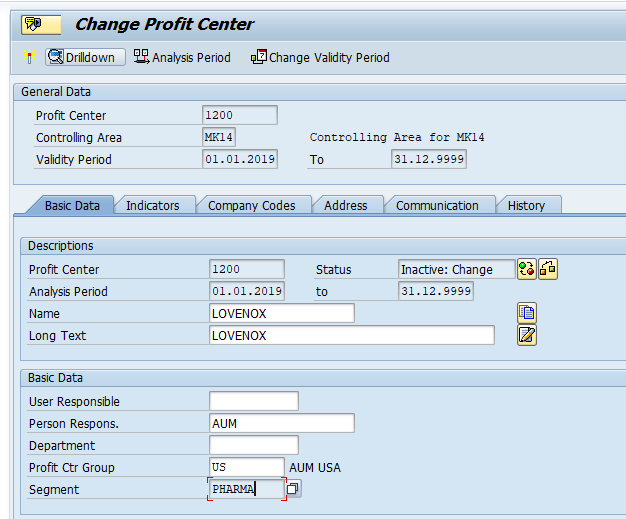

Define Segments

IMG Path: SPRO – Enterprise Segment – Definition – Financial Accounting – Define Segments

- Segments are derived from Profit Center. Profit Center derived from Cost center. So maintain Segment in Profit Center Master Data: KE52

- Segments can also be manually entered in GL line item where permitted

- Segment can also be derived using customer enhancement BADI FAGL_DERIVE_SEGMENT

- Set Additional Account Assignment field as Optional in Field status Variant – Field Status Group assigned to GL account to which posting is made in FS00

- Assign scenarios to Ledgers: ( )* – Ledgers – Assign scenarios to Ledgers

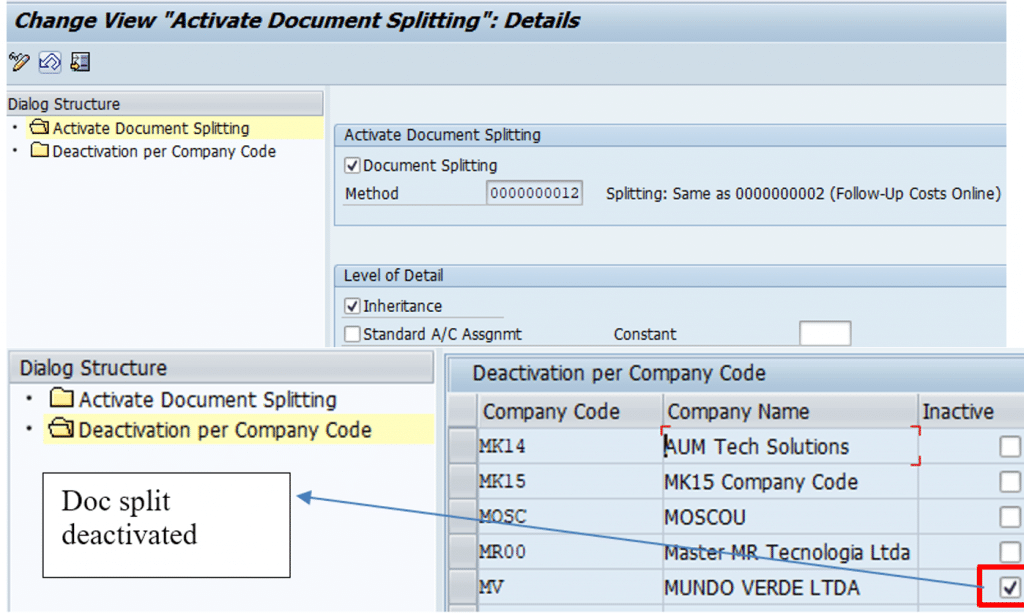

Activate Document Splitting

IMG Path: FA (N) – GL (N) – Business Transactions – Document Splitting – Activate Doc Splitting

Transaction : SM30-V_FAGL_SPLIT_ACT

In this IMG activity, you active document splitting. The splitting method used is that delivered by SAP as standard, which contains the splitting rules for the different business transactions. If this splitting method does not meet your requirements, you can first define and then select your own method in Customizing for document splitting. You do this under Extended Document Splitting -> Assign Splitting Method.

