Table of Contents

SAP Withholding Taxes

Withholding Taxes Configuration Basic Settings

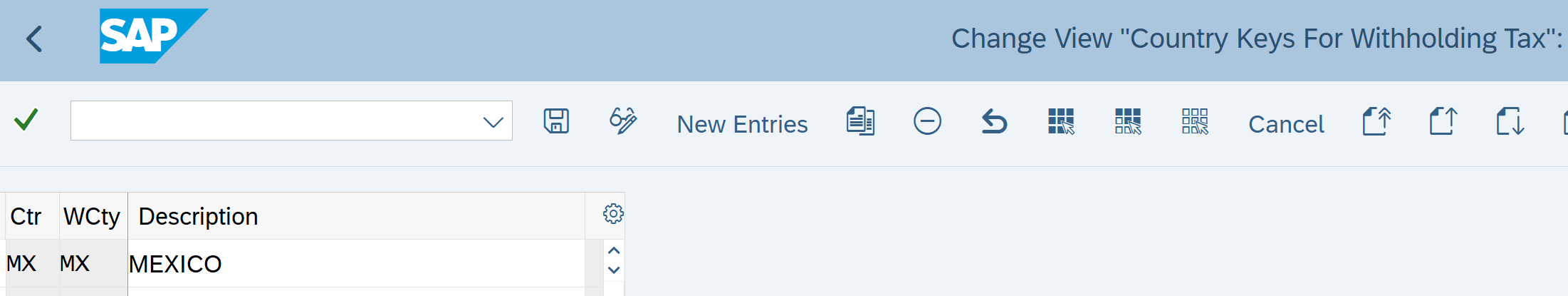

Check Withholding Tax Countries

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax – Basic Settings – Check Withholding Tax countries

The withholding tax country is needed for printing the withholding tax form and also for maintaining the tax codes in the vendor master and customer master

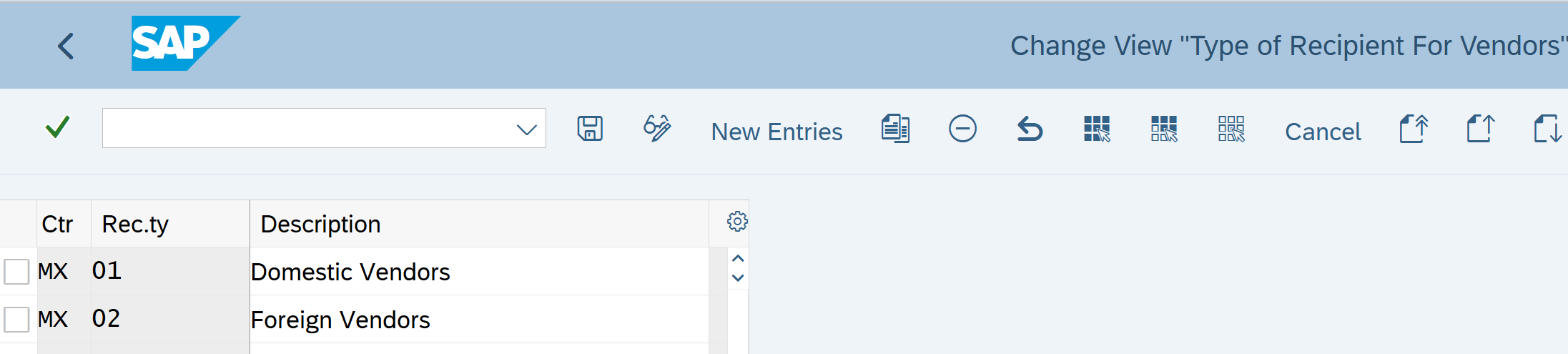

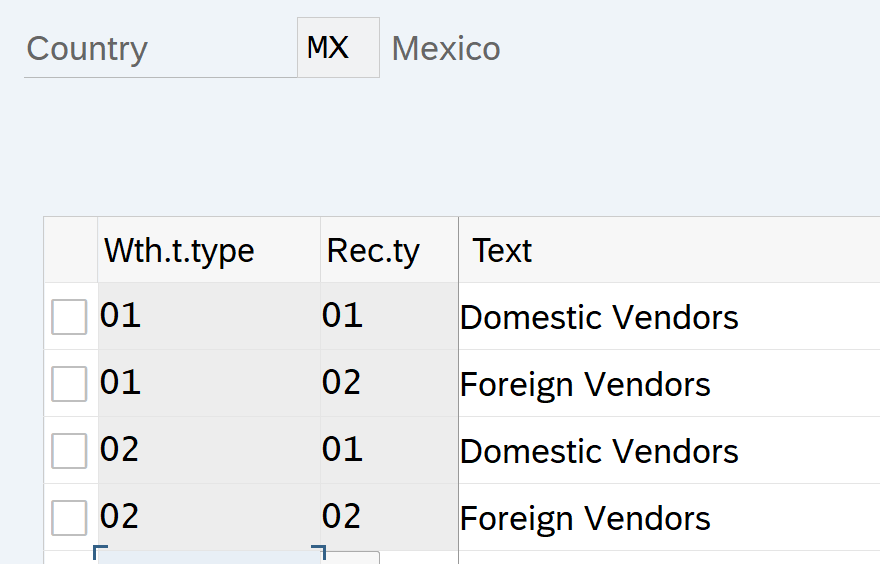

Maintain Types of Recipients

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax-Basic Settings – Maintain Types of Recipients

This is required to categorize the vendor. For example: Domestic Vendors, Foreign Vendors

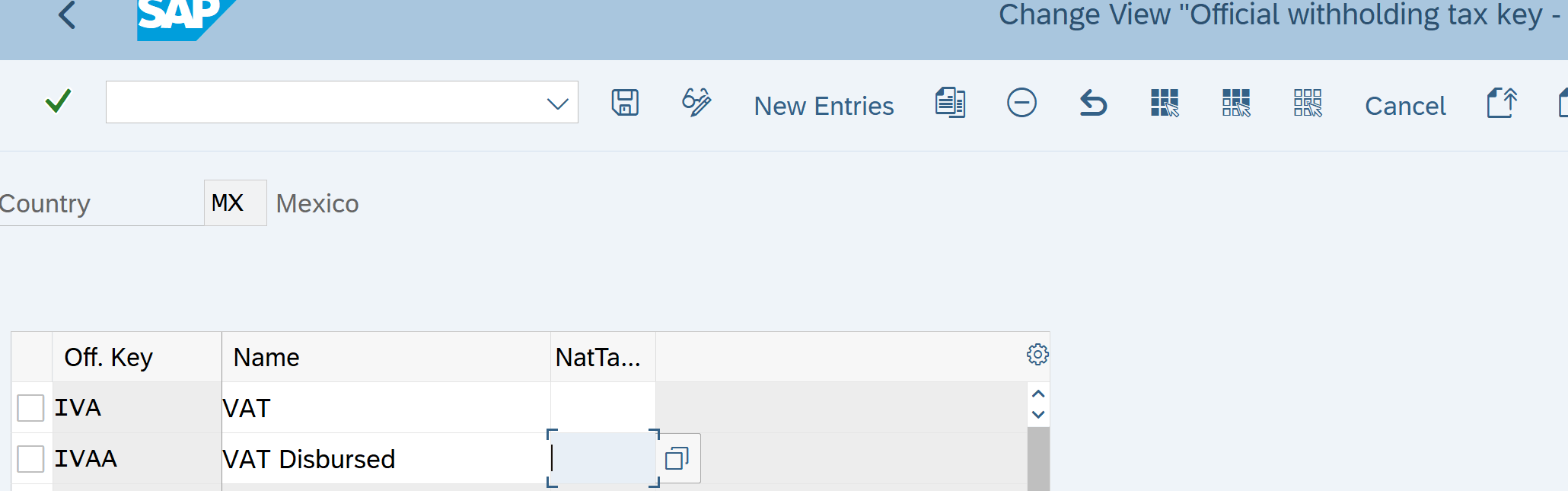

Define Withholding Tax Keys

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax – Basic Settings –Define Withholding Tax Keys

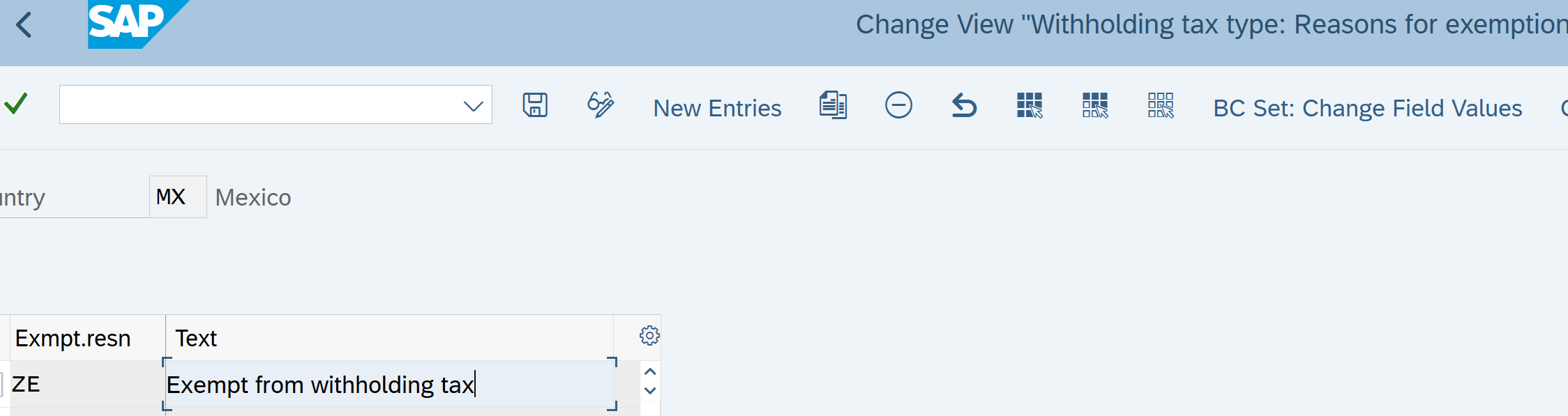

Define Reasons for Exemptions

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax – Basic Settings –Define Reason for Exemptions

Here we define reasons for exemption from withholding tax. This indicator can be entered in the vendor master record or in the company code withholding tax master record information.

