SAP Money Market

Money market transactions are used for short- and medium-term Investments and for borrowing of funds. Key money market instruments are as listed below:

- Fixed Term Deposit

- Commercial papers

- Deposit at Notice

- Interest rate Instruments

Fixed term Deposits

A Fixed term deposit is an investment that includes the deposit of money into an account at a financial institution. Term deposit investments usually carry short-term maturities ranging from one month to a few years. Investors can withdraw funds only at the end of term

Commercial Papers

A Commercial paper is an unsecured, short-term debt instrument issued by a company for the financing of accounts payable and inventories and meet short-term liabilities. Commercial paper is usually issued at a discount from face value and reflects prevailing market interest rates

Deposits at Notice

These investments are similar to fixed term deposit. However, money can be withdrawn only after advance notice period has expired. For e.g. If you have a 50-day notice deposit account, you ca withdraw money only after 50 day withdrawal notice period has expired

Interest rate Instruments

An interest-rate instrument is a derivative where the underlying asset is the right to pay or receive a notional amount of money at a given interest rate. Its value increase / decrease based on movement of the interest rate

In this tutorial we will discuss SAP business process, configuration, master data setup and end user transactions codes / testing of Money market instrument (Fixed term deposit)

Configuration steps – Money Market Instruments

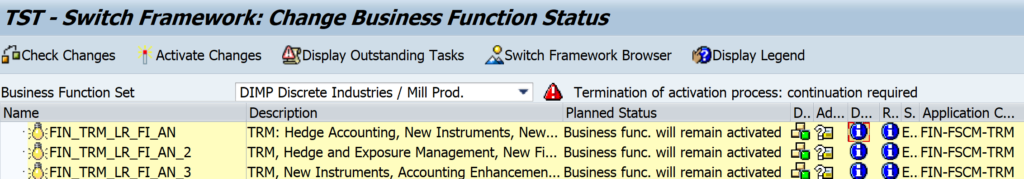

Activate Treasury Functions in SAP

Path: SPRO- Activate business functions – Continue – Enterprise Business functions -Activate below functions

- FIN_TRM_LR_FI_AN

- FIN_TRM_LR_FI_AN2

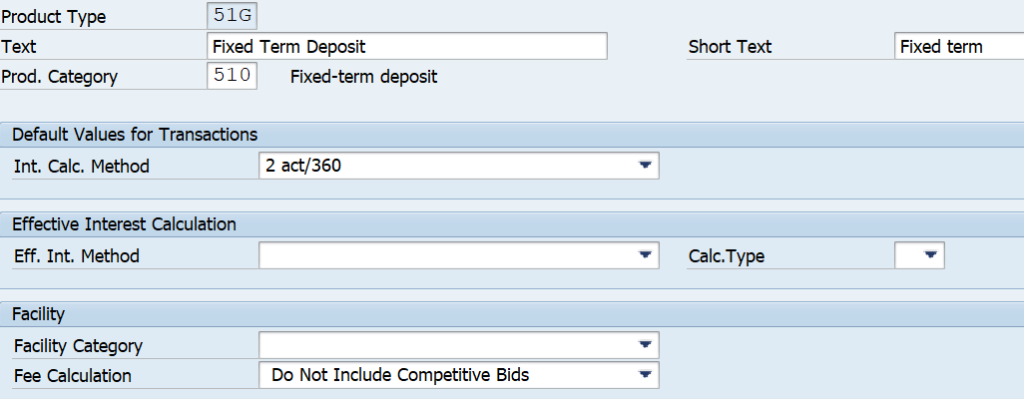

Define Product Type Path

Explanation

Product types help to differentiate between different Money Market financial instruments. In Money Market area, the following product categories are available in standard SAP

- 510 Fixed-term deposits

- 520 Deposits at notice

- 530 Commercial Paper

- 540 Cash flow transaction

- 550 Interest rate instruments

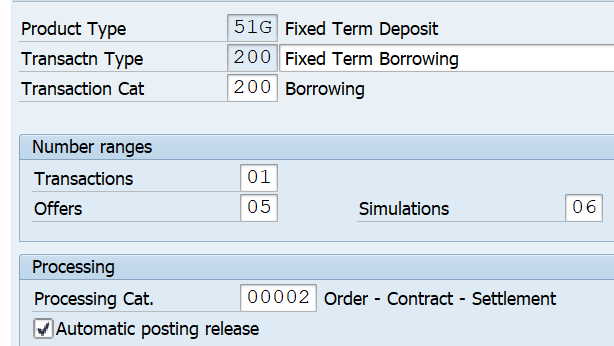

Product type 510 is used for fixed term deposits. We will configure a new product type 51G, which will be a fixed term deposit to understand various configuration steps in SAP