- Choose SAP predefined splitting method ‘000000012’ with pre delivered splitting rules for various business transactions

- Document Splitting Activation is done at Client Level

- Can De Activate document splitting for specific company codes

- Inheritance : If selected, derive splitting characteristic in the document from other line items

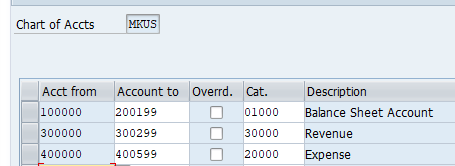

Classify GL Accounts for Document Splitting

IMG Path: FA (N) – GL (N) – Business Transactions – Document Splitting – Classify GL Accts for Document Splitting

Each business transaction that is entered is analyzed during the document splitting procedure. In this analysis, the system determines for each line item whether it is an item that remains unchanged or an item that should be split.

In order that document splitting recognizes how the individual document items are to be handled, you need to classify them. You do this by assigning them to an item category. An Item Category is a Group of GL Accounts. Instead of defining splitting rule for individual GL accounts they are defined for Item categories

System determines the item category by the GL account number. The following item categories are included in the system:

- Customer

- Vendor

- Cash discount offsetting

- Asset

- Material

- Expense

- Revenue

- Standard settings

Assign only the accounts relating to Revenue/ Expense / Bank / Cash / Balance Sheet

Item categories are included in the standard SAP System. You cannot define any additional item categories. If the item categories included in the system do not meet your needs, contact SAP.

Enter your accounts or account intervals and assign them to an item category.

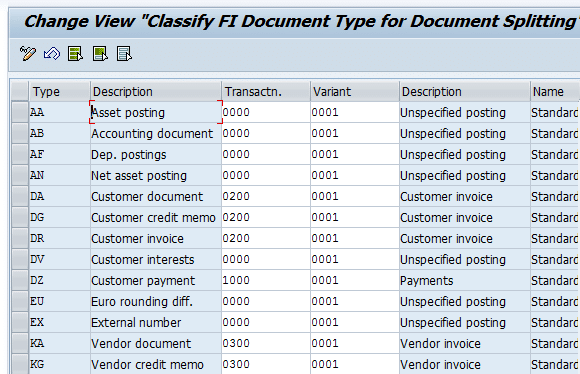

Classify Document Types for Document Splitting

Tcode: FA (N) – GL (N) – Business Transactions – Document Splitting – Classify Document Types for Document Splitting

Every business transaction that is entered is analyzed during the document splitting process. In this process, the system determines which splitting rule is applied to the document. In order that the system can determine the splitting rule, you must assign a business transaction variant to each document type.

Example

The business transaction 0200 (customer invoice), variant 0001 (standard), is delivered. In this transaction, the following item categories are allowed: customer, value added tax, withholding tax, expense, revenue, exchange rate differences, and company code clearing.

Standard settings

With the document types delivered in the standard system, SAP delivers a classification for document splitting. This classification is a proposal that you need to check against how your document types are organized. You need to check whether the classification or assignment to a business transaction variant produces the desired result in document splitting.

Activities

Assign your document types (Customer defined document types) to a business transaction and a business transaction variant.

System Process:

- GL Accounts assigned to Item Categories

- Document Type are assigned to a combination of (Business Transaction + Variant)

- Splitting Method is assigned to a combination of (Business Transaction + Variant + Item Categories)

- Item categories provide GL account numbers which can be split as per Splitting method above.