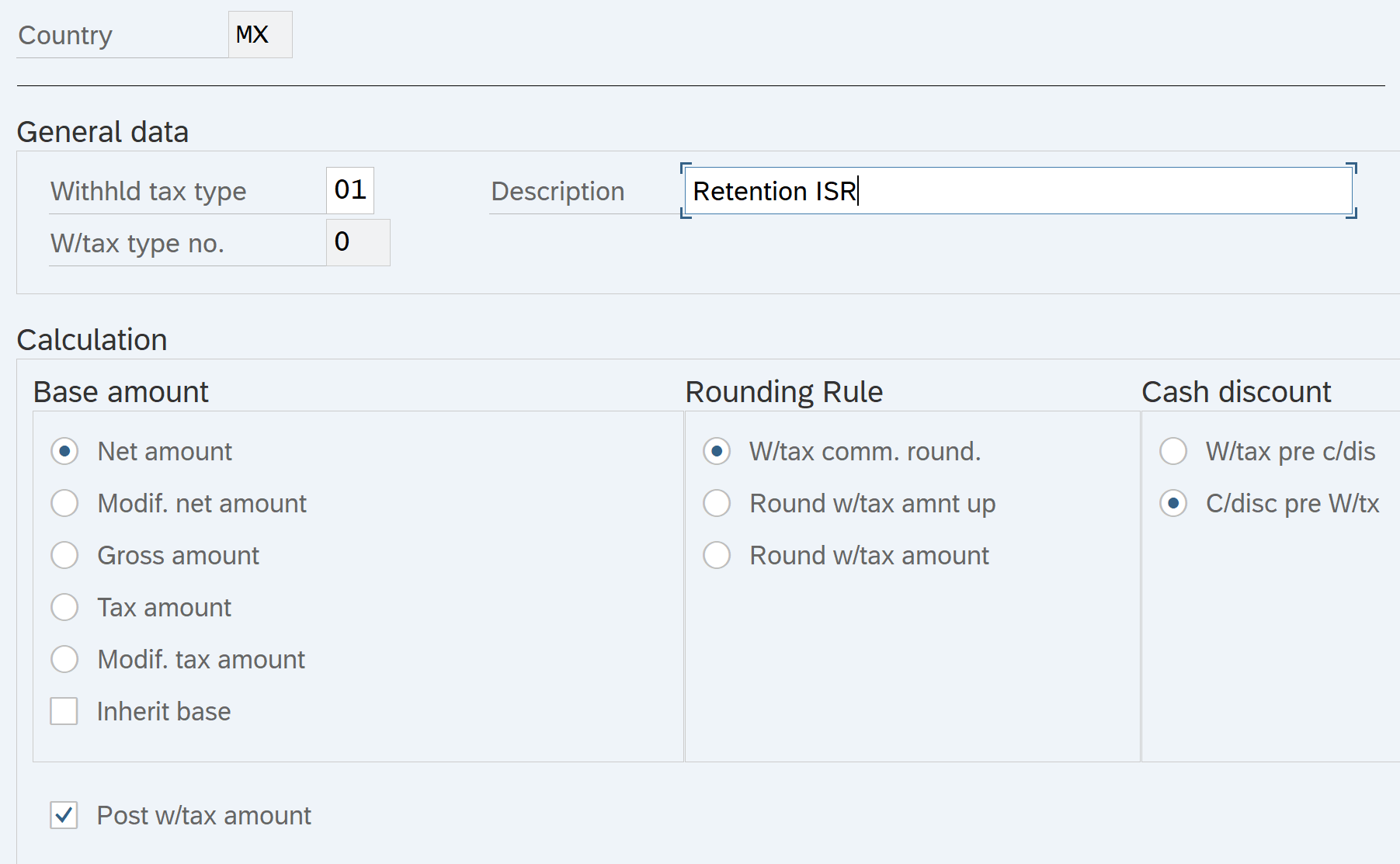

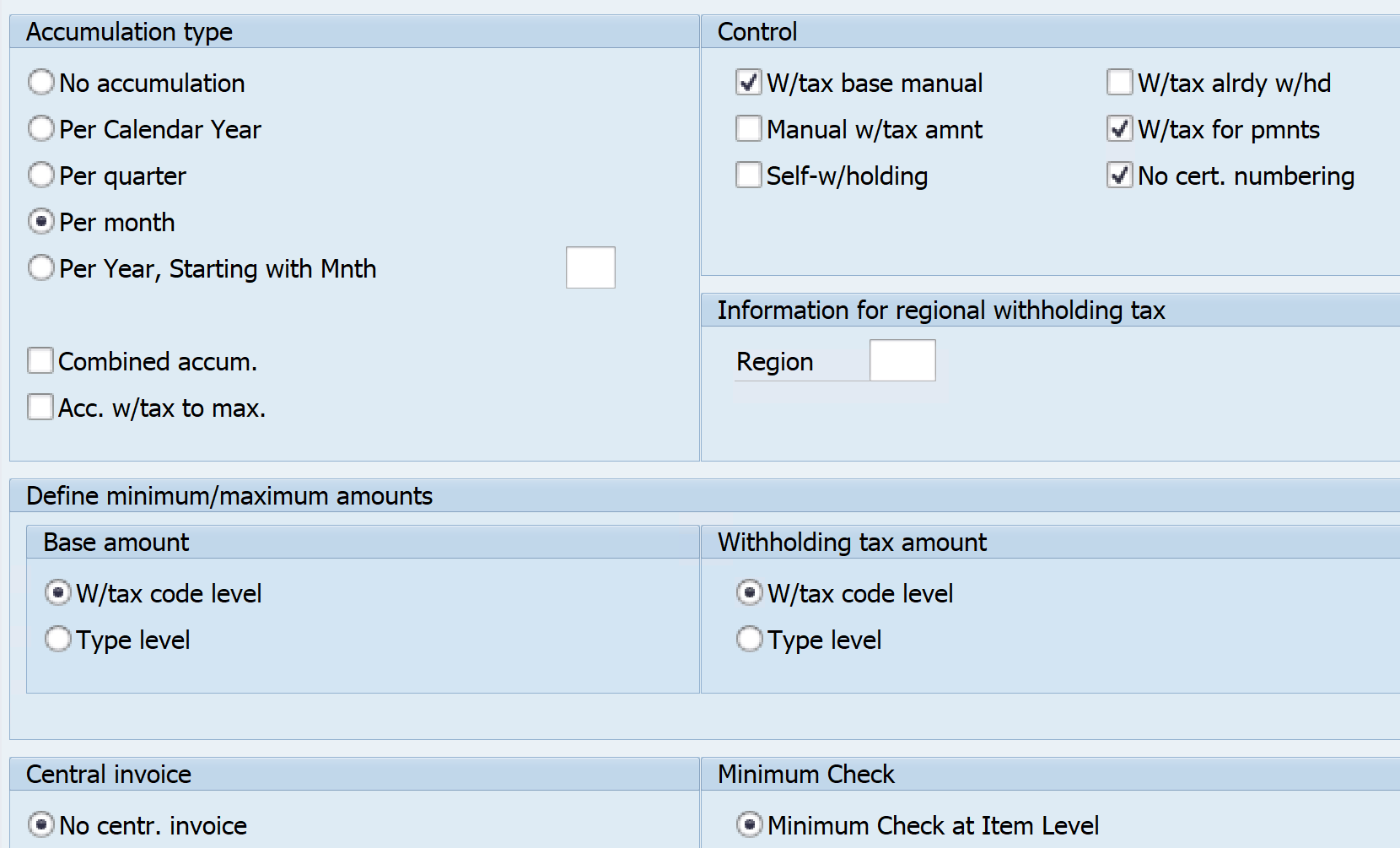

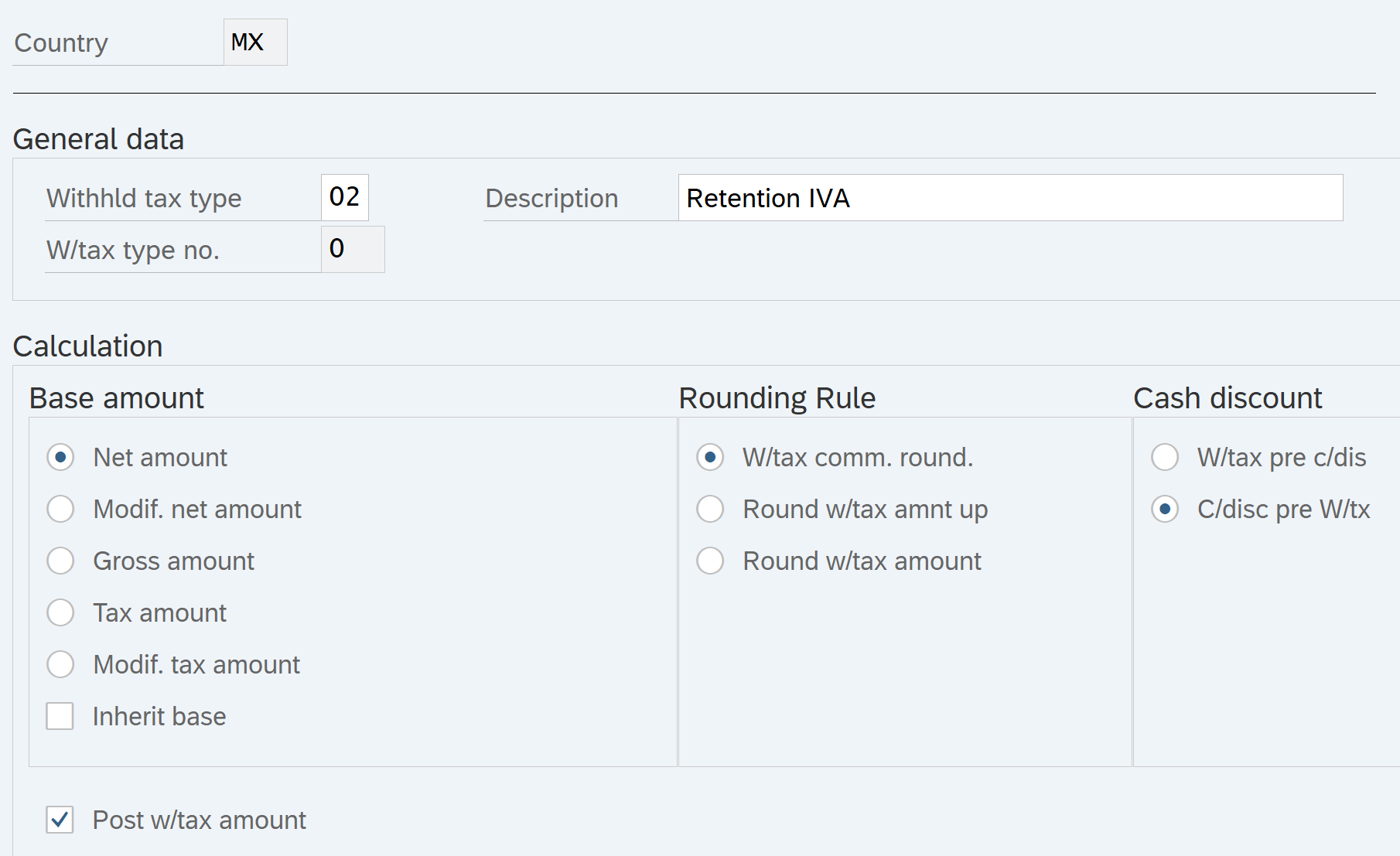

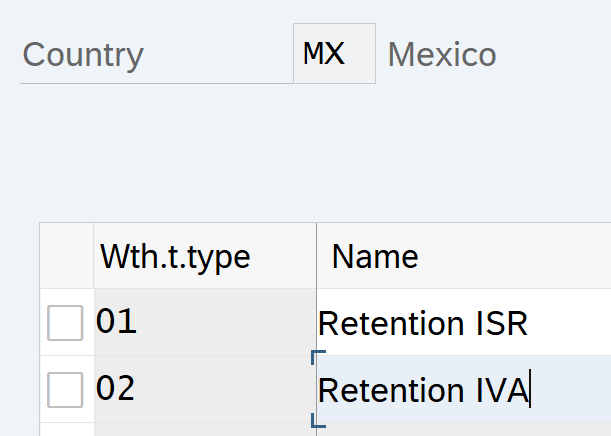

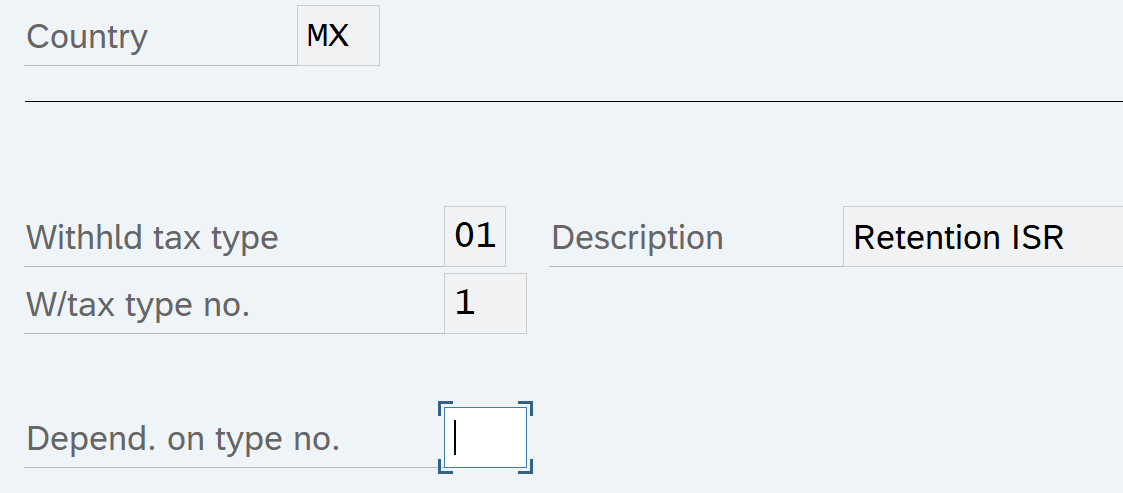

Define Withholding tax Types

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax – Calculations – Withholding Tax Types – Withholding Tax Types for Payment Posting

The withholding tax type controls the essential calculation options for extended withholding tax. While the withholding tax code controls the percentage rate of the withholding tax. Enter the withholding tax type in the customer/vendor withholding tax master data and in the company code master data.