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Product Type – Define Product Type

You can create it by copying SAP standard product type 51A for Fixed term Deposit

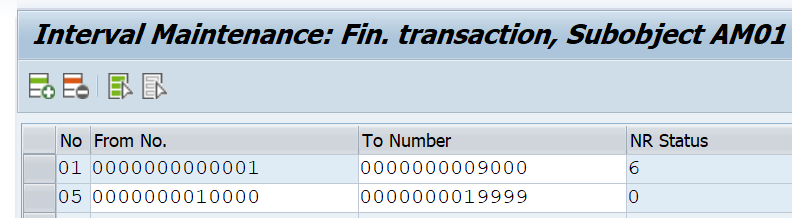

Define Number Ranges

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Transaction Type – Define Number Ranges

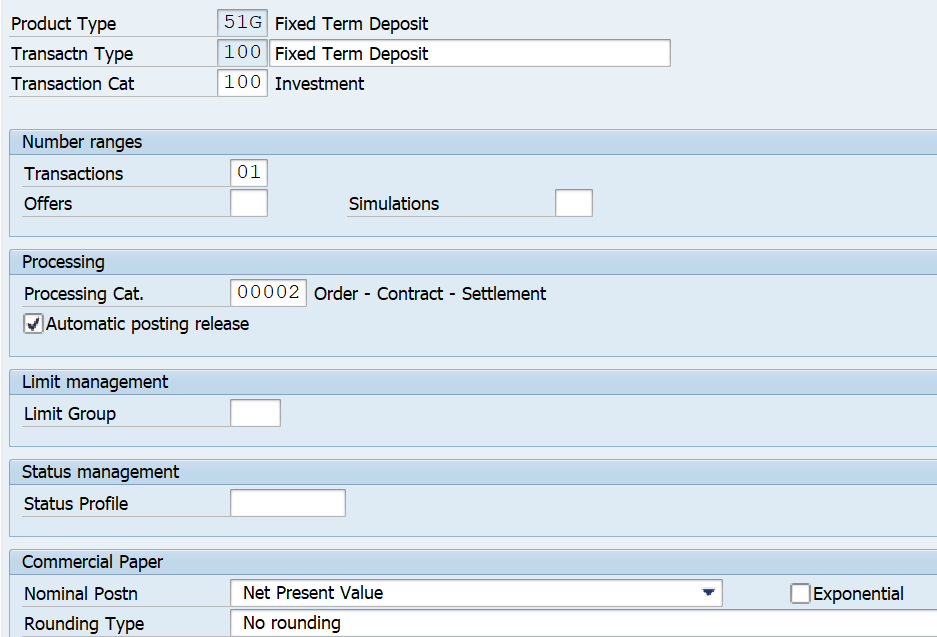

Define Transaction Types

Explanation: Transaction Type is assigned to a Product Type. Transaction Type define the direction of the Trade. For Product Type 51G, we can use Transaction Type used by 51A as below

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Transaction Type- Define Transaction Type

Transaction Type for Fixed Term Investment - 100

Transaction Type for Fixed term Borrowing -200

Define Flow Types

Explanation

Flow types represent different types of flows related to Fixed Term instruments. We will use the SAP standard Flow types used for product type 51A for our product type 51G. These are listed below

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Flow Types- Define Flow Types

| Product Type | Description | TType | Transaction | SAP Std. Flow Type | Flow Type name |

| 51A | Fix Term Dep | 100 | Investment | 1100 | Principal Increase |

| 51A | Fix Term Dep | 100 | Investment | 1110 | Principal Decrease |

| 51A | Fix Term Dep | 100 | Investment | 1120 | Final Repayment |

| 51A | Fix Term Dep | 100 | Investment | 1150 | Interest Capitalization |

| 51A | Fix Term Dep | 100 | Investment | 1901 | Charges |

| 51A | Fix Term Dep | 100 | Investment | 1905 | Withholding tax 1 |

| 51A | Fix Term Dep | 200 | Borrowing | 1105 | Borrowing / Increase |

| 51A | Fix Term Dep | 200 | Borrowing | 1110 | Borrowing Decrease |

| 51A | Fix Term Dep | 200 | Borrowing | 1120 | Final Repayment |

| 51A | Fix Term Dep | 200 | Borrowing | 1150 | Interest Capitalization |

| 51A | Fix Term Dep | 200 | Borrowing | 1901 | Charges |

Uses of SAP Treasury Payment Program

Assign Flow Types to Transaction Types

Path: Financial Supply Chain Management- Treasury and Risk management – Transaction Manager – Money Market – Transaction Management – Flow Types- Assign Flow Types to Transaction Types

| Product Type | Desc. | TType | Transaction | SAP Std. Flow Type | Flow Type name |

Comments are closed.