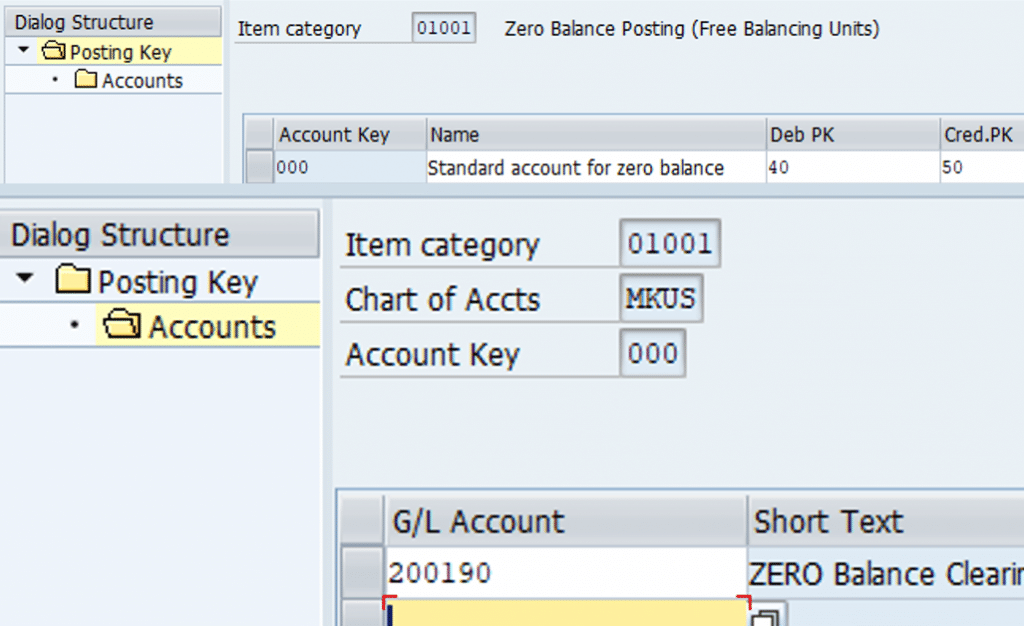

Define Zero Balance Clearing Account

IMG Path: Financial Accounting (New) – GL Accounting – Business Transactions – Doc Splitting – Define Zero Balance Clearing Account

The system checks whether the balance of account assignment object (Profit Center, Segment) is zero after document splitting. If this is not the case, the system generates additional clearing items. In this activity, you have to create a clearing account for these additional clearing items.

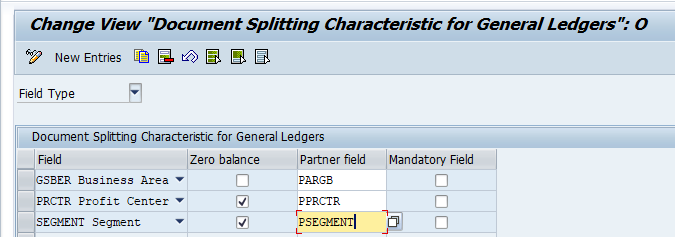

Define Document Splitting Characteristics for GL

Tcode: FA (N) – GL (N) – BT – Doc Splitting – Define Document splitting Characteristic for GL Accounting