Check Recipient Types

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax – Basic Settings – Check Recipient Types

This is required to categorize the vendor

Withholding Taxes Configuration – Calculation

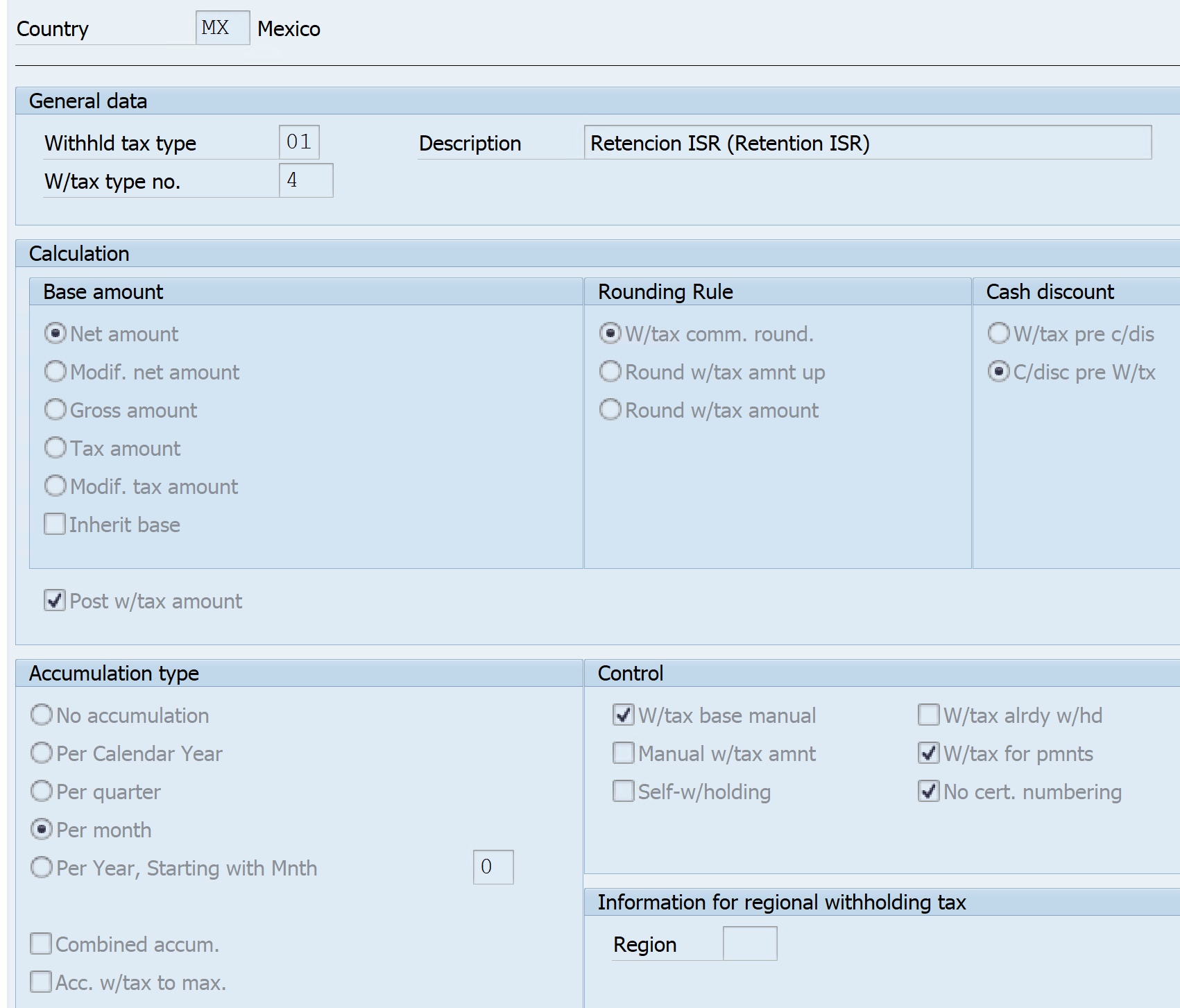

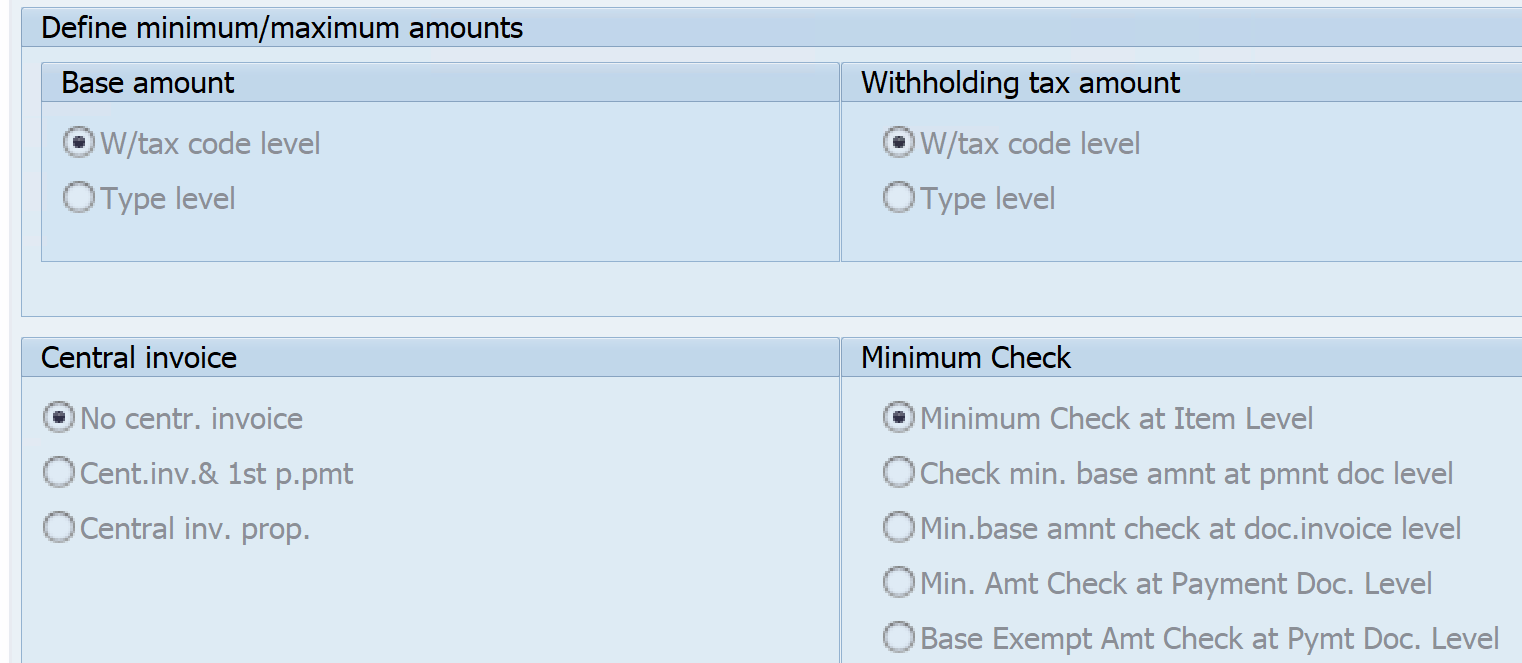

Define Withholding Tax Type for Payment Posting

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax –Calculation – Withholding Tax Type for Payment Posting

Here we define the withholding tax type for posting at the time of payment.

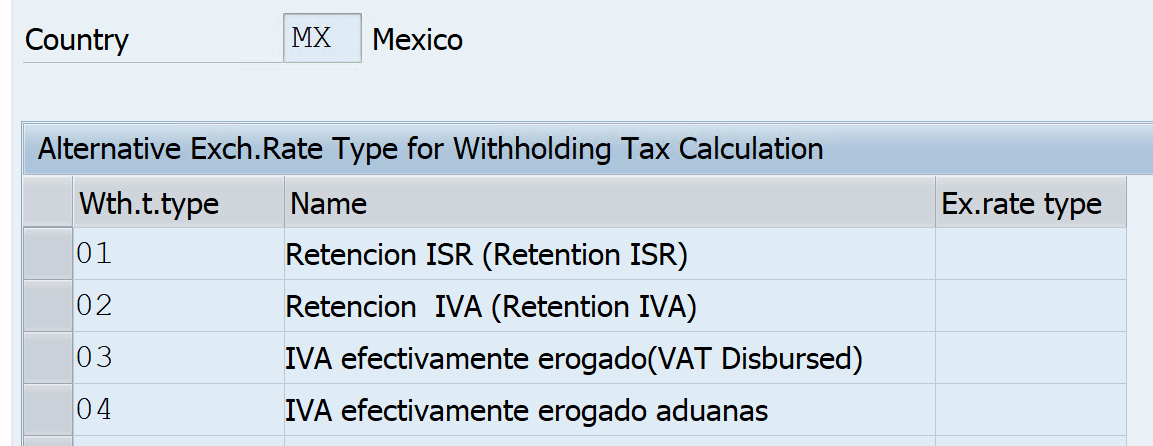

Define Exchange Rate Type for Withholding Tax Type

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax –Calculation – Withholding Tax Type – Define Exchange Rate for Withholding Tax Type

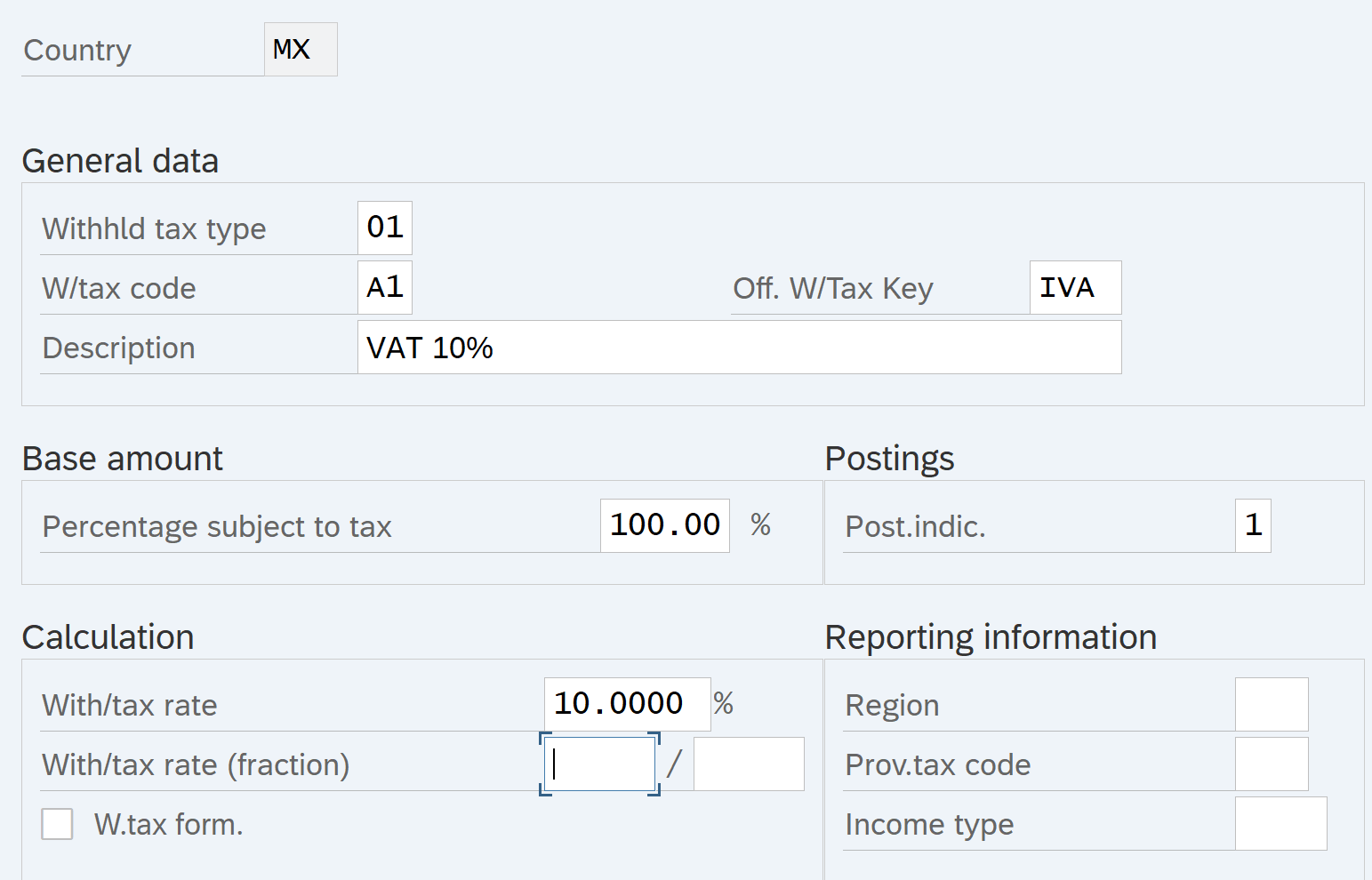

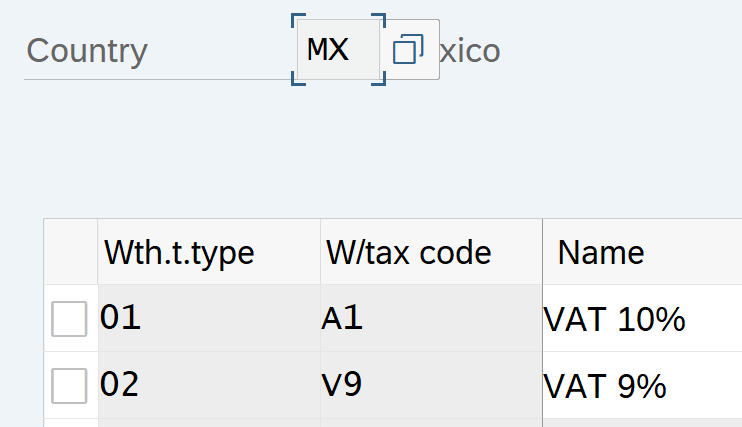

Define Withholding Tax Codes

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax –Calculation –Withholding Tax Codes – Define Withholding Tax Codes

Let us create 2 withholding tax codes A1 and V9 for Professional & Technical services for Invoice posting

Maintain dependencies between withholding tax types

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax –Calculation –Withholding Tax Base Amount – Portray dependencies between WH tax Type

Withholding Taxes Configuration- Company Code

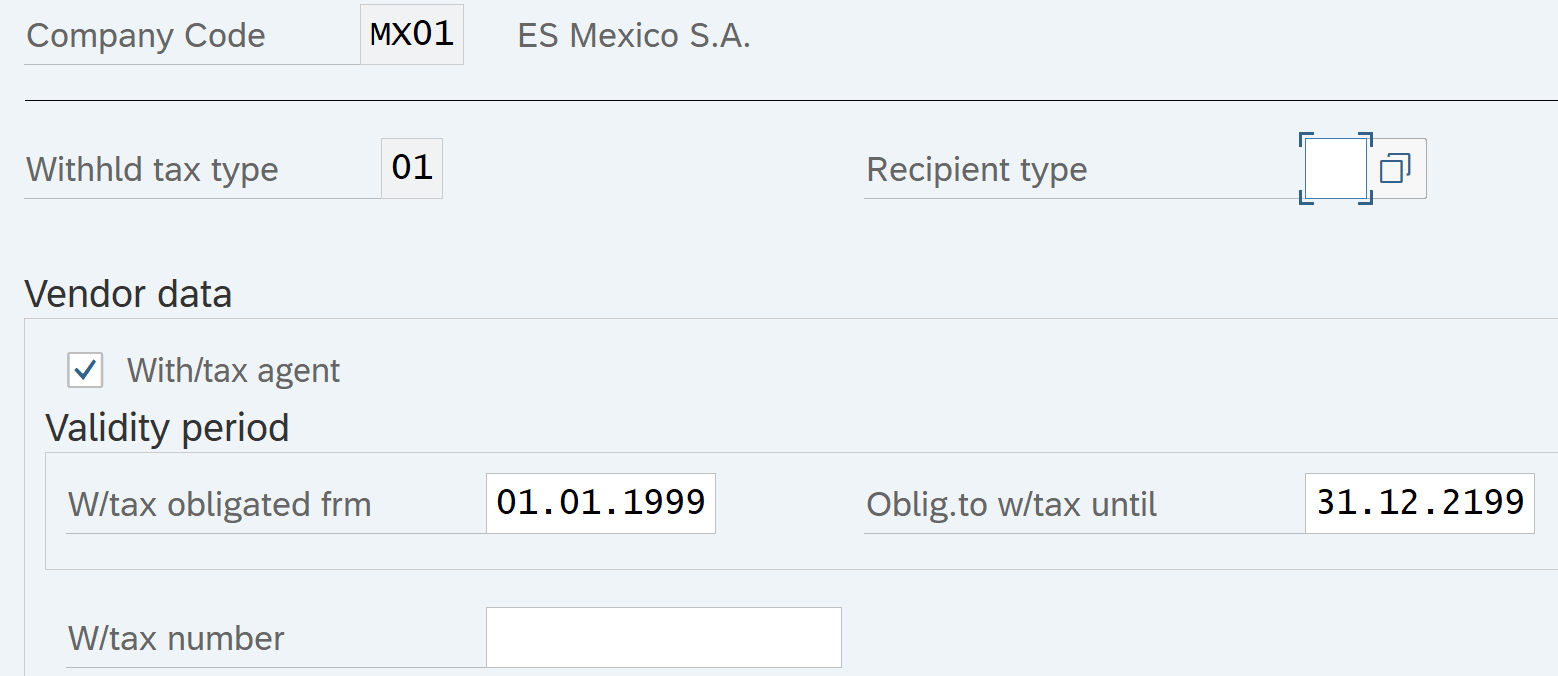

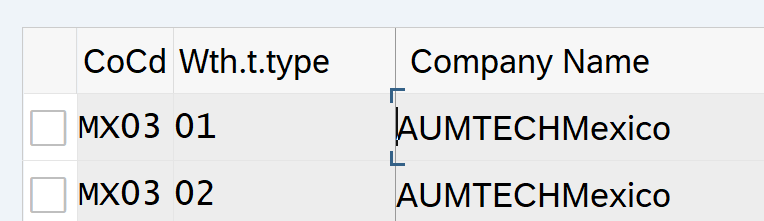

Assign Withholding Tax type to Company Code

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax – Company Codes – Assign Withholding Tax Type to Company Code

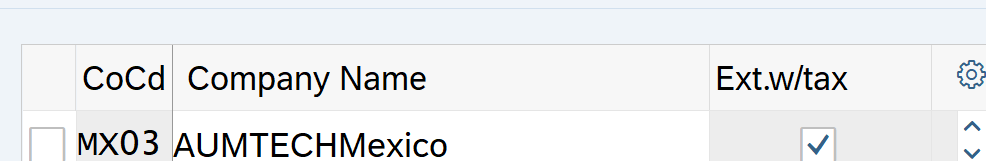

Activate Extended Withholding Tax

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax – Company Codes –Activate Extended Withholding Tax