Document Splitting Test Scenarios

Transaction Code: FB50

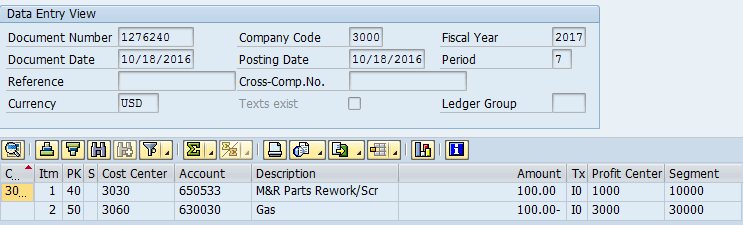

Entry View

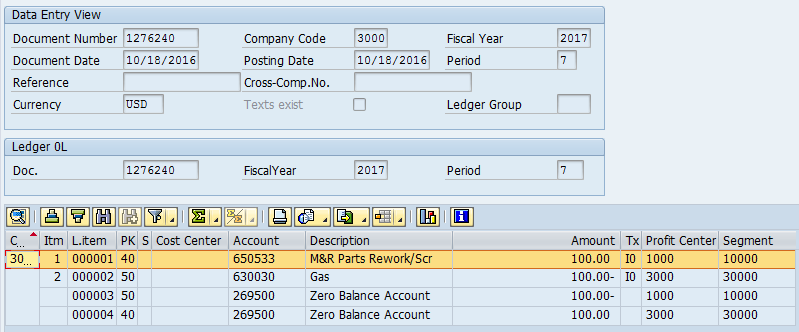

GL View

Posting made to Zero balance account in such a way that the total of Characteristics (Profit Center, Segment) is Zero

| Item | Account | Description | Amount | Segment |

| 1 | 650533 | Rework Parts | 100 | 1000 |

| 3 | 269500 | Zero Balance | -100 | |

| 2 | 630030 | Gas | 100 | 2000 |

| 4 | 269500 | Zero Balance | -100 |

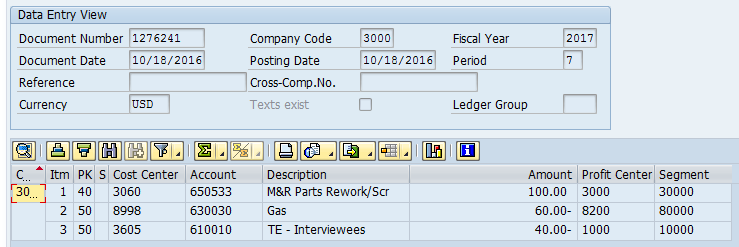

Example 2

Entry View

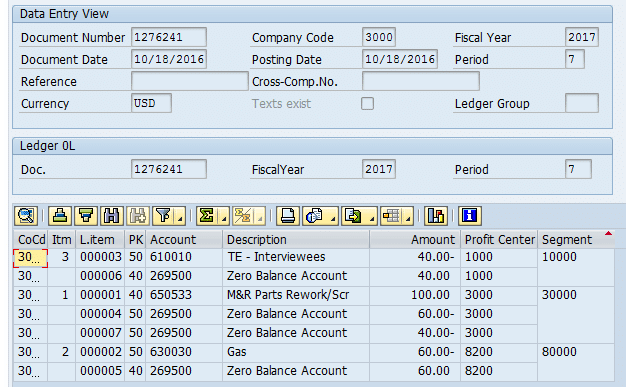

GL View

There are 4 zero balancing line as system creates clearing items for each combination of segment & as well as partner segment