Withholding Taxes Configuration- Postings

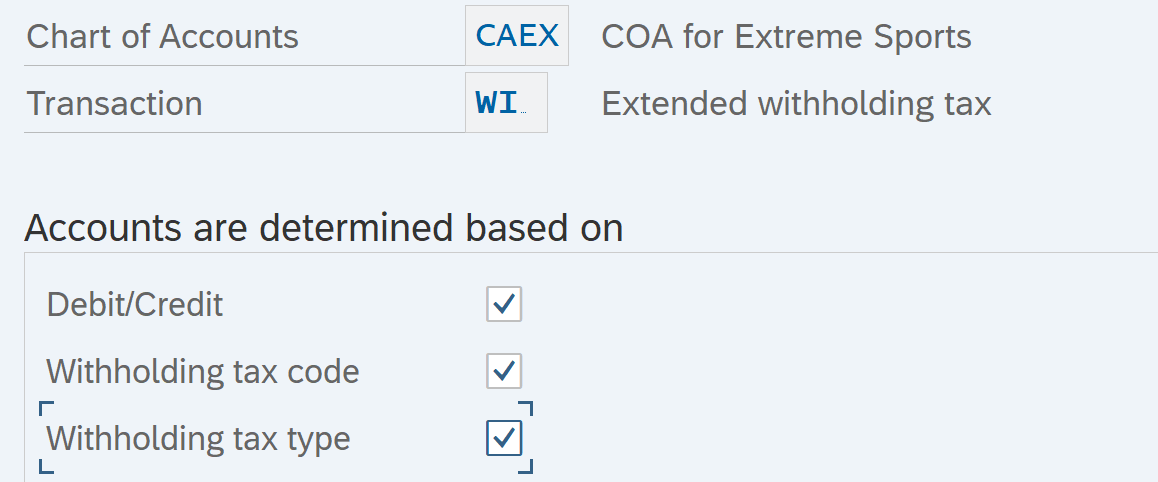

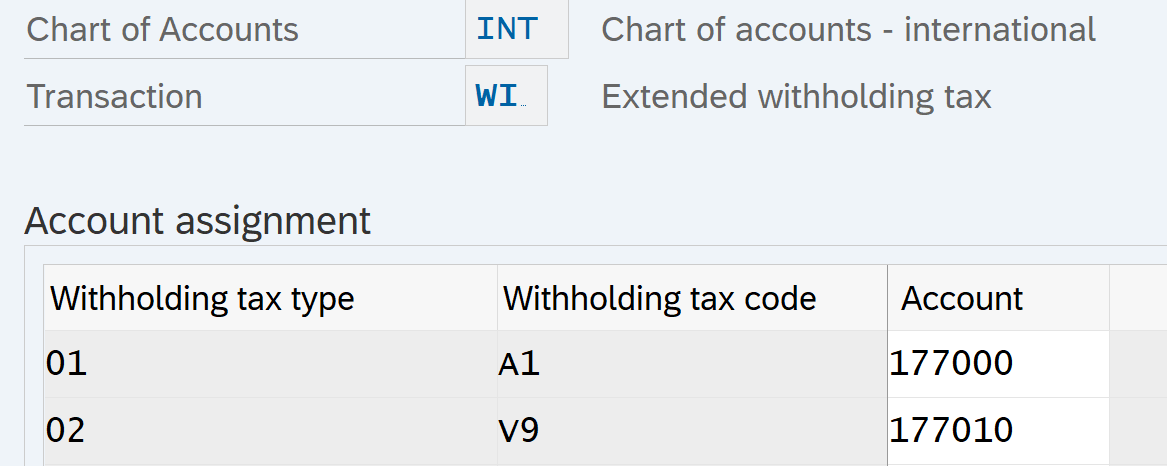

Define Accounts for Withholding Tax to be Paid over

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax –Posting – Accounts for Withholding Tax – Define Accounts for Withholding Tax to be Paid over

Withholding Taxes Configuration- Generic Reporting

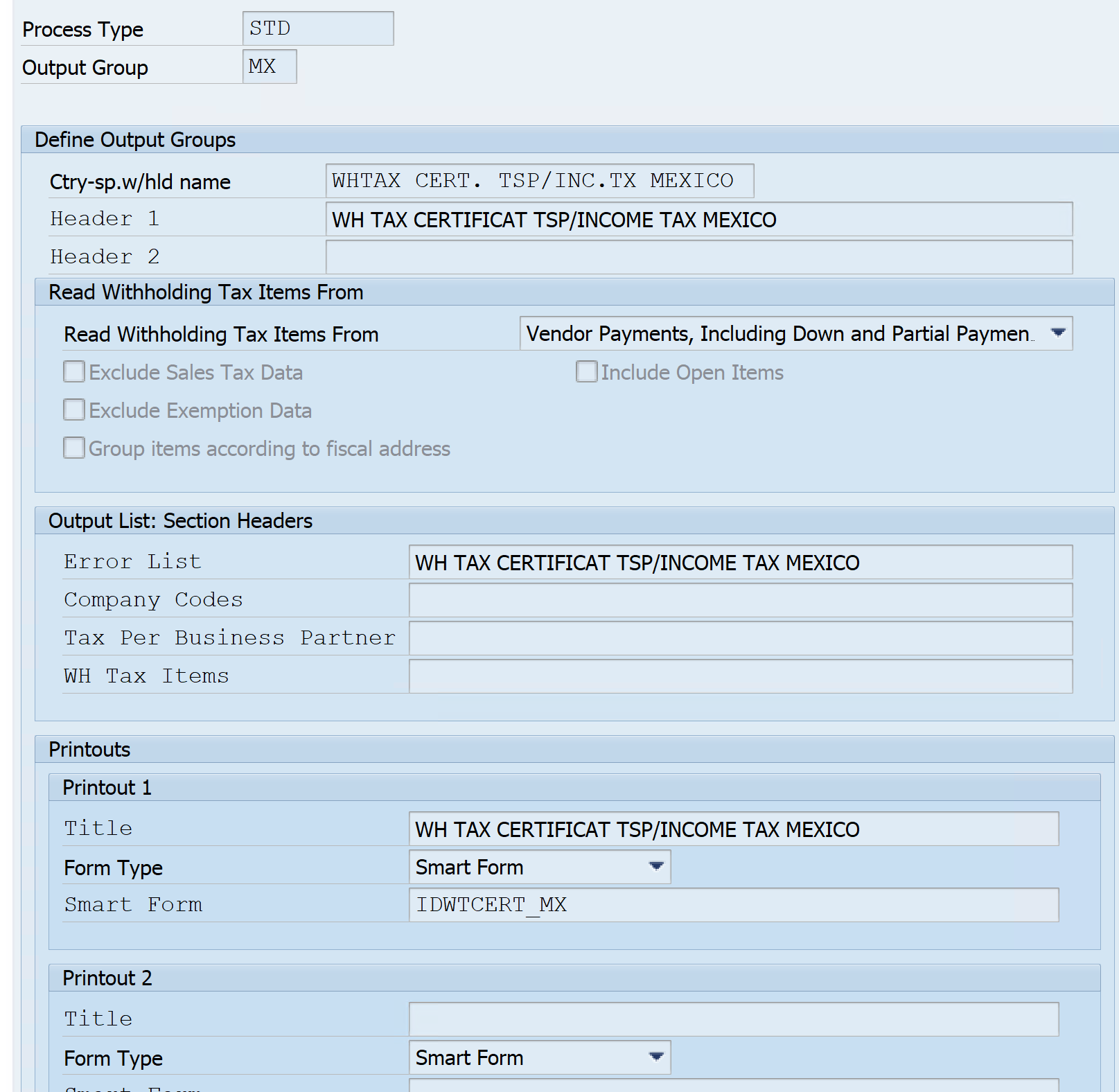

Define Output groups

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax –Generic Withholding Tax Reporting – Define Output Groups

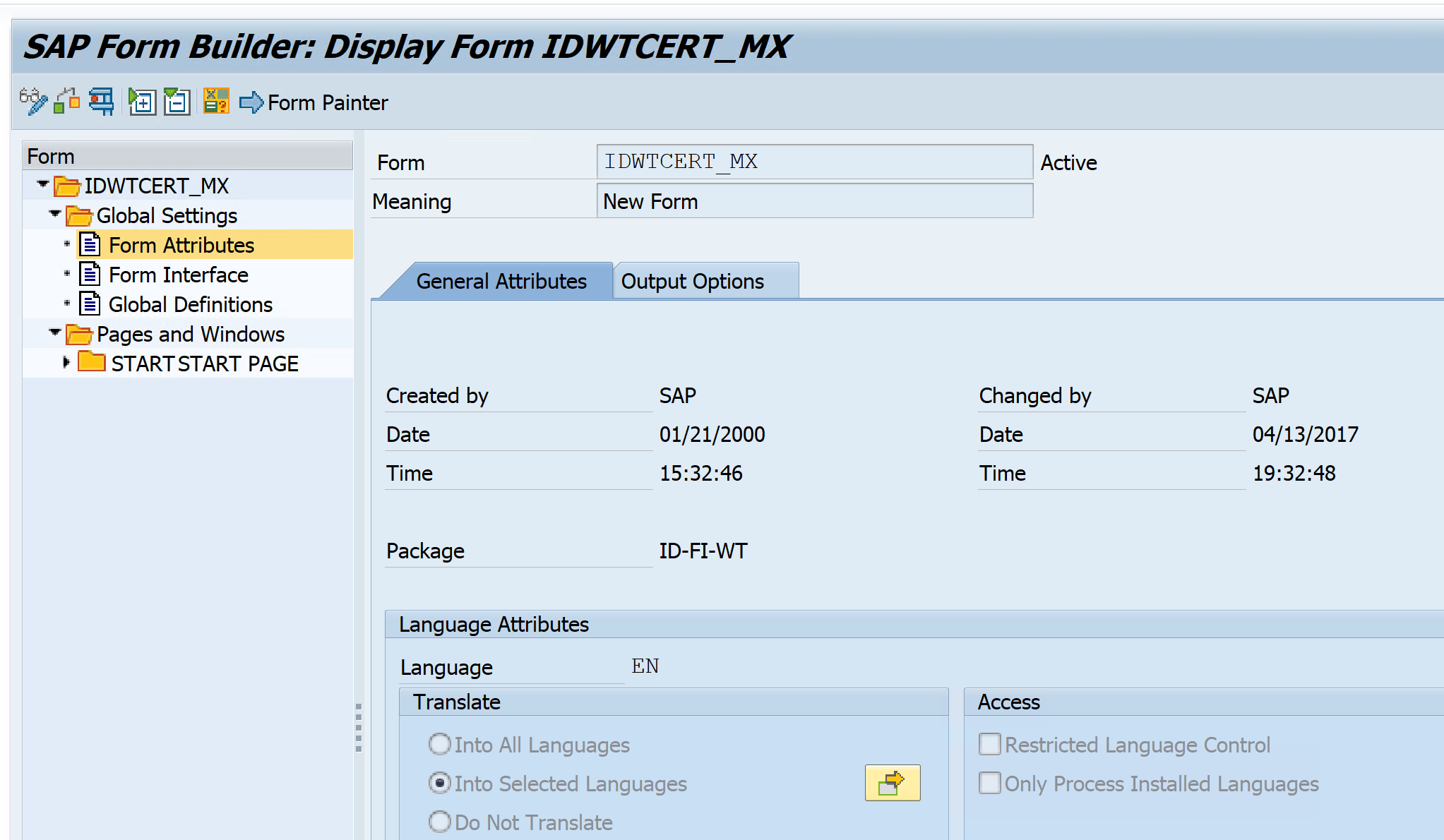

Define Forms for Withholding Tax Reporting

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax –Generic Withholding Tax Reporting – Printouts – Define Forms for withholding Tax Reporting

Use SAP predefined Form IDWERT_UK_CIS23I

Assign it in the output group

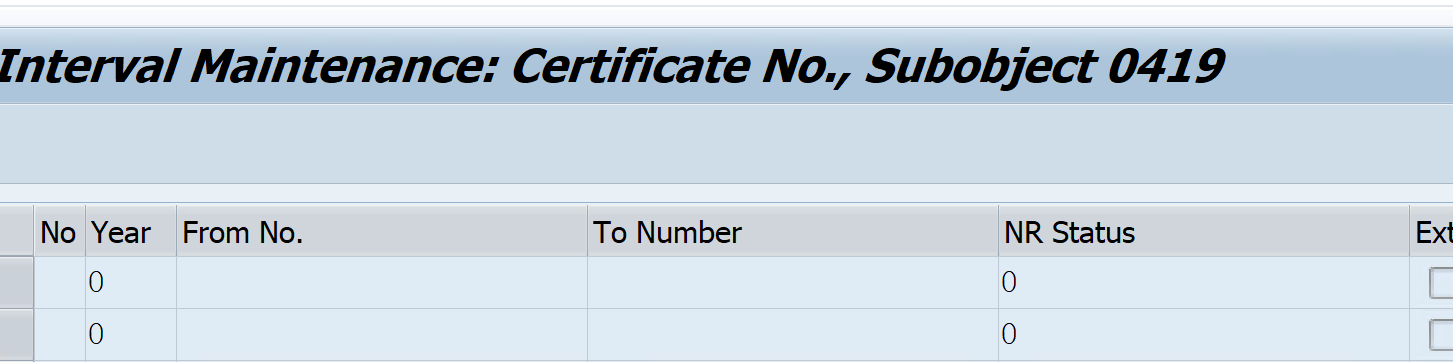

Define Certificate Numbering for Extended Withholding Tax

IMG – Financial Accounting- Financial Accounting Global Settings – Withholding Tax – Extended Withholding Tax –Generic Withholding Tax Reporting – Printouts- Define Forms for Withholding Tax Reporting

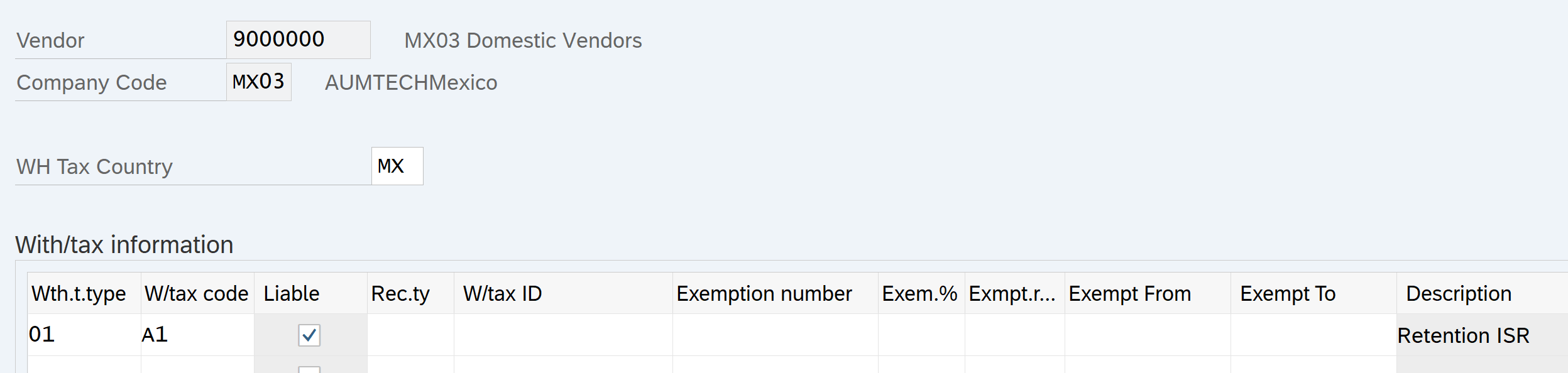

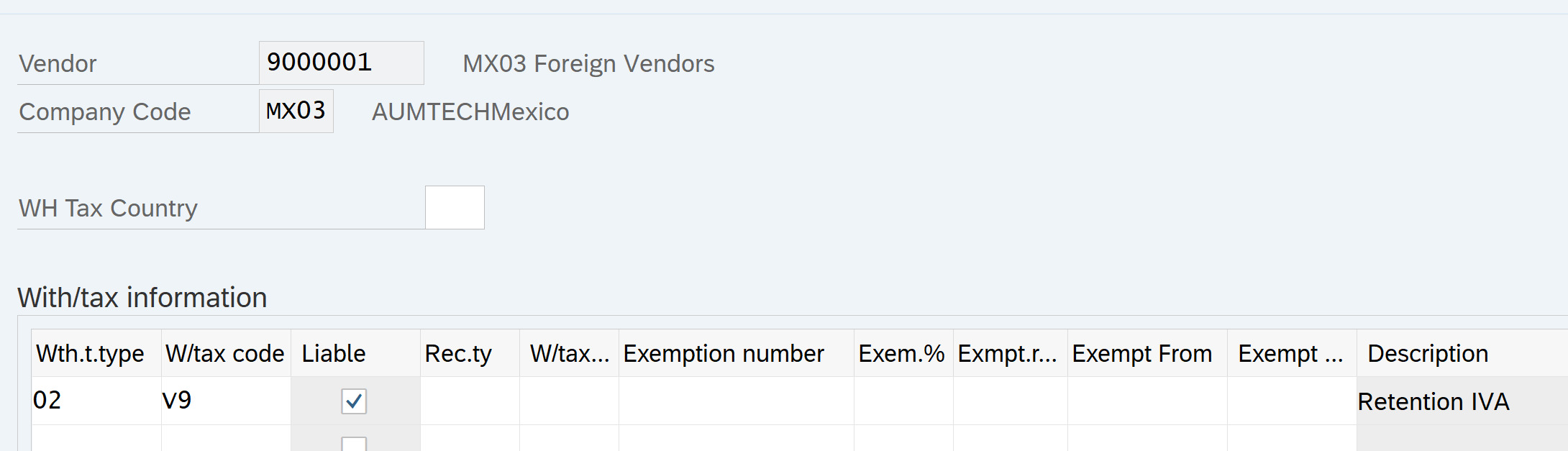

Withholding Taxes Vendor Master Data update

Update

Withholding Tax Codes in Vendor Master Data

Tcode: XK02

Withholding taxes business user transactions

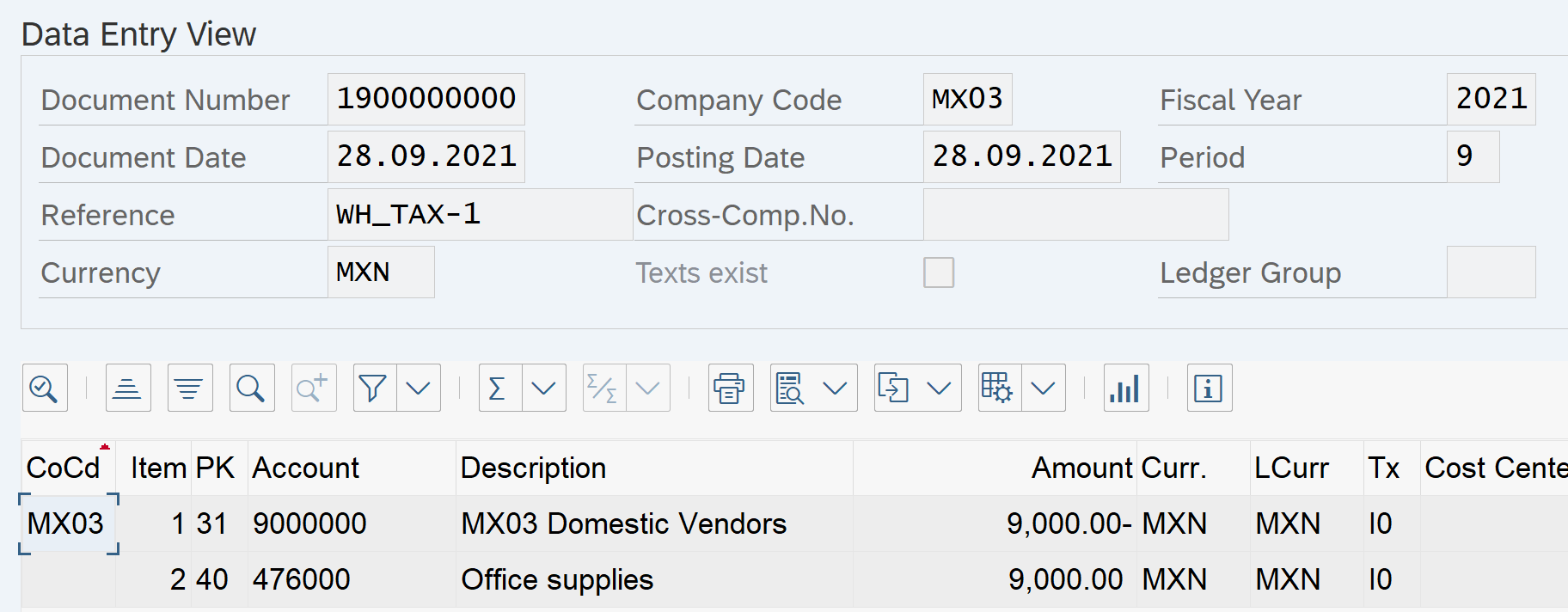

Post Vendor Invoice

Tcode: FB60

WH Tax auto populated from Vendor master entries

With Holding Tax amount is zero. Withholding Tax is posted at the time of Invoice payment.