End User Transactions – New GL

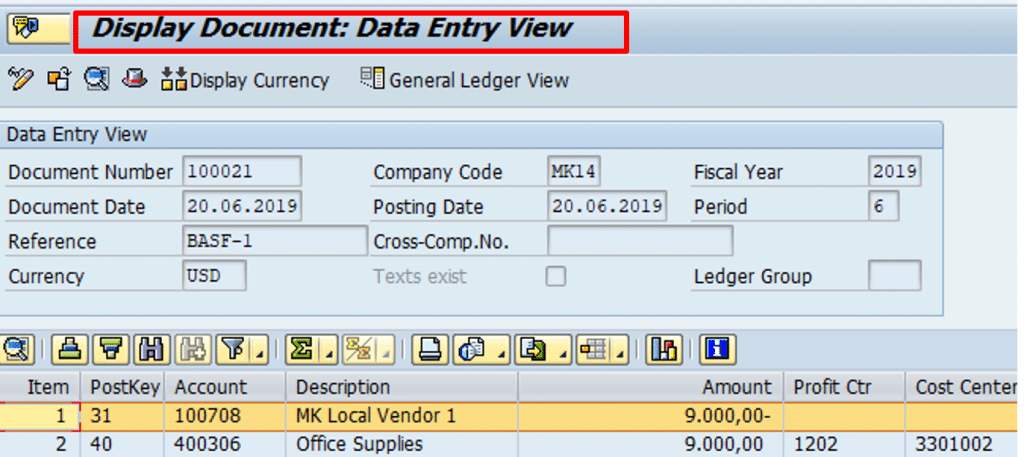

Tcode: FB60

Leading Ledger – 0L Entry View

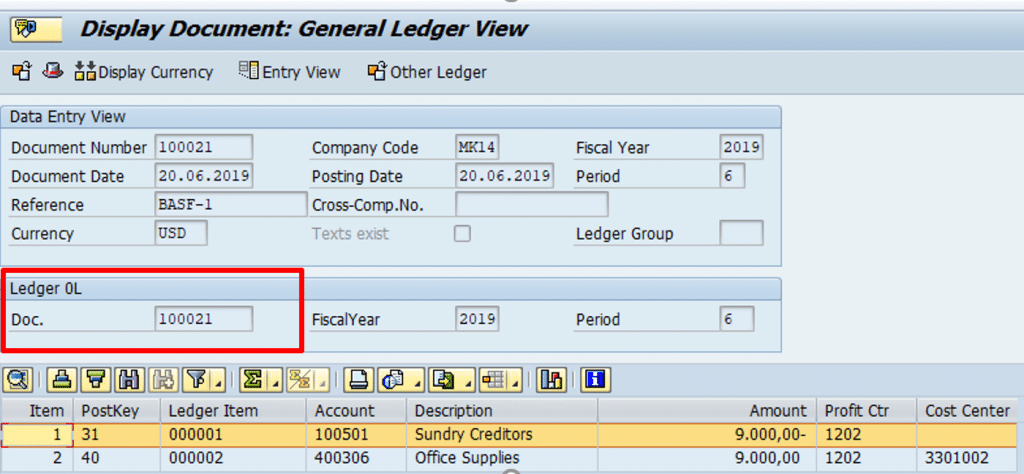

Leading Ledger – 0L GL View

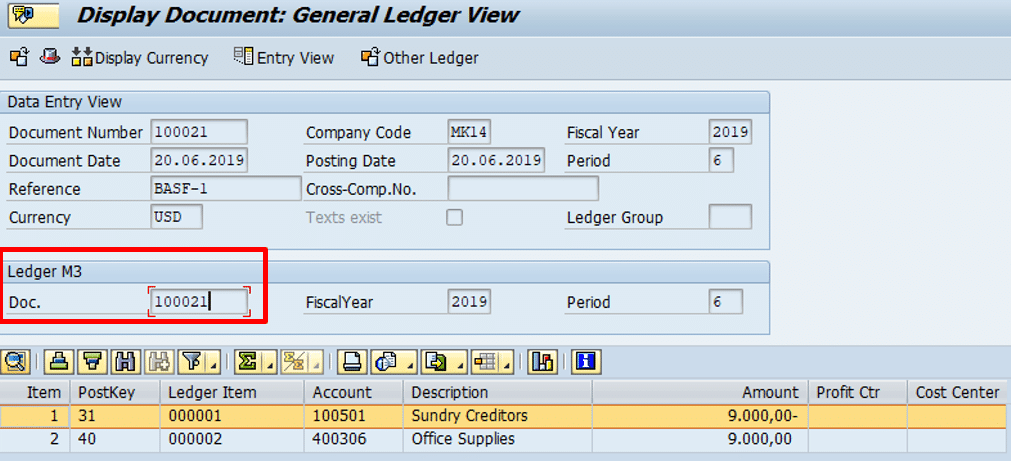

Non Leading Ledger – M3 GL View

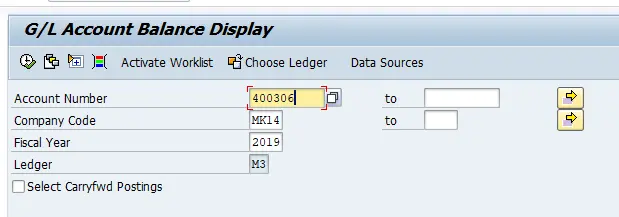

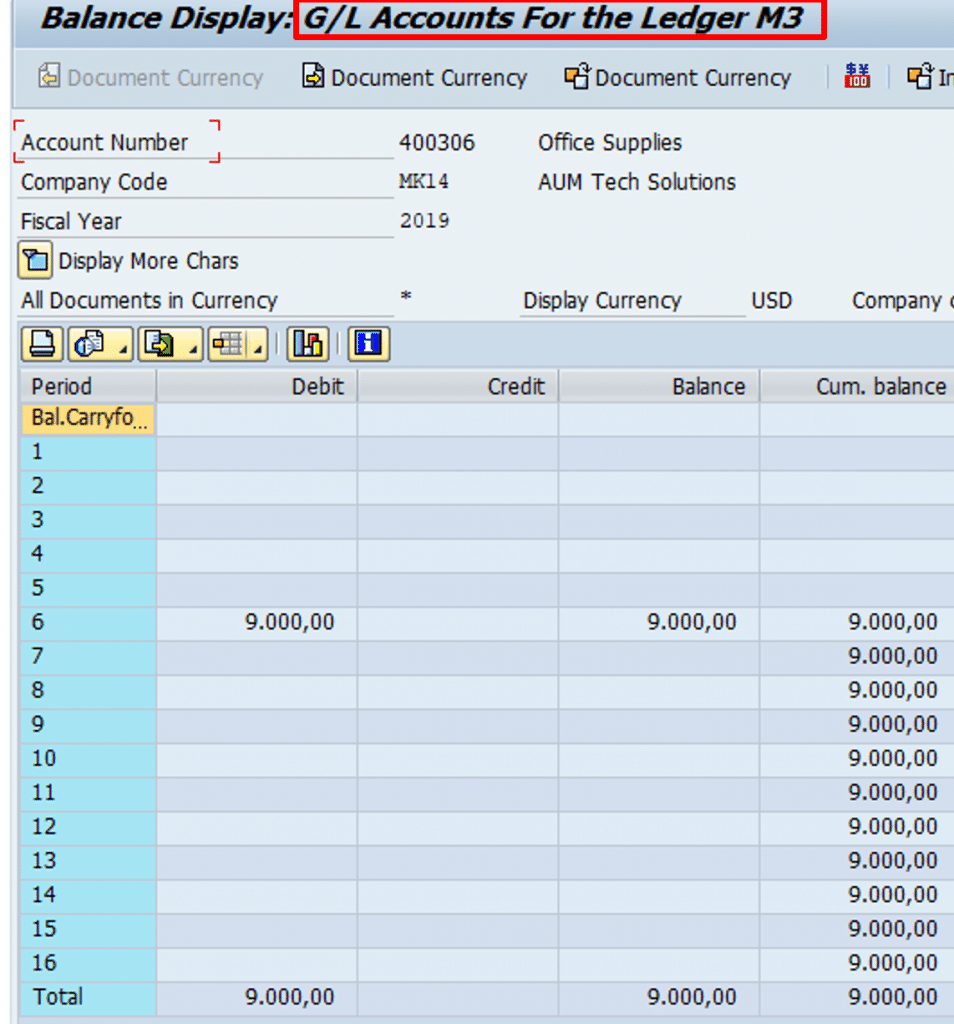

Display account balance in Non-Leading ledger

Transaction code : FAGLB03

For detailed, step-by-step instructions on SAP New GL follow along with my video tutorial below

This completes configuration and testing steps on New GL document splitting.

Pingback: SAP Finance General Ledger | SAP FINANCE and Treasury

Pingback: SAP Finance New GL Part 2 | Config and Testing of Document Splitting

Pingback: SAP Finance Enterprise Structure | SAP FINANCE and Treasury

Pingback: SAP Finance Tutorials | AUMTECH Solutions-SAP Training

Very good document. Thanks lot

Great Resource – Big Kudos to the Team