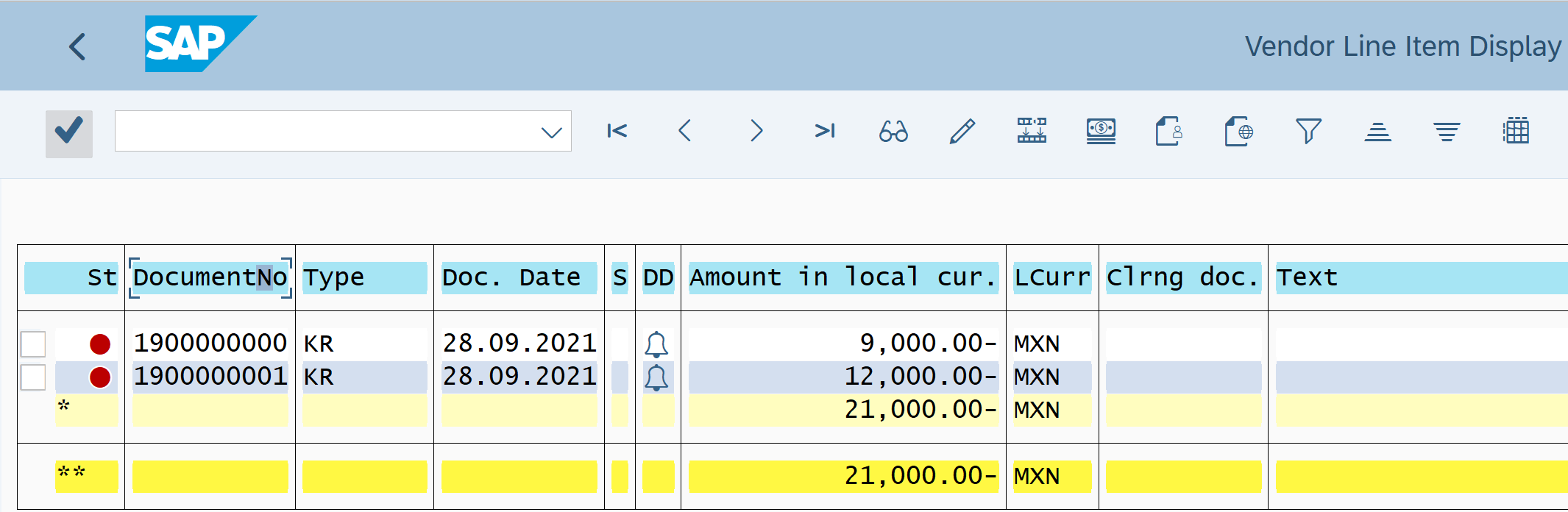

Let’s view the due Invoice. Transaction code : FBL1N

So, let’s pay vendor Invoice

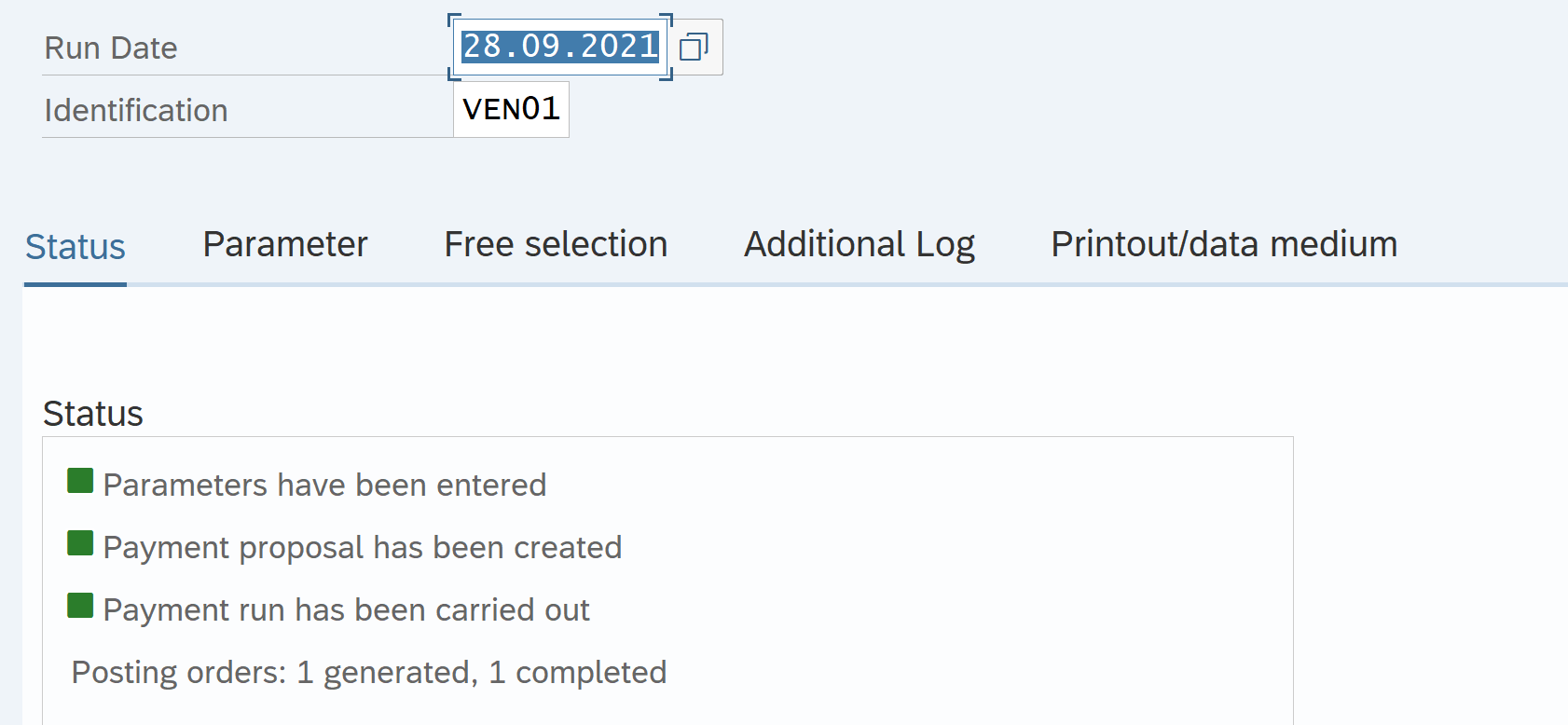

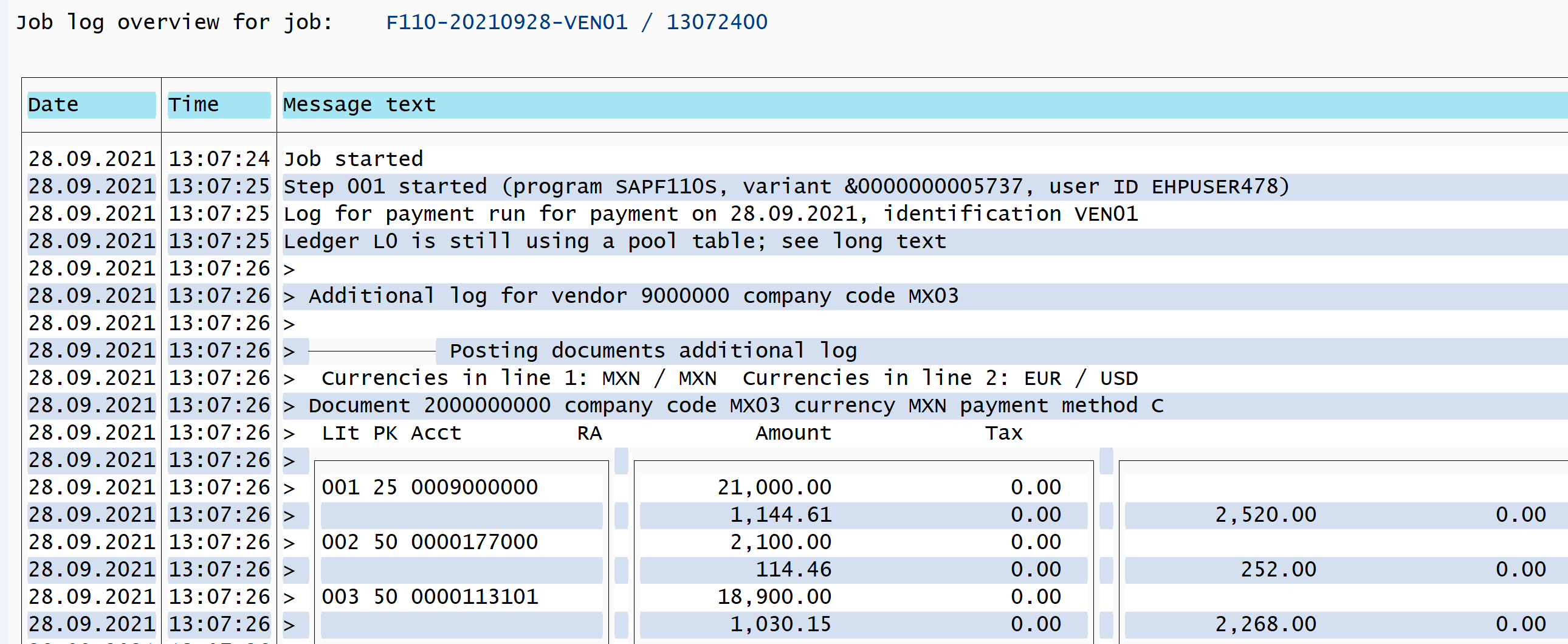

Transaction Code : F110

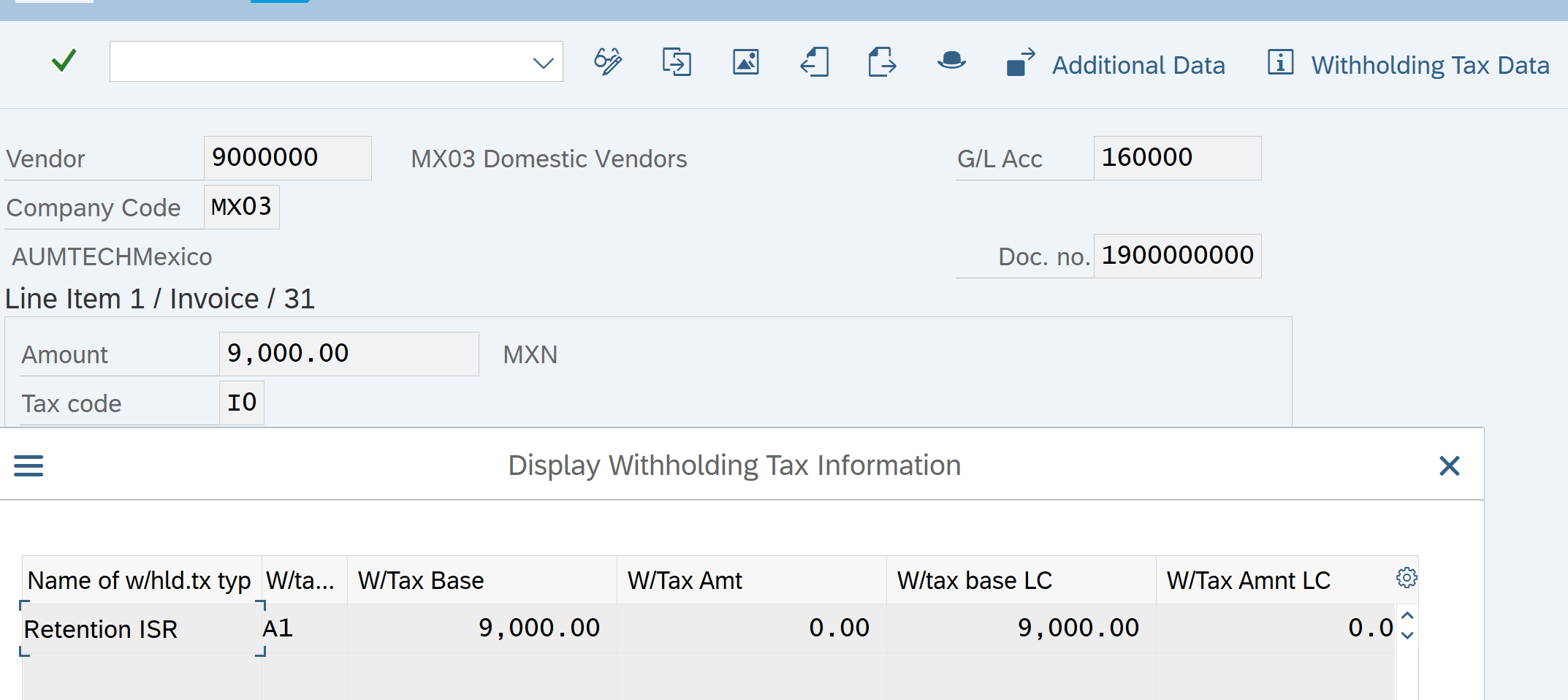

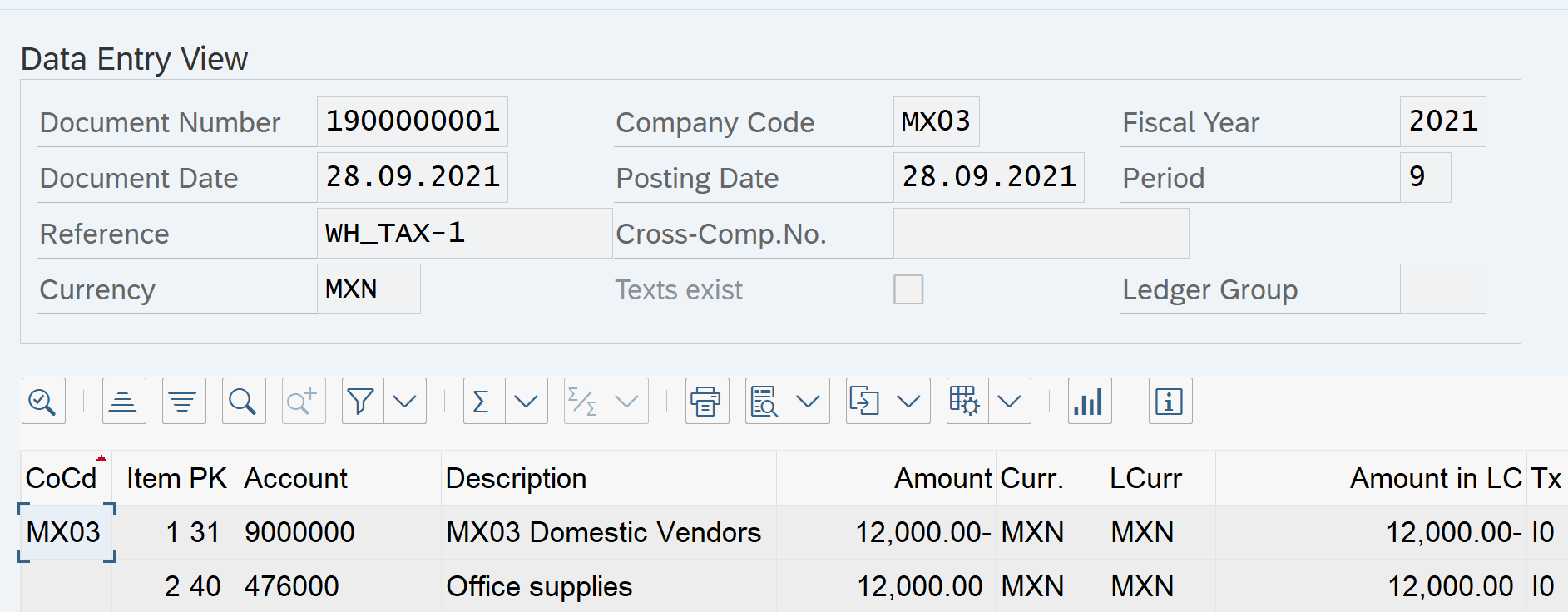

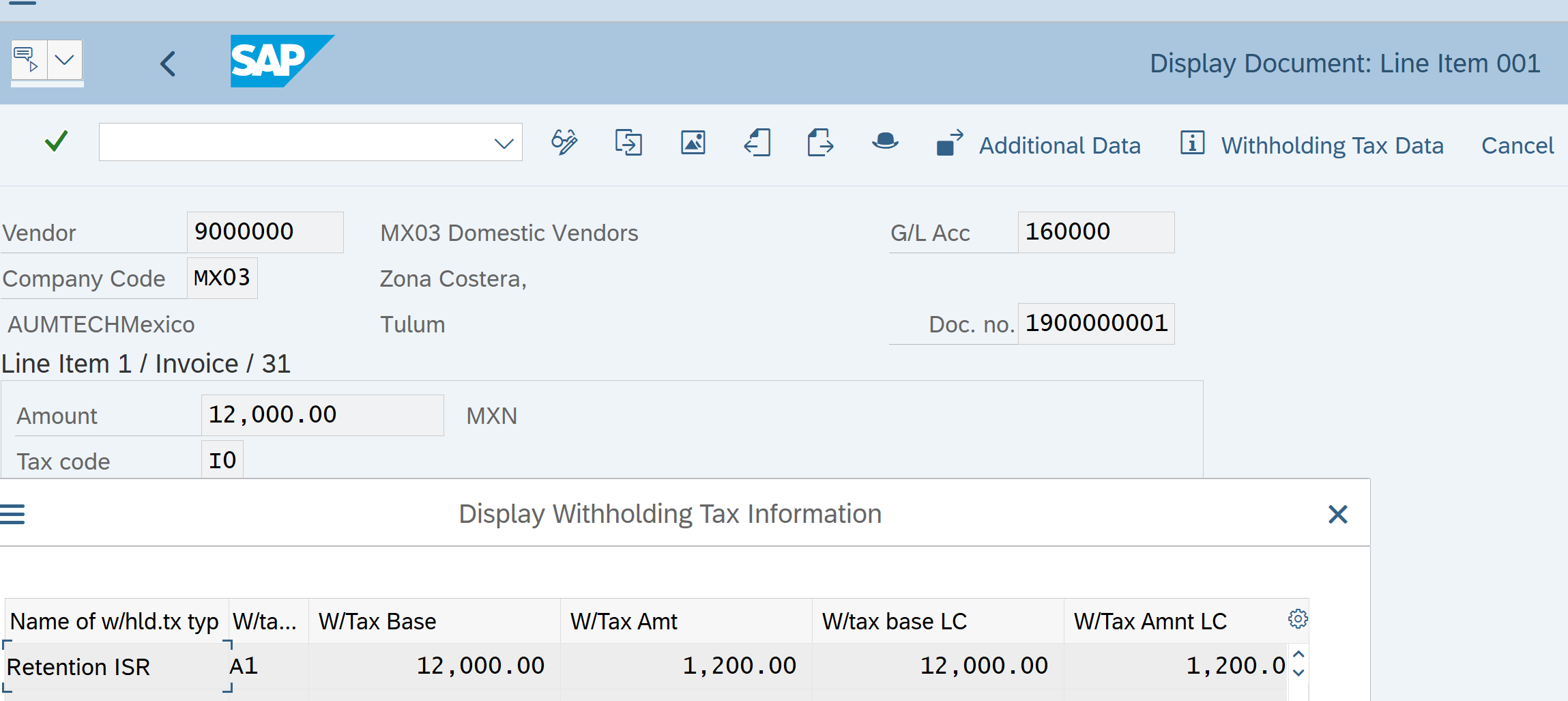

After Payment let’s view the Vendor Invoice

With Holding Tax calculation. With holding Tax code is A1. This calculates 10% of base amount

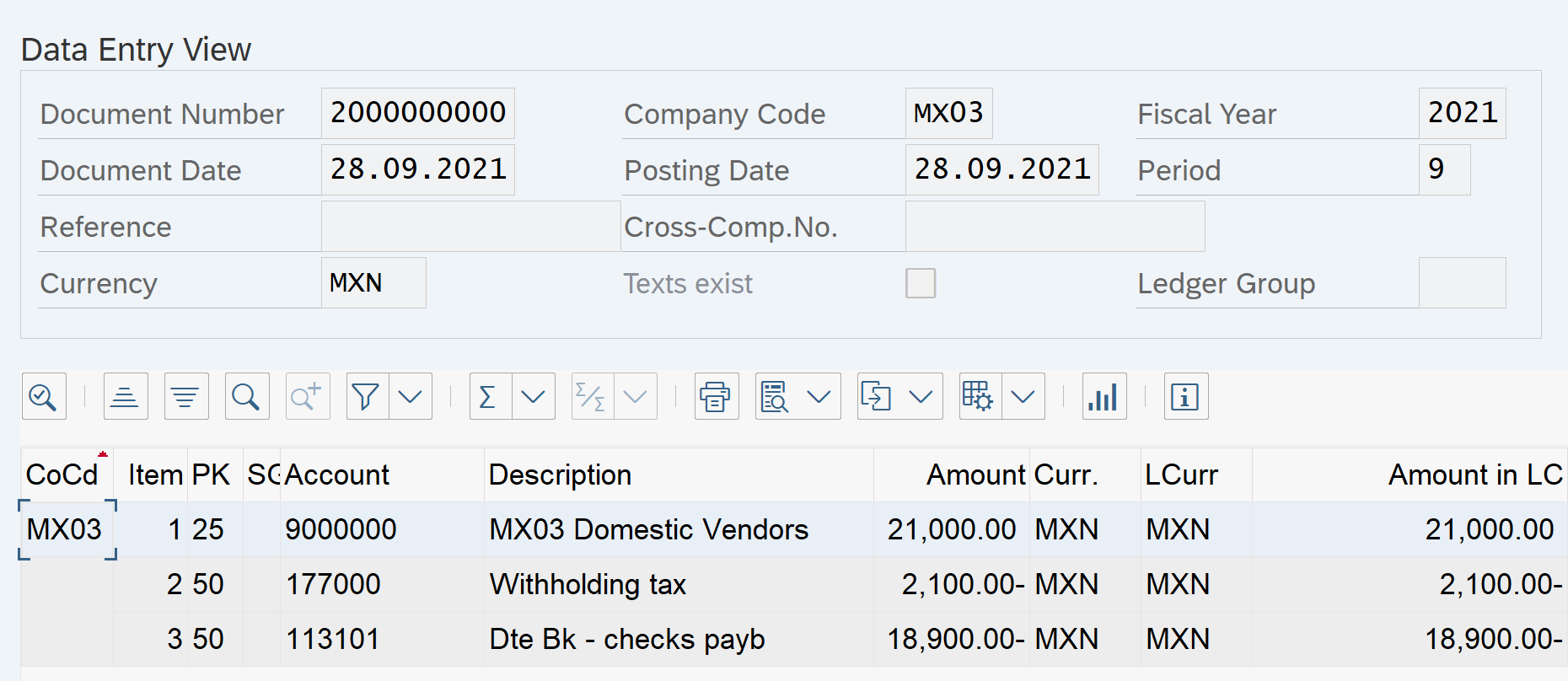

Payment Document

GL Account 177000 is With Holding Tax payable account setup in configuration in earlier steps

Pingback: SAP Tutorials | AUMTECH Solutions-SAP Training